Views from Astoria’s Investment Committee

- Liquidity is very poor in August so investors should keep in mind that the moves in both the stock and bond market tend to be exaggerated.

- However, the reality is that macro-economic data and earnings outlook have been deteriorating for several quarters.

- The old Wall Street adage lives on! “When central banks start to panic, markets stop panicking.”

- Astoria believes that the global bond market will remain skittish until central banks get more aggressive. There is no reason for the U.S. Fed Funds rate to be above to the 30-year U.S. Treasury.

- In Astoria’s view, the net result is that the U.S. market is experiencing a growth slowdown – not a recession. Some international economies are on the brink of (or have entered) a recession.

- The U.S. consumer and U.S. housing market remain strong. However, the U.S. economy can enter into a recession if a trade resolution isn’t reached soon.

- We continue to position defensively across both stocks and bonds and include a healthy amount of alternatives in our portfolios.

Why is the U.S. yield curve inverting?

- PMIs have significantly declined across a number of countries.

- Yield curves in several international markets inverted earlier this year, prompting overseas investors to invest in the U.S. treasury market for higher yields.

- Tariffs have been a huge driver behind investors’ flight to quality, but there are some powerful supply/demand imbalances that are also contributing to the inverted U.S. curve:

- Certain developed markets have an aging population creating more demand for bonds

- Pension funds need to meet liability targets

Does an inverted yield curve mean a recession is imminent in the U.S.? No!

7 out of the 8 U.S. yield curve inversions since 1960 were followed by a recession.

- The key however, is that a recession isn’t imminent:

- The number of months between inversion and recession has increased (17 months) for the prior 3 yield curve inversions compared to the prior four inversions (9 months).

- There was a 22-month lag between the time the yield curve inverted in 2008 and the subsequent recession.

- The sample size of these data sets is small and the variance is high. Moreover, we believe there are too many eyes focused on the inversion which makes its predictive power less effective.

- By the way, everyone seems to be an expert on forecasting recessions. Where were all these recession checklists and forecasters in 2000 and 2008??

Astoria would be more concerned about a pending U.S. recession if credit spreads widened, the U.S. housing market deteriorated, or the U.S. consumer slumped. For now, these risks seem contained.

- We believe there are 3 key areas that have to materially weaken for a U.S. recession to occur:

- credit spreads need to widen (they still remain contained).

Source: Bloomberg

2. the U.S. consumer weakens (for now, confidence remains strong).

Source: Conference Board

3. the U.S. housing market declines.

- Separately, lower interest rates are leading to higher refinancing levels which provides investors with more disposable income (see chart below).

Source: Mortgage Bankers Association

What is Astoria Portfolio Advisors telling investors?

1. Extend time horizons

- The research shows that the probability of making money increases as you lengthened your time horizon.

- If a 3% decline in the S&P 500 makes you uncomfortable, then you are taking too much risk in your portfolio.

- We often ask investors: what edge do you have competing with machine learning and computer algorithms that focus on short term trading?

2. Diversify across factors

- This can help provide a smoother risk/return profile over extended periods of time. For instance, an equal weighted portfolio of QUAL, MTUM, VLUE, USMV, & DGRW has produced a higher Sharpe Ratio vs. SPY (1.10 and 0.99 respectively) since August 2013.

3. Diversify internationally

- International markets are offering a much wider margin of safety. The earnings yield in many international markets are high. In a world where there is $15 trillion of negative yielding debt, the earnings yield for international stocks is attractive.

4. Incorporate alternatives into your portfolio

- The key is to find strategies that are inversely correlated to stocks.

- We have written before that we like Gold, Gold miners, Merger Arb, and Long/Short market neutral strategies.

BTAL has historically produced a -70% correlation to the U.S. equity market

- Now is a good time to include alternatives if you are worried about short term mark-to-market losses.

- In our view, global indices peaked in January 2018.

- The chart below shows how BTAL (goes long low beta stocks and shorts high beta stocks) has performed relative to the S&P 500 and other international indices since January 24, 2018.

Source: Bloomberg

Source: Bloomberg

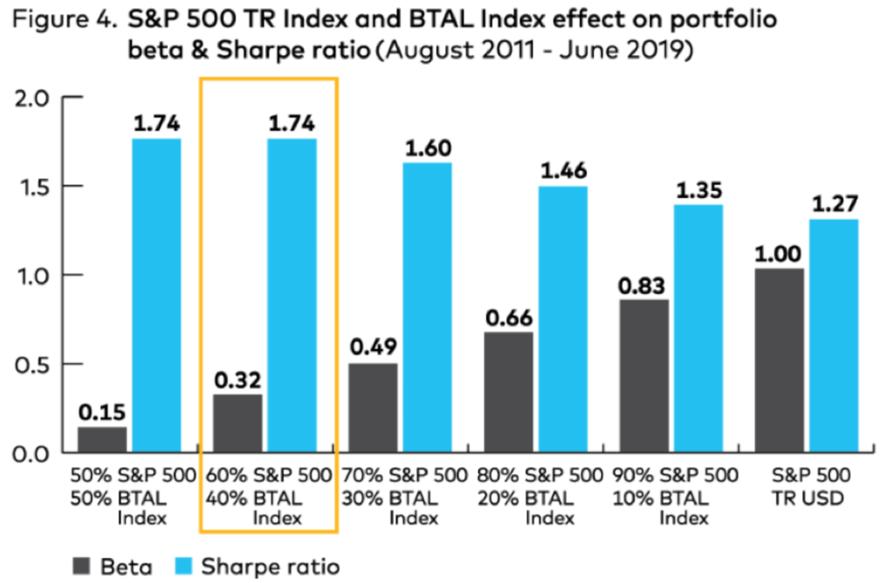

- Adding an allocation of BTAL to a SPY portfolio has produced a higher Sharpe Ratio since August 2011 (see chart below).

Source: AGFiQ

Look under the hood. Markets are trading as if we are in a bear market.

- As mentioned above, the earnings and macro outlook are poor.

- Investor sentiment is quite poor judging by the large year-to-date inflows into bonds funds and outflows from stock funds.

- State Street maintains an investor sentiment index which is hovering near 5-year lows (see chart below).

Source: State Street

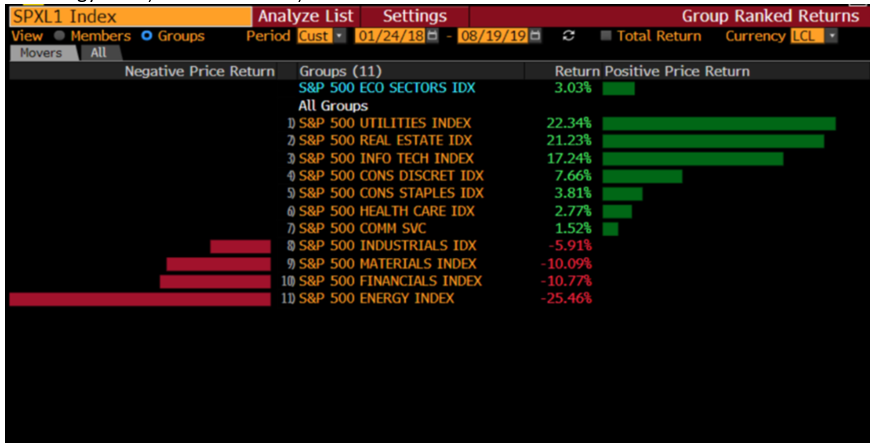

Note the following returns from January 24, 2018 through August 19, 2019:

- SPX +5%

- NKY -12% in JPY terms, -9% in USD terms

- SX5E -2% in EUR terms, -12% in USD terms

- MXEF -19% in USD terms

- Within the S&P 500, there has been a dramatic spread between bond like proxies and cyclicals over this time period.

- Utilities +22%, REITs +21%

- Energy -25%, Financials -11%, Materials -10%

Check out some of Astoria’s latest content!

- Know What You Own! (click here)

- Astoria Interviewed by CNBC on Portfolio Construction, Recession Fears, and the Inverted Yield Curve (click here)

- John Davi Highlighted as a Top ETF Strategist on Bloomberg’s Trillions Podcast (click here)

- Astoria’s Investment Committee ETF Risk Analytics (click here)

- Astoria’s ETF Insights: A Surgical Look at QUAL, DGRW, EDIV, DNL, and GDX (click here)

- Astoria Interviewed by CNBC on Gold, US Quality, Emerging Markets, and Portfolio Construction (click here)

- Astoria’s Investment Committee ETF Insights (click here)

- ETFs For 2nd Half Of 2019 (click here)

- What Happened to Risk Assets in the First Half of 2019? (click here)

Best,

Astoria Portfolio Advisors Investment Committee

Astoria Portfolio Advisors Disclosure: As of the time this report was written, Astoria held positions in DGRW, QUAL, and BTAL. Note that this is not an exhaustive list of holdings across Astoria’s dynamic or strategic ETF portfolios. Also note that Astoria’s holdings vary across both our dynamic and strategic asset allocation portfolios. For full disclosure, please refer to our website: https://www.astoriaadvisors.com/disclaimer.