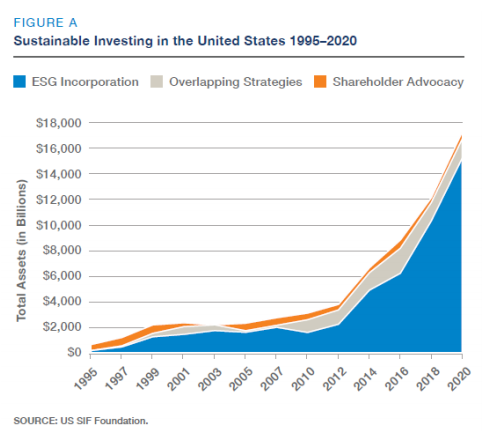

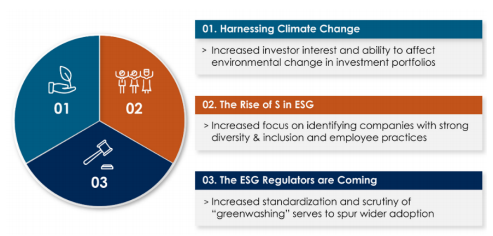

Environmental, Social, and Governance (ESG) concerns have continued to build upon their recent notoriety. Investment flows into ESG integrated investment strategies were growing rapidly, even while a very anti-ESG Administration was in office.

With President Biden’s election, this growth has only accelerated. The personnel that has been put in place will

provide support to this trend, as a “Whole of Government” strategy is pursued in the battle for greater sustainability.

Into the Forefront: Social

Concern over inequality has been growing for some time. The 700-page academic tome, “Capital,” by French

economist Thomas Piketty reached number one on The New York Times Best Seller list in 2014. Its focus is wealth and income inequality. The Gini coefficient, a once-obscure ratio that measures inequality, has become a fairly common data point in policy discussions. The impact of the Pandemic has focused the spotlight that had been shining on ESG concerns, putting Social issues front and center.

Labor

Joe Biden has referred to himself as the most pro-Union president in history. Unsurprisingly, he’s also the most proESG president in history, and the personnel in his administration reflect that. Marty Walsh serves as Secretary of the Department of Labor. He is the first DoL Secretary with union roots (Laborers Local 223) since William Usery Jr. served in Gerald Ford’s administration in 1976. [1]

The President’s support and Secretary Walsh’s leadership are expected to help Union membership stabilize and

perhaps recover some of the declines experienced. Investors growing focus on the treatment of employees will make it more difficult to hide inappropriate corporate behavior. This includes the mistreatment of employees, and puts a spotlight on employers who do not offer reasonable pay and benefits.

In his time as Mayor of Boston he was strongly supportive of ESG investing and encouraged other municipal leaders to do the same. Secretary Walsh is likely to remain an outspoken proponent of ESG integration. The DoL has confirmed that it will not enforce the anti-ESG investing rule the prior Administration pushed through. President Biden recently ordered the Department of Labor to make a permanent change to rule by September 2021.

International

John Kerry was named as the Special Presidential Envoy for Climate, otherwise known as the climate czar. He is making the connections and having the discussions that had been sidestepped by the previous Administration. Kerry oversaw the U.S. rejoining the Paris climate accord and pledging to take aggressive steps to aggressively shrink its carbon footprint. A carbon border-tax has been floated as a possibility.

Kerry’s position also gets him a seat on the President’s National Security Council, the first time a climate-related position has received such weighty consideration, signaling that this Administration sees climate-driven threats to agriculture, water, and infrastructure as national security issues. “That puts Kerry on the same footing with the Department of Defense and the Treasury Secretary and the Secretary of State in internal planning decisions made by the U.S. government,” according to Jesse Young, a former senior advisor to the Obama administration’s climate envoy and current climate change policy lead with Oxfam. [2]

Disclosures

Gary Gensler heads up the SEC. He is an experienced regulatory administrator, having served as chairperson of the Commodity Futures Trading Commission (CFTC) in the Obama Administration and in various roles at the Treasury. It appears that he will push for additional corporate disclosures related to ESG concerns. He has indicated that he is open to requiring companies to share ESG data that is not explicitly financial in nature (reasoning that has historically been used to sidestep disclosures). This information will fall into the S (Social) and E (Environmental) areas of ESG investing.

John Coates, the SEC’s Acting Director for the Division of Corporation Finance, used asbestos exposures as a historical corollary to today’s undisclosed ESG risks. While initially, it could have been argued that asbestos exposure was non-financial or non-pecuniary, over time these exposures were clearly financial, and investors could have benefitted from explicit disclosures. [3]

Coates revealed that the new disclosure requirements will focus on three topics: diversity, equity and inclusion; climate change; and human capital management. [4]

More detailed disclosures will make it easier for investors to make decisions around these areas of concern, integrating the data into their investment assumptions. It will also make it more apparent which companies are actively addressing ESG related risks, and which remain most exposed.

Summary

The Biden Administration’s objectives dovetail with those of ESG investors. This symbiotic relationship should continue to drive the adoption of ESG integration in the investment industry, and open new doors to investors who have historically been shut out of Responsible/Sustainability focused investment options. The tailwind for ESG strategies remains firmly in place.

Originally published by Nottingham Advisors

Nottingham Advisors offers both institutional and individual clients experience, sophistication, and professionalism when helping them achieve their goals. With over 40 years of serving Western New York and clients in more than 30 states, Nottingham tailors each solution to fit the specific needs of each client. For more information about Nottingham’s offerings, visit www.nottinghamadvisors.com or call 716-633-3800.

Further Positioning

The Department of Homeland Security has created a Climate Change Action Group

The Interior Department has set up a Climate Task Force

NASA has created a Senior Climate Adviser role

The Agriculture Department’s Climate Advisor has been nominated to serve as Under Secretary for Farm Production & Conservation

The Treasury Department created a Climate Hub

References

1 From Laborer to Labor Secretary: Marty Walsh Officially Ushers in New Era at DOL:https://www.ibew.org/media-center/Articles/21Daily/2103/210324_FromLaborer

2 ‘Climate Czar’ Positions Point to Biden’s Dual Approach to the Global Crisis: https://www.audubon.org/news/climate-czar-positions-point-bidens-dual-approach-global-crisis

3 ESG Disclosure – Keeping Pace with Developments Affecting Investors, Public Companies and the Capital Markets: https://www.sec.gov/news/public-statement/coates-esgdisclosure-keeping-pace-031121

4 Acting Corp Fin Director Coates says ESG disclosure requirements “overdue”: https://cooleypubco.com/2021/05/14/coates-esg-disclosure-overdue/

5 Glenmede – A New Era for Sustainable & Impact Investing? Predictions for the Biden Administration: https://www.glenmede.com/our-ideas/new-era-sustainable-impact-investingpredictions-biden-administration

Nottingham Advisors, LLC (“Nottingham”) is an SEC registered investment adviser located in Amherst, New York. Registration does not imply a certain level of skill or training. Nottingham and its representatives are in compliance with the current registration and notice filing requirements imposed upon SEC registered investment advisers by those states in which Nottingham maintains clients. Nottingham may only transact business in those states in which it is registered, notice filed, or qualifies for an exemption or exclusion from registration or notice filing requirements. For information pertaining to the registration status of Nottingham, please contact Nottingham or refer to the Investment Advisor Public Disclosure Website (www.adviserinfo.sec.gov). Any subsequent, direct communication by Nottingham with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

This newsletter is limited to the dissemination of general information pertaining to Nottingham’s investment advisory services. As such nothing herein should be construed as the provision of personalized investment advice. The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Adhering to the assumptions, theories and principles serving the basis for the information contained herein should not be interpreted to provide a guarantee of future performance or a guarantee of achieving overall financial objectives. As investment returns, inflation, taxes and other economic conditions vary, your actual results may vary significantly. Furthermore, this newsletter contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of their dates. As such, there is no guarantee that the views and opinions expressed in this article will come to pass. This newsletter should not be construed to limit or otherwise restrict Nottingham’s investment decisions.

This newsletter contains information derived from third party sources. Although we believe these third party sources to be reliable, we make no representations as to the accuracy or completeness of any information prepared by any unaffiliated third party incorporated herein, and take no responsibility therefore. Some portions of this newsletter include the use of charts or graphs. These are intended as visual aids only, and in no way should any client or prospective client interpret these visual aids as a method by which investment decisions should be made. We have provided performance results of certain market indices for illustrative purposes only as it is not possible to directly invest in an index. Indices are unmanaged, hypothetical vehicles that serve as market indicators and do not account for the deduction of management fees or transaction costs generally associated with investable products, which otherwise have the effect of reducing the performance of an actual investment portfolio. It should not be assumed that your account performance or the volatility of any securities held in your account will correspond directly to any benchmark index. A description of each index is available from us upon request.

Investing in the stock market involves gains and losses and may not be suitable for all investors. Past performance is no guarantee of future results.

For additional information about Nottingham, including fees and services, send for our Disclosure Brochure, Part 2A or Wrap Brochure, Part 2A Appendix 1 of our Form ADV using the contact information herein.