By Doug Sandler, CFA, Head of Global Strategy

SUMMARY

- Cash feels safe during a crisis, but there is a cost…

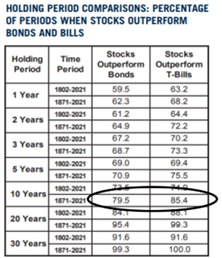

- Historically, stocks have performed better than cash 85% of the time over 10-year periods since 1871.

- In choosing between stability and growth…

- …Investors should not underestimate the impact of inflation.

Over the past two months my wife and I drove across the country twice. During that time, I had a lot of time to think and observe. One thing that I observed is that motorists tend to drive more slowly and cautiously after passing an accident. Drivers essentially alter their behaviors even though the probabilities of being involved in an accident have not changed.

Investors often display similar behaviors after seeing a ‘crash’ in the stock market, like the 18% fall in the S&P 500 in 2022. Post-crash, many investors become more cautious even though the likelihood of a subsequent crash is no greater. In fact, the statistics show that a repeat performance is less (not more) likely in the following year. For example, since 1928, there have been only two years out of six (1931 & 1932) that cash beat stocks after a stock market drop of 15% or more in the prior year.

The field of behavioral finance calls this investing pitfall ‘recency bias’, which is defined as the unfounded belief that recent events will continue into the immediate future. Recency bias and other behavioral traps are obstacles that have historically stood in the way of investing success. We see this bias being displayed today in investors’ eagerness and excitement in allocating a larger portion of their long-term investment dollars to cash and cash equivalents (money markets, T-bills, and certificates of deposit (CD’s)). The Investment Company Institute reported that money market accounts had reached a record $4.8 trillion as of January 4, 2023, which was slightly higher than the prior $4.79 trillion record reached in May 2020, when fears of COVID-19 ran rampant through investor’s minds.

If You Too Are Wondering: ‘Why Should I Buy Stocks, When I Can Get 4% Cash Yields Elsewhere?’ …Consider The Following Four Points:

- Historically, more often than not, stocks beat cash: Wharton professor Jeremy Siegel’s seminal 1994 publication Stocks for the Long Run analyzed the long-term returns delivered by major asset classes, like stocks, bonds, and real estate; throughout history. Recently, his research partner Jeremy Schwartz, updated and contextualized a few of his findings. The table on the right is one example of this and displays the long-term superiority of stocks relative to bonds and T-Bills (cash equivalents). From the table, we can see that stocks beat bonds 79.5% of the time and beat cash 85.4% of the time over 10- year periods since 1871.

- Stocks are more aligned with investors’ desire for growth: While investors can come in all shapes and sizes, many of those we speak to have one goal in mind: growing their assets. At a minimum, they need their cash investments to grow to keep up with inflation and maintain purchasing power. More often, investors need their money to grow to fund significant expenses including retirement, college funding, and second-home purchases. This can be a difficult endeavor after considering data from the Pew Research Center (chart right), which shows that the purchasing power of American paychecks have stayed stagnant between 1964 and 2018. Given that wage growth has barely offset inflation, investors who need their portfolios to grow will need to utilize something other than cash and cash-equivalents to accomplish their goals. Without portfolio growth an investor would have to 1. Increase their rate of savings, or 2. Scale-back their objectives. Under the surface, the lack of wage growth may be worse for many Americans since the increases that have happened since 2000 have largely accrued to the small number of workers earning the top 10% of wages.Stocks, on the other hand, compare favorably to wage growth. According to RiverFront’s Price Matters valuation framework, US large-cap equities have returned approximately 6.4% real returns (after subtracting inflation) since 1926. While actual returns typically vary year-to-year, large-caps have registered positive returns in 94% of the rolling 7-year time periods since that time.

Source: U.S. Bureau of Labor Statistics, “For most U.S. workers, real wages have barely budged in decades.” Pew Research Center, Washington, D.C. (August 7, 2018) https://www.pewresearch.org/fact-tank/2018/08/07/for-most-us-workers-real-wages-have-barely-budged-for-decades/. Shown for illustrative purposes only. Past Performance is no guarantee of future results.

- Inflation’s ‘bite’ may be worse for many: Inflation has been called the ‘thief in the night’ because it steals from investors under the cover of darkness. If you are vigilantly watching your bank account to catch inflation, you will miss it. This is because bank balances are measured in ‘nominal’ not ‘real’ terms. ‘Real’ considers the impact of inflation, while ‘nominal’ does not. Inflation also ‘hides’ by only impacting investments by a small amount… roughly 2.5% annually over the last 30 years (Consumer Price Index). However, this rate represents a nation-wide average, which we believe may be irrelevant to many retirees, particularly those with wealth, for a few reasons:

- Geographical Differences: More desirable places to live have higher costs. Those planning to retire at the beach, in the mountains, in warmer climates, or near walkable attractions should plan on paying more, and in most cases, much more. Prices are rising in these attractive areas due to the ‘graying of America’ and due to changing preferences brought about by COVID-19 and social unrest.

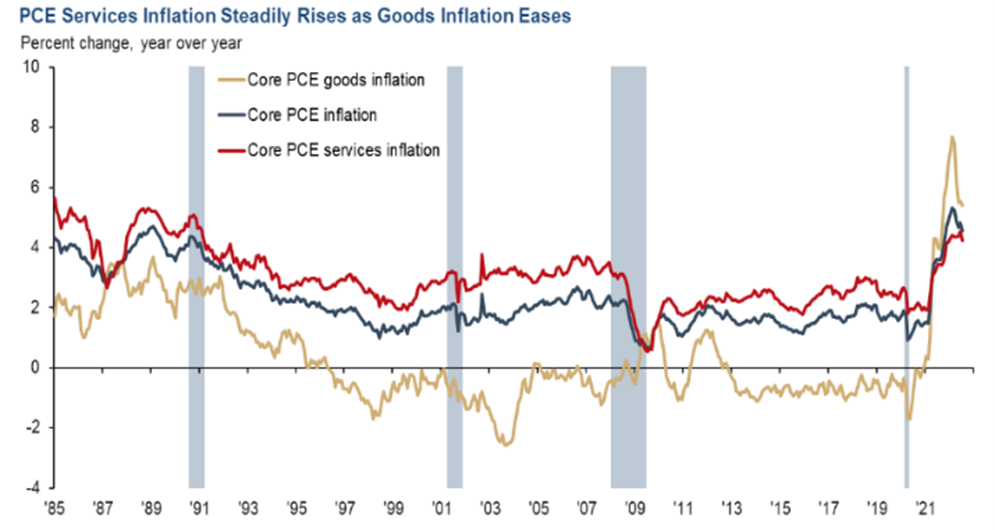

- Preference for Services: Typically, as one ages, one tends to spend more on services like restaurants, travel, healthcare, and entertainment. While long-term CPI might be relatively low (blue line below), the components of CPI are very different. Services inflation (red line) has been running at levels significantly higher than goods inflation (brown line) for the last three decades. Services have not experienced the same level of benefits as goods, which have benefitted from globalization and the use of low-cost workers around the world.

- Longevity Increasing: Given growing life expectancies due to advances in medical care – and the high levels of inflation of health care costs themselves – we believe there’s an underappreciated risk of older individuals ‘outliving their money’. This is particularly true for married couples, given the surprising math around ‘joint longevity’ -the probability that at least one spouse lives to an advanced age. RBC Wealth Management highlighted these stats in an informative 2021 report entitled ‘Taking Control of Health Care in Retirement’. In the report, they noted that married couples face nearly a 1 in 2 chance that at least one spouse will live to age 90.

- Stock losses may be temporary, purchasing power losses are more often permanent: Between 1926 and 2021, there has never been a period that the losses from a diversified basket of US equities have not been fully recovered. If you are looking for proof… Simply look to the 70 new all-time highs the S&P 500 registered in 2021.

Those that lose cash in the stock market, typically do so one of two ways: 1. They put all their ‘eggs in one basket’ owning stocks like Enron or WorldCom that go bankrupt and never recover; or 2. They abandon stocks after experiencing losses and fail to reinvest in stocks to benefit from their inevitable rebound. Said another way, as long as an investor is in a diversified portfolio, like the S&P 500, and does not sell, equity losses between 1926 and 2021 have proven temporary.

On the other hand, lost purchasing power is more often permanent. Once prices rise, they rarely retreat, except in a few rare cases like electronics. Consider this, according to the AARP, just over 50 years ago (1972) coffee was $0.66 a pound, a gallon of gasoline cost $0.36, a Ford Mustang would set you back $2,510 and a postage stamp was a mere $0.08.

Conclusion

At the end of the day, we believe investors must make a choice between two objectives and the risks/costs that each carry.

- Objective 1 is to focus on quarterly statement stability and thus minimize changes in account values. Those choosing this option will worry less about the macro-economic environment and the daily gyrations of financial markets. The cost of objective 1, however, can be great because it is likely to deliver little to no ‘real’ (inflation-adjusted) portfolio growth, and thus is unlikely to meet long-term investment goals.

- Objective 2 is to focus on long-term portfolio goals by constructing portfolios from asset class that have historically delivered higher returns. The risk/cost is significant since it exposes the investor to market volatility and fluctuating quarterly statement values.

Both objectives are attainable independently with sound financial planning, in our view. However, it is nearly impossible to fully achieve both in combination. Essentially, there is no free lunch. RiverFront manages portfolios to balance the two objectives depending on the goal of the investor. For investors in their ‘Distribution’ phase, the balance may favor portfolio stability and income over growth. On the other hand, ‘Accumulate’-oriented portfolios will favor growth over stability.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

Definitions:

In behavioral economics, recency bias (also known as availability bias) is the tendency for people to overweight new information or events without considering the objective probabilities of those events over the long run.

The money market refers to trading in very short-term debt investments. At the wholesale level, it involves large-volume trades between institutions and traders. At the retail level, it includes money market mutual funds bought by individual investors and money market accounts opened by bank customers.

A Treasury Bill (T-Bill) is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less. Treasury bills are usually sold in denominations of $1,000. However, some can reach a maximum denomination of $5 million in non-competitive bids. These securities are widely regarded as low-risk and secure investments.

A certificate of deposit (CD) is a savings product that earns interest on a lump sum for a fixed period of time. CDs differ from savings accounts because the money must remain untouched for the entirety of their term or risk penalty fees or lost interest. CDs usually have higher interest rates than savings accounts as an incentive for lost liquidity.

The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

RiverFront’s Price Matters® discipline compares inflation-adjusted current prices relative to their long-term trend to help identify extremes in valuation.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 2749903