Source: https://twitter.com/

Click here to read Astoria’s Q3 Investment Committee Views

- Astoria Portfolio Advisors has produced hundreds of pages of content in the past 3 months. Why do we spend so much time writing content?

- Astoria’s edge = research, portfolio construction, & ETF product expertise

- Below is a subset of our Quarterly Investment Committee ETF Insights. Please click the above link as the content below is only a small subset of our presentation.

- 2 things to remember about recessions: 1) They are always determined on an ex post basis 2) Very few people can accurately predict the timing. Remember 2008?

Source: https://www.reuters.com/article/us-usa-fed-bernanke-growth/bernanke-fed-is-not-forecasting-a-recession-idUSWBT00818220080117, https://money.cnn.com/2008/02/14/news/economy/bernanke_paulson/index.htm

- We believe in being discipline and strategic in our portfolio construction. However, asset allocation shouldn’t be a set it and forget it strategy.

Source: https://www.bloomberg.com/news/videos/2017-12-27/the-year-of-the-hedge-for-etfs-video, https://www.bloomberg.com/news/videos/2018-07-05/reading-the-dark-signs-in-etf-flows-video

- Is the Death of Value trade similar to when Business Week famously quoted the “Death of Equities” in the late 70s (and before the ensuing bull market of the 80s)?

Source: https://twitter.com/verdadcap/status/1175153208064380928, https://www.bloomberg.com/news/articles/2019-08-13/it-s-been-40-years-since-our-cover-story-declared-the-death-of-equities

- Global equity indices peaked in January 2018. Don’t believe us? The stats don’t lie!

Source: https://twitter.com/AstoriaAdvisors/status/1163906553403101186?s=20

- The betting market, which correctly predicted the rise of Elizabeth Warren in the race for the democratic nominee, has repriced the odds of Trump completing his first term as POTUS. The odds have fallen from 85% a couple of weeks ago to 65%.

- As democratic leadership grows in the polls, market uncertainty will increase. This is yet another headwind for stocks.

- Astoria began allocating to the quality factor in Q4 2018. In 2019, pretty much every buyside and sellside firm has recommended an allocation to this factor. This makes us nervous.

Source: Kenneth French Data Library, with data as of 12/31/17, WisdomTree.

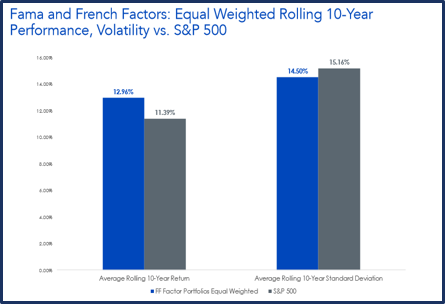

- The Street is now pushing the value trade and suggesting to fade momentum. Don’t forget that value and momentum ideally should be utilized together given their lower correlation.

- Combining factors has historically led to better risk adjusted returns when harvested over long periods of time. That’s why Astoria utilizes several factors in our dynamic and strategic portfolios.

Source: WisdomTree, Bloomberg, Zephyr StyleAdvisor, Kenneth R. French Data Library as of 6/30/2018.

- Why does Astoria utilize alternatives?

Source: Astoria Portfolio Advisors

- What is Astoria telling investors?

Source: Astoria Portfolio Advisors

- Astoria believes in being transparent with our portfolio risk characteristics. Some firms want to protect their “intellectual property” by saying their models or investment processes are proprietary. If we were on the other side of the table thinking about allocating to a manager, we certainly would want them to be as transparent as possible.

- We have been very vocal about utilizing portfolio construction tools and risk models when building multi-asset ETF portfolios.

- We don’t know how many of our peers are as transparent as Astoria.

Best,

Astoria Portfolio Advisors Investment Committee

Astoria Portfolio Advisors Disclosure: As of the time this report was written, Astoria held positions IHDG & BTAL. Note that this is not an exhaustive list of holdings across Astoria’s dynamic or strategic ETF portfolios. Also note that Astoria’s holdings vary across both our dynamic and strategic asset allocation portfolios. For full disclosure, please refer to our website.