By The BCM Investment Team

Much will be written about the challenges, difficulties, pain and suffering endured by humanity in 2020. We would like to focus on some of the good that came out of last year’s strife:

- Our Democracy, while far from perfect, works. While many did not see their preferred candidates win, as always, this is part of Democracy, and Democracy is still the best system of government humans have yet devised.

- Our society, while far from perfect and through too much tragedy, edged a bit closer to embracing equality in all that the word means. Now we all need to go forth in peace to finally make the words of our founding fathers our creed, our bond…and everyone’s reality.

- Our biotechnology and pharmaceutical industries, while far from perfect, are prodigious. Instead of the typical ten years, they created at least three viable vaccines from scratch in less than one year.

- Our health care system, while far from perfect, has been exalted by all those who serve. Faced with the worst pandemic in more than a century, these caregivers’ devotion, tenacity, compassion, and disregard for personal well-being is beyond reproach.

- Love, while far from perfect, is a much stronger force than any other. For this, we give thanks…

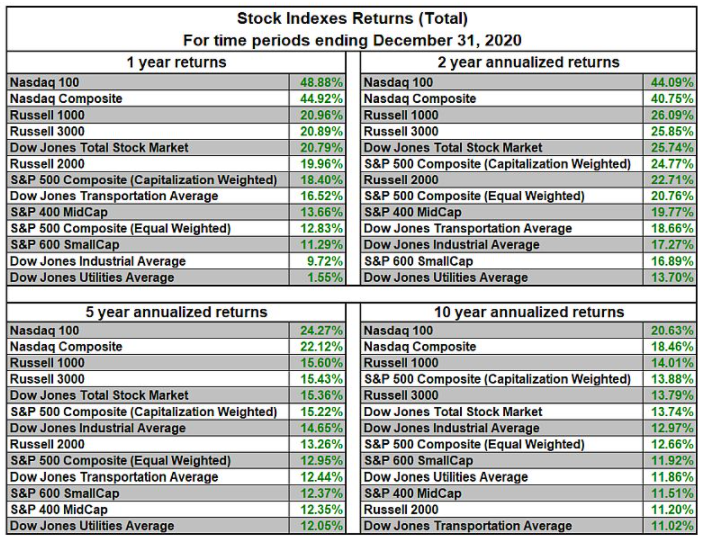

Meanwhile, our financial system and markets—while also far from perfect—showed resilience, resolve and reward in 2020. The chart above illustrates how consistent U.S. equity markets have been since the Great Recession. In fact, at a high level, 2020 was almost the perfect continuation of the trends established in the decade that preceded it. U.S. equities ruled the roost. The big got bigger. Humanity continued to adopt technology at an increasing rate. Don’t fight the Fed. Interest rates can go to zero…even slightly lower…

Of course, annual returns are wholly insufficient to describe a year in which we experienced multiple market cycles. We can’t hope to adequately capture all of the nuances of 2020’s market landscape, but we do think it’s worth expanding on factor returns—a particular point of interest to quantitative managers. Factors, often marketed as “smart-beta,” are common attributes that have historically led to one group of equities outperforming another. Examples of widely accepted factors include momentum, size, quality, yield, low volatility, and value. Not only were many of these factor relationships flipped on their heads in 2020, but the change in factor leadership throughout the year made it particularly challenging for any factor-based investors to perform well. Given the extreme and unique circumstances of the year, it appears as though a predominant “Covid factor” emerged.

This Covid factor exhibited attributes of momentum and quality and represented a new way in which investors segmented the equity markets. Companies across various industries with disparate characteristics were split into two groups: those that benefitted from the societal changes brought about by the virus and those that did not. For example, technology companies and homebuilders were beneficiaries of the work from home economy while utilities and commercial real estate companies were not. Of the six most common factors, only one outperformed the S&P 500 index, and the sole factor which outperformed—momentum—captured all of its outperformance in the first half the year. While the second half offered hope for some of the more beleaguered factors, it did not offset the losses suffered earlier in the year. For anyone who lived through 2020 day by day, this simply confirms our intuition. 2020 proved to be a continuation of some long-term trends and a turning point for others.

Source: Bloomberg and Beaumont Capital Management (BCM), for the period 1/1/20 through 12/31/20. Factors are represented by the following indices: S&P 500 Momentum Index, S&P 600 Index, S&P 500 Low Volatility Index, S&P 500 Value Index, S&P 500 Quality Index, and S&P 500 High Dividend Index.

For the remainder of this letter we’ll attempt to look forward. We humans are constantly subject to our emotional coping skills. Translated, we have biases and one of the strongest is recency bias…what has been happening is going to continue. This bias can endure even in the face of the obvious. While no one knows what the future is going to bring, perhaps a little reflection on what may be important going forward is in order.

- The U.S. dollar has been weakening. Since its March peak, the USD has fallen 13.1%1 and is near the 2018 low. This could provide a tailwind for export-oriented industries, such as manufacturing, and boost international asset classes and commodities. Rising import prices and higher commodity prices may well begin the reflation cycle so notably absent for the past 10 years.

- When is too big too big? Apple is worth ~$2.2 trillion, Microsoft ~$1.7 trillion, and Amazon gets the bronze medal at ~$1.6 trillion2. There are many active anti-trust lawsuits in progress against the mega-cap tech and internet-related companies. At some point, just like AT&T and Standard Oil, oligopolies and monopolies will be split up…

- The Federal Reserve dusted off its 2008 QE playbook with great success and has indicated that monetary easing is here to stay for the foreseeable future. What makes this time different is that Congress embarked on a revolutionary fiscal stimulus program of its own. While it’s true that the recovery has been K-shaped, it’s safe to say that the U.S. has never before emerged from a recession with household wealth at an all-time high.

- Interest rates cannot fall forever; there is a practical floor even if it is slightly negative. This ensures that returns from fixed income will be lower in the future and traditional static asset allocation portfolios will have to rely almost entirely on equities to meet their return expectations. Worse, if rates rise, fixed income could prove to be a temporary headwind to portfolio returns.

- Retail investors, many working from home with “time on their hands,” have embraced the market in a magnitude not seen since the internet bubble of the late 90’s. A record was set for the most IPOs in a single year, over half of the IPO proceeds went to special purpose acquisition corporations (SPACs, also referred to as “blank check companies”), and retail interest in equity options is at an all-time high. While there’s disagreement about the level of influence these market participants hold, their presence is too large to ignore and has added more emotion to the markets’ movements.

All in all, we believe optimism is warranted as we launch into 2021. Every year, the degree of life’s challenges can be similar to the degree of the market’s challenges…they are unknown and often temporarily set us back, but our resiliency and will to overcome have always prevailed.

As always, we thank you for your confidence in and business with BCM.

This article was contributed by Dave Haviland, Portfolio Manager and Managing Partner at Beaumont Capital Management, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosures:

1 Source: The Chart Store, from 1/8/21

2 Source: “List of Public Corporations by Market Capitalization.” Wikipedia, Wikimedia Foundation, 12/31/20, https://en.wikipedia.org/wiki/List_of_public_corporations_by_market_capitalization

Copyright © 2021 Beaumont Capital Management LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Beaumont Capital Management. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Beaumont Capital Management.

Past performance is no guarantee of future results. Index performance is shown on a gross basis and an investment cannot be made directly in an index.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk.

Diversification does not ensure a profit or guarantee against a loss.

The Standard & Poor’s (S&P) 500® Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not managed and do not incur fees or expenses. The S&P Small Cap 600® Index is an unmanaged index that tracks the performance of 600 widely held, small-capitalization U.S. stocks. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World ex-U.S. Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the United States. The MSCI ACWI Index captures large and mid-cap representation across 23 Developed Markets and 26 Emerging Markets countries. The MSCI ACWI Index ex-U.S. captures large and mid-cap representation across 22 Developed Markets and 26 Emerging Markets countries, excluding the United States. The Bloomberg Barclay’s U.S. Aggregate Bond Index is a broad base index and is often used to represent investment grade bonds being traded in the United States.

“S&P 500®”, and “S&P Small Cap 600®” are registered trademarks of Standard & Poor’s, Inc., a division of S&P Global, Inc. MSCI® is the trademark of MSCI Inc. and/or its subsidiaries.

For Investment Professional use with clients, not for independent distribution. Please contact your BCM Regional Consultant for more information or to address any questions that you may have.

Beaumont Capital Management was originally created in 2009 as a separate division of Beaumont Financial Partners, LLC. Beaumont Capital Management LLC spun off as its own entity as of 1/2/2020. Beaumont Financial Partners, LLC was originally registered as Beaumont Trust Associates in 1981 and was reorganized into Beaumont Financial Partners, LLC in 1999.

Beaumont Capital Management LLC

75 2nd Ave, Suite 700, Needham, MA 02494 (844-401-7699)