By The BCM Investment Team

With apologies to Admiral Farragut…

The S&P 500® Index’s 8.5% third-quarter gain was a welcome response to the first half of the year’s histrionics. The quarter had its own volatility as the markets flirted with a 10% correction, but then resolutely continued climbing the proverbial wall of worry. Ultimately, the trends that were in place at the beginning of the quarter continued and little changed:

- Equity markets rose, led by the mega-cap U.S. technology and consumer discretionary companies

- Small-cap, mid-cap and value stocks went up, but underperformed

- International markets largely went up, but underperformed

- Commodities generally went up, but underperformed

- Interest rates stayed low… almost everywhere

- The U.S. dollar went up… er no, it actually went down, breaking below its ten-year trendline

There were important nuances. The Federal Reserve (Fed) extended its policy of near-zero interest rates at least through 2023 and—perhaps more importantly—changed its inflation targeting policy. In the past, the Fed’s policy was a symmetrical 2% inflation target where the committee would work to nudge inflation up if it fell below 2% and stamp it out if it rose above 2%. This policy was often criticized as prematurely restrictive, choking off economic growth before large swaths of society are able to benefit. Under the new policy, the Fed is no longer pursuing a symmetrical approach; instead, it has moved its focus towards the long-term average rate of inflation. The Fed will now allow inflation to rise moderately above 2% for some time following periods where inflation has been persistently below its 2% target. To translate, the Fed has committed to allowing the economy to fully recover from the pandemic—and then some—before tightening monetary policy.

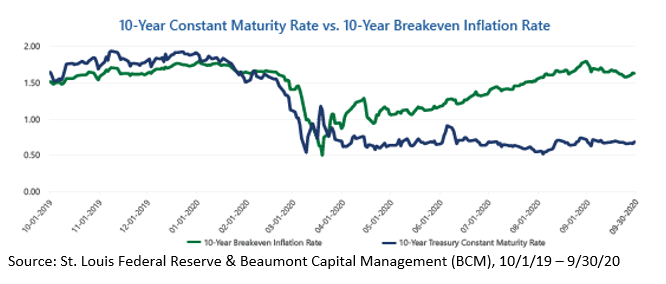

In our opinion, this is good news! At least for the time being, we don’t have to worry about the Fed “getting in the way” of the recovery, nor will it impede any subsequent economic growth. Leading up to this announcement, market inflation expectations had risen steadily since the low in March without any corresponding rise in interest rates. This combination has resulted in an incredibly stimulative environment, with real interest rates at historic lows. While this stimulus is a positive for the economy, considering the recession we find ourselves in, it creates quite a quandary for investors. First, if the market’s inflation expectation over the next 10 years is approaching 2%, why aren’t rates rising? Second, in a world where the risk-free real interest rate is sharply negative and nominal rates are near zero, how will investors meet their financial goals?

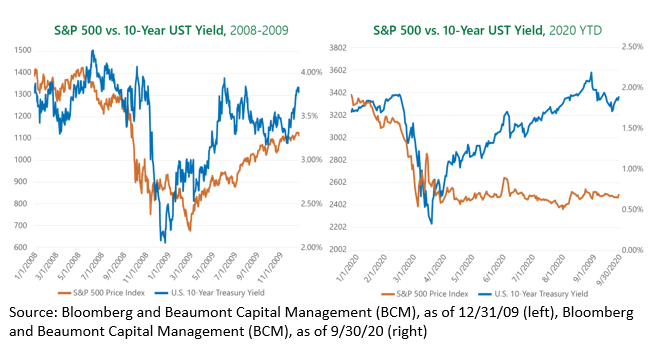

To provide some context for our first question, the dichotomy between nominal and real interest rates comes as another distinction between this recession and past recessions, most notably 2008. Typically, as the economy turns the corner towards recovery, the market, inflation expectations, and interest rates begin to rise in lockstep—signaling “risk on” and a general increase in economic activity. This has not been the case thus far as the Fed’s ~$3 trillion of QE and other measures have kept interest rates low. However, today investors seemingly hold opposing views simultaneously: the outlook for the economy is positive, but it is also worth paying a premium for risk-free securities.

Can this persist? Probably not. Investors may believe that the outlook for the economy has improved and that the Fed has enough tools to keep nominal interest rates low for a period of time. It’s also possible that investors aren’t expecting a broad economic recovery and are instead simply ascribing a higher value to the “winners” (i.e. large-cap tech) that comprise an ever-expanding percentage of the market indices. Only time will tell, as we are truly in uncharted territory.

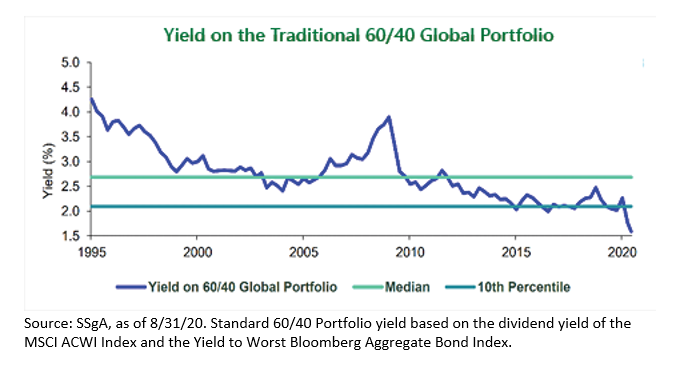

Whatever the reason, investors need to grapple with the effects that low nominal and real interest rates will have on their portfolios. The ten-year U.S. Treasury’s yield-to-maturity—the presumed risk-free rate of return—was 0.68% at quarter end and the Bloomberg Barclays U.S. Aggregate Bond Index’s (BBAB) was not much better with a yield-to-worst of 1.18%. With rates at or near historic lows, massive new supply of corporate and government debt, the Fed telegraphing a higher inflation tolerance and corporate defaults surging due to the pandemic, we believe static bond allocations are poised to have a tough go in the months and years ahead. Long gone are the days when fixed income investments will comprise a sizeable component of a portfolio’s expected return. Long gone are yields high enough to support the withdrawal assumptions in most financial plans. Fixed income may still play the role of risk mitigation and provide shorter periods of opportunity, but historic 60/40 model return expectations are now only achievable by accepting higher equity or other investment risk.

While “take more risk” may be an answer to meeting return expectations, we know that it is impractical for many investors to do so given their risk tolerance and time horizons. While not an all-encompassing solution, we believe dynamic and tactical strategies are incredibly powerful tools for investors in this environment. The ability to mitigate risk in poor market environments is immensely valuable, not only for the obvious reasons but also because it may allow investors to take more risk when in favorable market environments. Capitalizing on trends and opportunity in the markets has always been a hallmark of successful investing, but the current market environment may necessitate it.

In closing, we would be remiss to not acknowledge the 200,000+ American deaths and 1,000,000+ global deaths caused by the pandemic. Our hearts and prayers go out to all those who have lost loved ones. Looking ahead, we are in the midst of one of the most contentious elections in American history. While it’s easy to make the case that the present circumstances are different than those in past elections, history tells an appealing story. Regardless of who wins, the markets generally react well over the following year. While many/most/all of us cannot wait for 2020 to end, we are pleased that our investment systems are poised to react to whatever the pandemic, politics, economics or markets throw at us.

As always, we thank you for your business and confidence in BCM.

This article was contributed by Dave Haviland, Portfolio Manager and Managing Partner at Beaumont Capital Management, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Originally published by Beaumont Capital Management

Disclosures:

Copyright © 2020 Beaumont Capital Management LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Beaumont Capital Management. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Beaumont Capital Management.

Past performance is no guarantee of future results. Index performance is shown on a gross basis and an investment cannot be made directly in an index. The performance of any ETFs, as contributors or detractors to the strategy, are provided on a gross basis. An Exchange Traded Fund (ETF) is a security that tracks an index, a commodity or a basket of assets like an index fund, but trades like a stock on an exchange. ETFs experience price changes throughout the day as they are bought and sold. All BCM strategies invest only in long-only ETFs.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk.

Diversification does not ensure a profit or guarantee against a loss.

The Standard & Poor’s (S&P) 500® Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not managed and do not incur fees or expenses. The S&P Small Cap 600® Index is an unmanaged index that tracks the performance of 600 widely held, small-capitalization U.S. stocks. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World ex-U.S. Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the United States. The MSCI ACWI Index captures large and mid-cap representation across 23 Developed Markets and 26 Emerging Markets countries. The MSCI ACWI Index ex-U.S. captures large and mid-cap representation across 22 Developed Markets and 26 Emerging Markets countries, excluding the United States. The Bloomberg Barclay’s U.S. Aggregate Bond Index is a broad base index and is often used to represent investment grade bonds being traded in the United States.

“S&P 500®”, and “S&P Small Cap 600®” are registered trademarks of Standard & Poor’s, Inc., a division of S&P Global, Inc. MSCI® is the trademark of MSCI Inc. and/or its subsidiaries.

The BCM investment strategies may not be appropriate for everyone. Due to the periodic rebalancing nature of our strategies, they may not be appropriate for those investors who desire regular withdrawals or frequent deposits.

For Investment Professional use with clients, not for independent distribution. Please contact your BCM Regional Consultant for more information or to address any questions that you may have.

Beaumont Capital Management was originally created in 2009 as a separate division of Beaumont Financial Partners, LLC. Beaumont Capital Management LLC spun off as its own entity as of 1/2/2020. Beaumont Financial Partners, LLC was originally registered as Beaumont Trust Associates in 1981 and was reorganized into Beaumont Financial Partners, LLC in 1999.

Beaumont Capital Management LLC

75 2nd Ave, Suite 700, Needham, MA 02494 (844-401-7699)