By Solomon G. Teller, CFA, Chief Investment Strategist, Green Harvest Asset Management

Over the summer, my son really got into riddles and word games, his favorite type involving contradictory statements. While “he who hesitates is lost”, doesn’t “haste make waste”? As the prospect of tax hikes populates headlines and interest in tax management grows, the old adage “don’t let the tax tail wag the dog” comes to mind. Perhaps “you can have your cake and eat it too.”

At Green Harvest, we seek to provide investors tax alpha through smart portfolio construction and continuous tax management, every market day. However, the “cake” – the desired market exposure of your portfolio – remains intact throughout. When Green Harvest sells positions to capture losses (for tax benefits), it simultaneously purchases similar ETFs to keep portfolios fully invested. This past month was no exception.

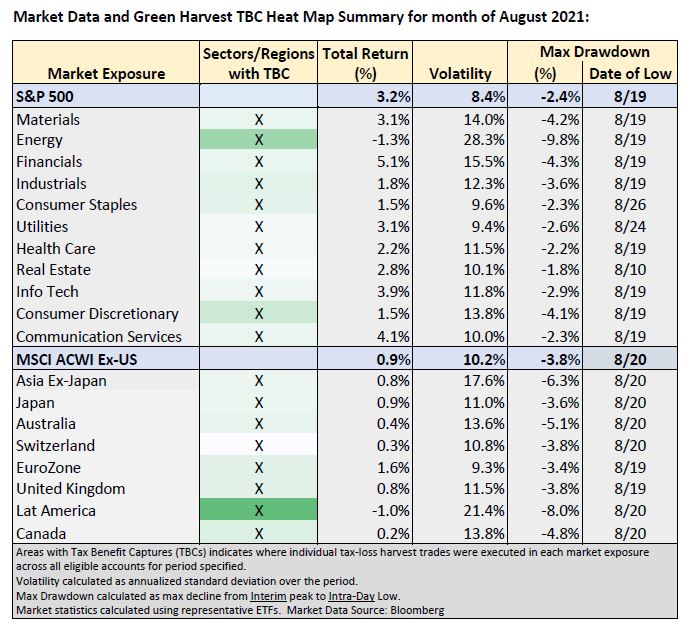

Here are highlights, accompanying statistics in the table on page 2:

- Stocks continued to climb, particularly in the U.S., with the S&P 500 up 3% and International stocks up nearly 1%, but there were still several opportunities for Tax Benefit Capture (TBC).• Stocks continued to climb, particularly in the U.S., with the S&P 500 up 3% and International stocks up nearly 1%, but there were still several opportunities for Tax Benefit Capture (TBC).

- Similar to July, there was one sector and one region that fell much more than others, enabling targeted and meaningful TBC.

- After losing more than 8% in July, Energy stocks declined again in August. On the date of their maximum decline (August 19th), Energy stocks were down more than 4 times the overall S&P 500 index. For the second month in a row, Green Harvest seized the opportunity, as Energy sector trades comprised 1/3 of all U.S. Equity TBC related trading.

- Globally, Latin America was the source of divergence, leading to more than half of the international tax benefits harvested in that region.

In reality, there is no cake or wagging dog. Investors needn’t be discouraged by contradiction; with the right tools and strategy, they can assess trade-offs and take control. Consider the largest investment cost – taxes – and focus on the real (returns). And make an investment plan.

Hope you had a great Labor Day weekend.

Disclaimers:

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when the portfolio is liquidated. Current performance may be higher or lower than that quoted. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

GHAM does not provide tax advice. Although GHAM does not employ a Certified Public Accountant on its staff, we have, and continue to work with outside accounting firms and outside tax counsel that provide ongoing guidance and updates on all relevant tax law. Federal, state and local tax laws are subject to change. GHAM is not responsible for providing clients updates on any changes in tax laws, rules or statutes.

Reasons to harvest capital losses, sources of capital gains and the suggestion that mutual funds distribute capital gains are for example purposes only and not meant to be tax, estate planning or investment advice in any form or for any specific client.

All performance and estimates of strategy performance, after tax alpha, after tax alpha opportunities and other performance figures are derived from data provided from multiple third-party sources. All estimates were created with the benefit of hindsight and may not be achieved in a live account. The data received by GHAM is unaudited and its reliability and accuracy is not guaranteed.

The availability of tax alpha is highly dependent upon the initial date and time of investment as well as market direction and security volatility during the investment period. Tax loss harvesting outcomes may vary greatly for clients who invest on different days, weeks, months and all other time periods.

All estimates of past returns of broad, narrow, sector, country, regional or other indices do not include the impact of advisor fees, unless specifically indicated. Past performance and volatility figures should not be relied upon as an indicator of future performance or volatility.

This material is not intended to be relied upon as legal, investment or tax advice in any form or for any specific client. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person. All investments carry a certain degree of risk, and there is no assurance that an investment will perform as expected over any period of time.

As a convenience to our readers, this document may contain links to information created and maintained by third party sites. Please note that we do not endorse any linked sites or their content, and we are not responsible for the accuracy, timeliness or even the continued availability or existence of this outside information. While we endeavor to provide links only to those sites that are reputable and safe, we cannot be held responsible for the information, products or services obtained from such other sites and will not be liable for any damages arising from your access to such sites.