Nobu’s Notes

September FOMC Press Conference

Once again, we would like to introduce you to an informal advisor to the firm, Nobuya Nemoto, who brings an economist’s perspective to the team. His bio is provided at the bottom. As we have highlighted in past Nobu Notes, we think it important to attach our newsletter, A New Regime, as it appears that the Fed and other central banks will be continuing their tightening path.

Now on to his thoughts…

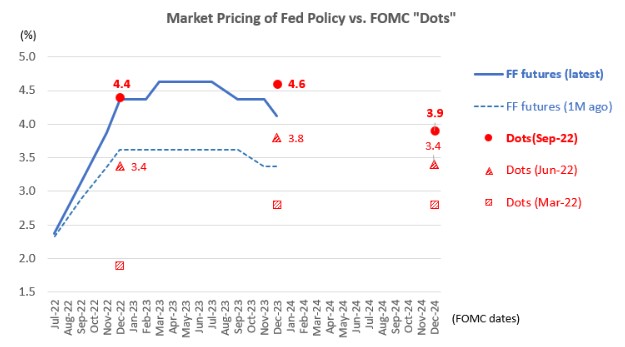

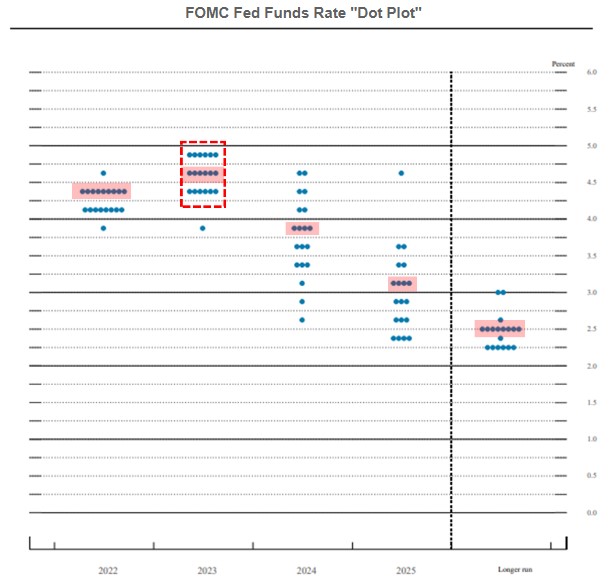

“Higher for longer”: As broadly anticipated, the Fed delivered yet another 0.75 percentage point rate hike (the third in a row) bringing the benchmark Fed Funds target range to 3.00 to 3.25%. In line with its hawkish concerted communication campaign since the Jackson Hole Symposium in late August, the Fed clearly signaled its intention to keep interest rates “higher for longer”. The so-called dot plot released at the same time shows the FOMC members collectively penciling a trajectory of the Fed Funds rate that is almost a full percentage point higher over the next 18 months, compared to the previous set of projections.

- “In light of high inflation, we think we will need to bring the funds rate to a restrictive level, keep it there for some time.”

- “We want to act aggressively now and keep at it until we get inflation down.”

The R-word…: During the press conference, Chairman Powell noted that “a long period of below trend growth” would be necessary. The official growth forecasts have been ratcheted down, more commensurate with the tough task the Fed has to face in order to bring down inflation. to bring inflation down. Following the technical recession during the first six months of this year, the Fed expects the economy to grow by a paltry 1.0% during the second half, followed by a mere 1.2% next year. With the standard errors around Fed’s growth projections estimated to be as wide as +/-1.8% (Fed’s own calculations), no wonder Powell sounded much more agnostic as to whether a recession can be avoided:

- “Restoring price stability while achieving soft landing is challenging.”

- “No one knows if we will get a recession, or if so, how deep it will be.”

- “Chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive or restrictive for longer.”

Fed Funds rate with a 5%-handle?: While the FOMC’s central message and projections have come a long way to reflect the strong stagflationary dynamics buffeting the economy, the balance of risks looks still skewed toward the Fed having to do more to get inflation under control. Actually, part of Powell’s narrative hints at such a possibility:

- “We’ve just moved into the lowest levels of what we consider restrictive today.”

- “Still a way to go on rates.”

Crucially for next year-end, the dot plot shows that FOMC members are evenly split between Fed Funds target ranges of 4.25-4.50%, 4.50-4.75%, and 4.75 to 5.00%. Chances are that the market might witness the Fed Funds rate with a 5%-handle first before being able to price in a “Fed pivot” scenario…

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20220921.pdf

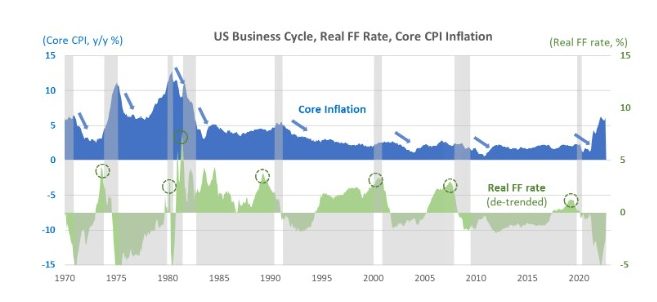

Real rate vs. business cycle: As many market commentaries have been pointing out recently, a positive real FF policy has tended to precede recessions, which in turn were followed by sizable reductions in core CPI inflation. The real FF rate measured simply as nominal FF rate minus realized (core) CPI inflation remains deeply in negative territory, even after today’s rate hike announcement. It could perhaps explain the relative resilience of the economy so far, but in any case, the historical stylized fact strongly suggests that the Fed might have additional catching up to do.

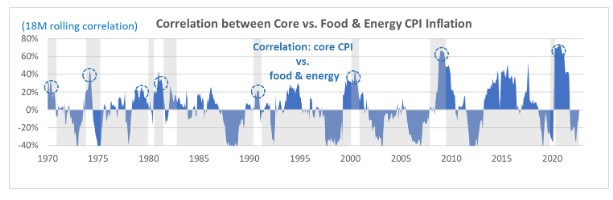

Commodities vs. core inflation: One interesting aspect of the relationship between business cycles and the inflation dynamics is the correlation between core CPI vs. food & energy components, which has tended to be prominently positive around recessions while remaining muted or negative in other times. Without a recession, the peak out (if any) of energy and food prices might not necessarily translate into a swift moderation across a broader segment of consumer prices.

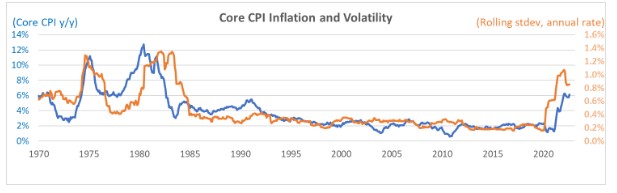

Heteroskedasticity…: Last but not least, inflation in statistical jargons is both non-stationary and heteroskedastic; it exhibits non-constant mean and variable standard deviation. Historically, the standard deviation of CPI data tends to be higher when inflation is high. Given the still elevated levels of actual inflation, investors need to be prepared for the prospects of persistent high degree of variability in monthly CPI releases that could be prone to surprises (relative to consensus) and hence exacerbate market volatility.

Best,

Nobu

Nobuya Nemoto has a background in macroeconomic and quantitative research. Nobuya was one of the founding partners of Washington-based Potomac River Capital LLC (“PRC”; a macro hedge fund) as the Head of Strategy and Quantitative Research, and helped the fund grow its AUM twentyfold over the course of 10+ years. Prior to PRC, Nobuya was a Managing Director at Citigroup Asset Management (“CAM”) heading its Capital Market Research in charge of developing CAM’s global asset allocation platform and served as a senior member of the Asset Management Committee that produced key asset allocation decisions for firm-wide balanced products. Before joining Citigroup, Nobuya was the Chief Japan Economist at Nomura Securities, ranked multiple times as one of the top three research teams by Institutional Investor Magazine. He has a BA in International Economics from the University of Tokyo and pursued doctoral studies in economics at Columbia University under Nomura’s sponsorship. Nobuya resides in London, UK with his wife and two cats.

Best regards,

The Auour Investments Team

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal.

All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Auour Investments LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.