By: BCM Investment Team

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.” Charles Dickens, in A Tale of Two Cities, set out to describe the necessity of compassion and the possibility of redemption during the French Revolution. Based on how 2020 has unfolded so far, we too are going to need all the compassion and redemption we can get.

Covid-19 has had a profound effect on all of our lives and seems set to continue to do so for the foreseeable future. We firmly believe that we will prevail over the virus, but it will take more time than any of us want, and the costs in all facets of life have been—and will continue to be—enormous. As of June 30th, worldwide confirmed cases have topped ten million with over 500,000 lives lost.

Here in the U.S., it is “a tale of two cities” as well…New York and the Northeast have beaten back the first wave while Los Angeles and much of the South and West are experiencing a true first wave of their own. Over 130,000 Americans have been lost due to Covid-19—well over two times the number of American servicemen lost in Vietnam—and there will be more. This virus is very good at spreading, and until a vaccine and/or cure is developed, we must all practice social distancing and wear masks. From the human side, this is the new normal.

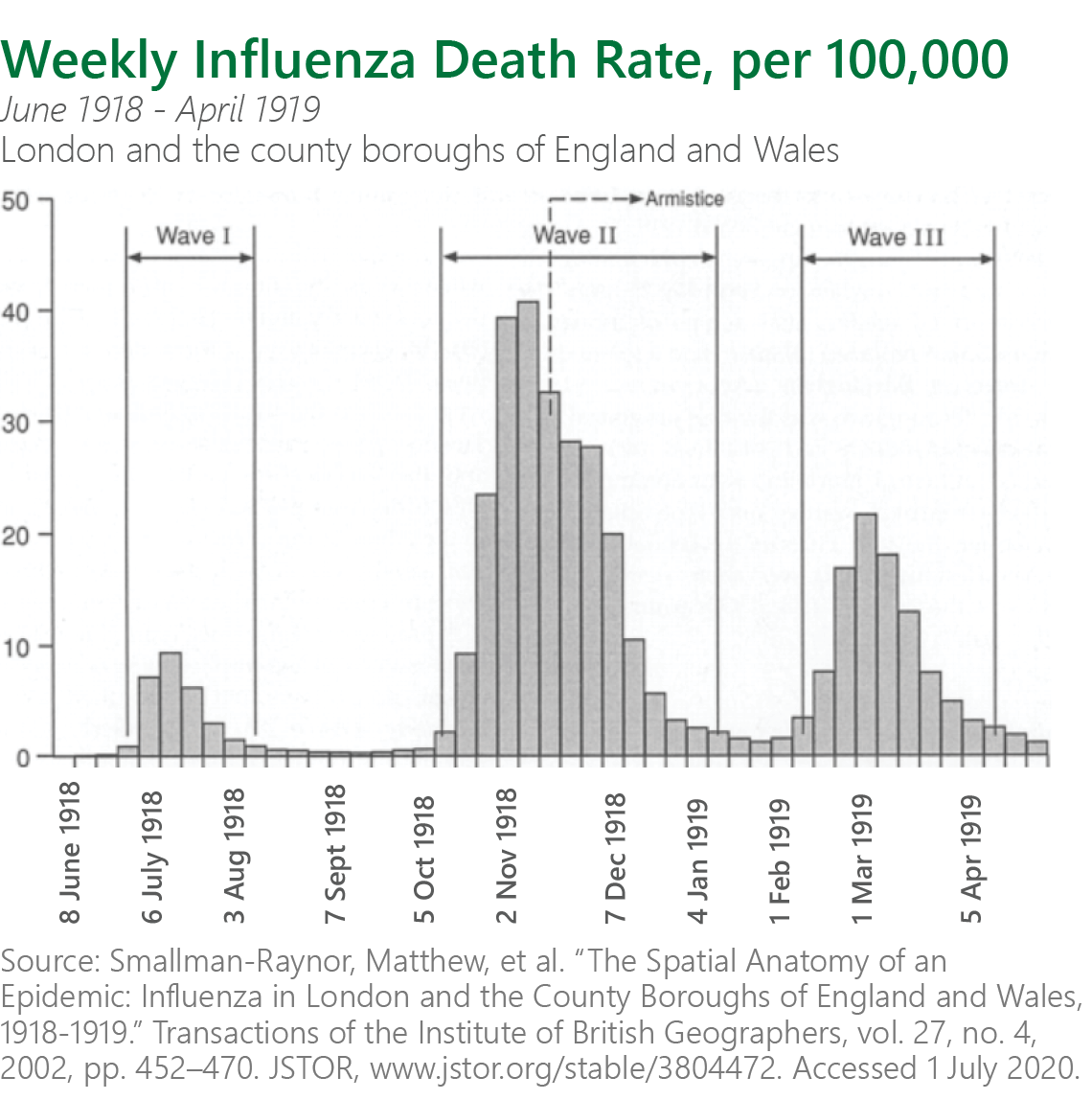

How long will this pandemic last? No one knows, but we can look to history for guidance. The influenza pandemic of 1918-20 may shed some light. The following chart is from a medical study performed in the U.K. showing the death rates of the first, second and third waves of that pandemic:

Now we do not wish to propagate despair, but it is right to be informed about what may happen if all Americans do not resolve to stamp out Covid-19. With new cases topping 50,000/day in the U.S. as of July 2nd, it is clear this resolve is not yet in place. We can live without bars, large gatherings and other pleasantries until the vaccine and/or cure is found, but lost family and friends will never return.

Speaking of despair, we would be remiss to not mention George Floyd and the movement for social justice for all Americans due to his tragic, but not uncommon demise. The Black Lives Matter movement has caused an awakening amongst Americans to face prejudice and racism head-on. Our hope is that meaningful reform, where needed, is finally put into place. It is time for our American ideals, so eloquently put forth by our founding fathers, to become a reality for each and every one of us.

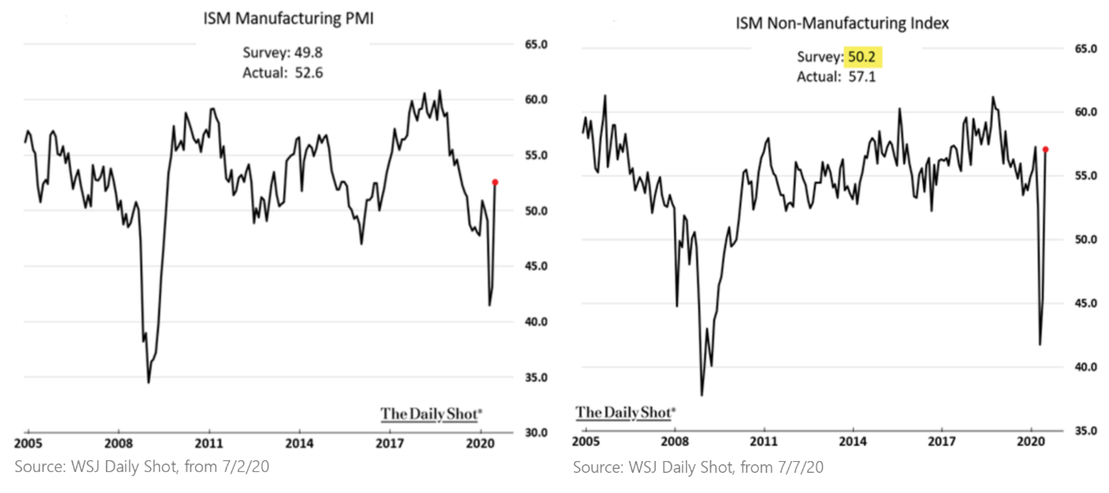

Turning to economics, as expected, the economy fell off a cliff in March and April with the Covid-19 shutdowns. U.S. GDP was down 5% in 1Q20 as the March shutdowns immediately took their toll. The second quarter will likely show further contraction as many states were fully or partially closed during April and May. In late June, continuing unemployment claims exceeded 20 million Americans. The Fed’s actions and the government’s fiscal stimulus programs have certainly helped, but the reality is that bankruptcies and closures will mean some jobs have been lost forever. The good news is that on July 2nd, non-farm payrolls rose by 4.8 million, shattering expectations to the upside as the economy re-opens. Both the Manufacturing and Services Purchasing Managers Indexes saw rebounds back into growth in June. Yet we worry that the more recent Covid-19 outbreaks may put a damper on the recovery.

As we have heard many times, the markets are not the economy. The stock markets are forward-looking, and they have espoused optimism much earlier than the economic data has warranted. After bottoming on March 23rd, the S&P 500® Index has surged to within 3% of its all-time high while the tech-laden NASDAQ has already reached new record highs. It is worth noting again that this was the fastest decline to a bear market ever and has been one of the steepest recoveries ever. What used to take months and years has been condensed to weeks and months.

Instead of sharing additional dismal datapoints and writing off the market’s movements as irrational and disconnected from reality, we’re going to take the opposite approach. We have, admittedly, been skeptics of the market’s rise, so we set out to find reasons why the markets may not be disconnected from reality. As an aside, behavioral finance is a core tenet of our investment philosophy and confirmation bias is a well-known cognitive tendency where one tends to search for information that confirms their opinions as opposed to that which invalidates them.

Ben Breitholtz, a data scientist at Arbor Research, created the following chart for Joe Weisenthal of Bloomberg to illustrate how ancillary economic information can paint a powerful picture. In short, it compares the S&P 500 (orange) with an index of Google search results for consumer items (blue). The point is to see, based on this 2020 search activity, how far we are above or below the normal search levels. Now as Joe points out, “searching for something and buying something isn’t exactly the same thing, but it’s safe to guess that the two are highly correlated.” We observe that the consumer search activity and the markets are moving almost in lock step.

Source: Bloomberg, from June 29, 2020. Data shown is the average of the searches; it is benchmarked back to 2017 and is seasonally adjusted.

Weisenthal then raises the question:

“Sure, activity rebounded dramatically, but the market isn’t taking into account that the unemployment insurance expansion is set to be retired, and that the $1200 check only went out one time, and the rising virus cases likely mean further slowdowns in activity, and that as layoffs affect higher paid workers and are less temporary, then that will put us into another recession.”

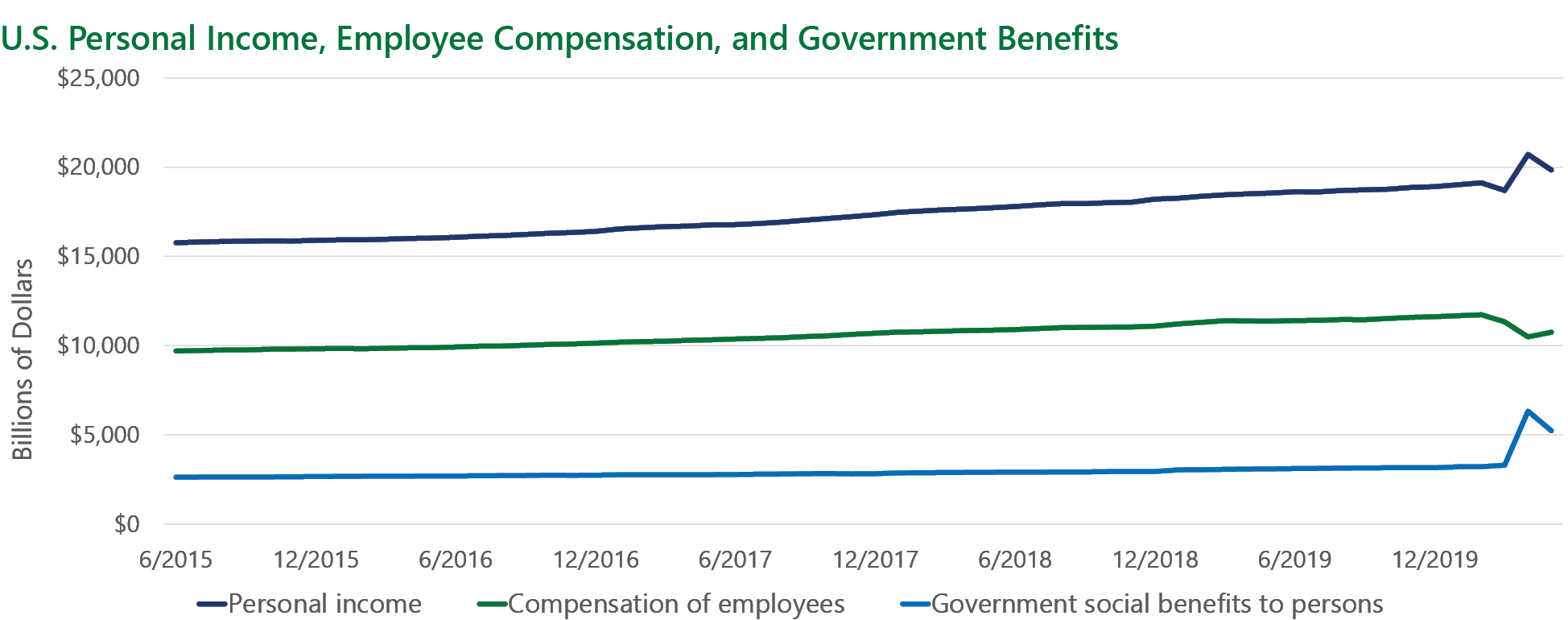

Maybe, but these things haven’t happened yet. What has happened is that our understanding of the virus has improved, lockdown restrictions across the country have been reduced, and the federal government’s monetary and fiscal response has staved off the negative economic feedback loops that normally characterize a recession. In fact, despite a 14.7% unemployment rate in April, personal income actually increased!

Source: U.S. Bureau of Economic Analysis and Beaumont Capital Management, as of 5/31/20

If the economy is recovering and consumers—the main driver of U.S. economic growth—largely remain intact, doesn’t it make sense that the markets should recover as well? As active managers, we’re the first to admit that markets aren’t wholly efficient, but it would be foolish to ignore the substantial reappraisal of trillions of dollars of capital. The risks listed above are real. If they come to fruition, the stock market will likely fall. We may think the probability of these risks becoming reality is higher than the market’s appraisal, but it’s indisputable that the economic outlook is rosier now than it was at the end of March.

All this uncertainty creates opportunity for managers like BCM. 2020 has been a trying year, and we’re only halfway through. There is light at the end of the tunnel though, and our investment systems are poised to guide us through these most unusual and uncertain times. As always, we thank you for your business and confidence.

This article was contributed by Dave Haviland, Portfolio Manager and Managing Partner at Beaumont Capital Management, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

Disclosures:

Copyright © 2020 Beaumont Capital Management LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Beaumont Capital Management. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Beaumont Capital Management.

Past performance is no guarantee of future results. Index performance is shown on a gross basis and an investment cannot be made directly in an index. The performance of any ETFs, as contributors or detractors to the strategy, are provided on a gross basis. An Exchange Traded Fund (ETF) is a security that tracks an index, a commodity or a basket of assets like an index fund, but trades like a stock on an exchange. ETFs experience price changes throughout the day as they are bought and sold. All BCM strategies invest only in long-only ETFs.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk.

Diversification does not ensure a profit or guarantee against a loss.

The Standard & Poor’s (S&P) 500® Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not managed and do not incur fees or expenses. The S&P Small Cap 600® Index is an unmanaged index that tracks the performance of 600 widely held, small-capitalization U.S. stocks. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World ex-U.S. Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the United States. The MSCI ACWI Index captures large and mid-cap representation across 23 Developed Markets and 26 Emerging Markets countries. The MSCI ACWI Index ex-U.S. captures large and mid-cap representation across 22 Developed Markets and 26 Emerging Markets countries, excluding the United States. The Bloomberg Barclay’s U.S. Aggregate Bond Index is a broad base index and is often used to represent investment grade bonds being traded in the United States.

“S&P 500®”, and “S&P Small Cap 600®” are registered trademarks of Standard & Poor’s, Inc., a division of S&P Global, Inc. MSCI® is the trademark of MSCI Inc. and/or its subsidiaries.

The BCM investment strategies may not be appropriate for everyone. Due to the periodic rebalancing nature of our strategies, they may not be appropriate for those investors who desire regular withdrawals or frequent deposits.

For Investment Professional use with clients, not for independent distribution. Please contact your BCM Regional Consultant for more information or to address any questions that you may have.

Beaumont Capital Management was originally created in 2009 as a separate division of Beaumont Financial Partners, LLC. Beaumont Capital Management LLC spun off as its own entity as of 1/2/2020. Beaumont Financial Partners, LLC was originally registered as Beaumont Trust Associates in 1981 and was reorganized into Beaumont Financial Partners, LLC in 1999.

Beaumont Capital Management LLC

75 2nd Ave, Suite 700, Needham, MA 02494 (844-401-7699)