By Richard Bernstein, Richard Bernstein Advisors

It’s time for our annual August report, “Charts for the beach.” Each year we highlight five of our favorite charts we think consensus is currently overlooking.

Profits (not GDP or politics) drive the stock market.

At RBA, we approach the current environment by staying disciplined, slowing down the investment process, and by staying dispassionate with respect to politics.

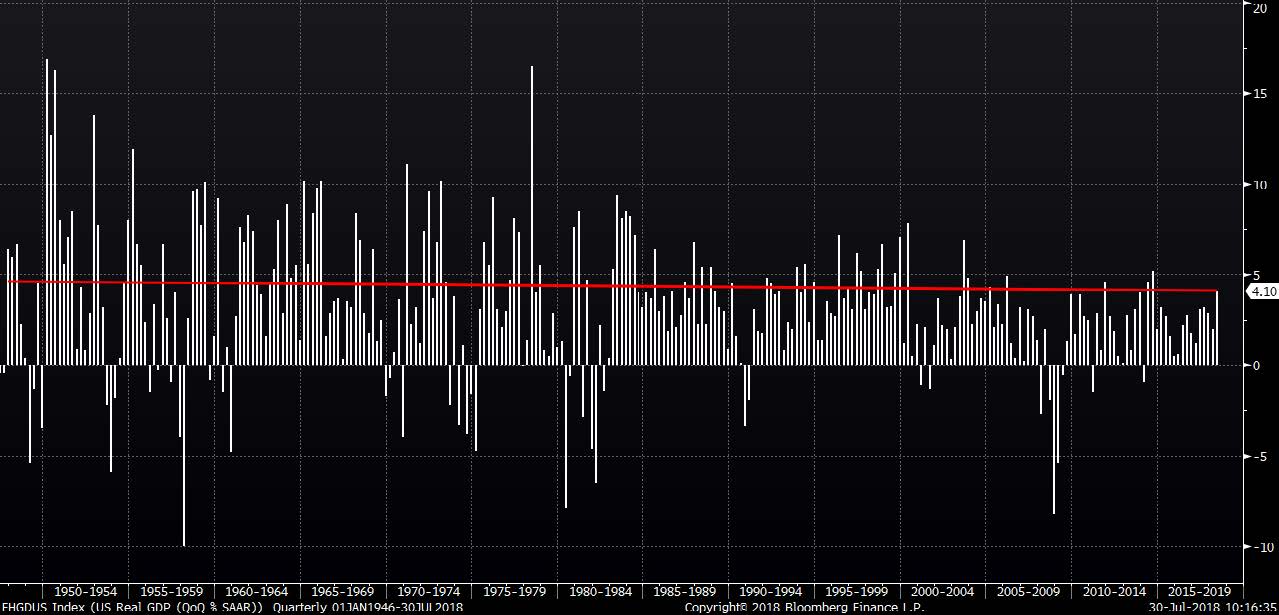

Along those lines, our first two charts show US real GDP and corporate profits through time. There has been considerable hoopla about the strength of GDP growth during the second quarter, but US real GDP growth remains within a slow-growth band that has existed since the bursting of the Technology bubble in 2000 (See Chart 1).

CHART 1:

US Real GDP

(QoQ % Jan. 1946 – Jul. 2018)

![]()

Chart 2 helps explain why the US bull market has been so powerful despite continued anemic GDP growth by highlighting corporate profits as a percent of GDP. The corporate sector’s proportion of national income rose to all-time highs post-2010. This ratio has smartly rebounded, which has fueled the more recent leg of the bull market.

Contrary to popular belief, the corporate sector (upon which the stock market ultimately focuses) has been historically healthy relative to the overall economy. The combination of tremendous liquidity provided by the Federal Reserve and an historically healthy corporate sector seems to justify both the length and magnitude of the 9-year bull market.

CHART 2

US Corporate Profits as a Percentage of GDP

(4Q 1947 – 1Q 2018)

We prefer fixed liabilities, not fixed income, during inflationary periods.

Data demonstrate that investors continue to focus on disinflationary asset classes and have yet to re-orient portfolios toward assets that outperform during periods of accelerating inflation. Unfortunately, inflation expectations troughed more than two years ago, and asset classes that benefit from accelerating nominal growth (stocks and commodities) have appreciated significantly whereas broad fixed income has provided negative total return.