By Komson Silapachai, Research & Portfolio Strategy

Investors have been holding their collective breath for the inevitable increase in 10-year Treasury yields, as many associate a rising interest rate environment with negative fixed income returns. This perception may be true – but only over relatively short time periods.

Given the large moves in interest rates over the past 12 months, investors are focused on the near-term direction of rates. Understandably so, but we recommend zooming out and considering fixed income returns over a longer time horizon.

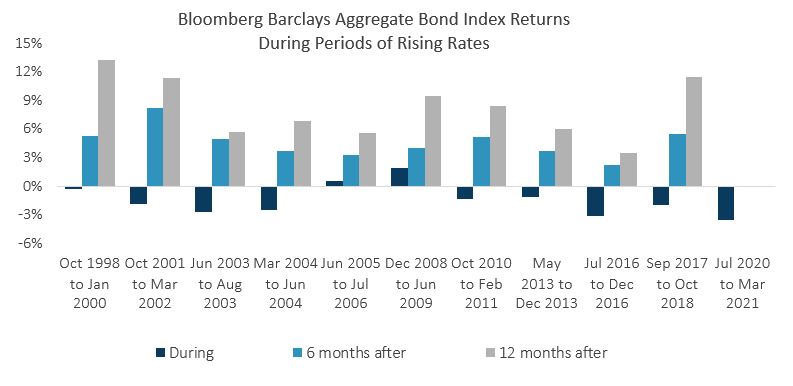

Investing is all about time in the market as opposed to timing the market. During the last 11 periods of rising interest rates, fixed income investors may have experienced negative total returns while yields were rising, but ultimately, they experienced positive returns over the following 6 and 12 months.

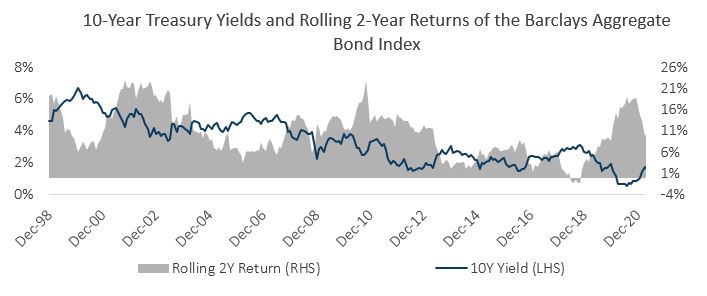

Additionally, over a longer holding period, bonds have consistently provided positive total returns. Over the rolling two-year period going back to December 1998, rarely have there been periods where fixed income has experienced negative returns.

During periods of rising rates, it’s important to keep in mind the reasons we own fixed income, namely for diversification, predictability of returns, and a shield against stock market volatility. Since 1976, bonds have provided consistent diversification during equity drawdowns – the top 10 worst quarters for stocks saw positive performance for bonds.

To be a successful fixed income investor, taking a comprehensive approach is key, as near-term total return rarely tells the whole story.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

Source for chart “The 10 Worst Quarters for Stocks (1976-2021)” is Bloomberg as of 6/30/2021. Source for chart “Bloomberg Barclays Aggregate Index” is Bloomberg as of 3/31/2021. Source for chart “10-Year Treasury Yield and Rolling 2-Year Returns of Barclays Aggregate Index” is Bloomberg as of 7/30/2021.