A poor jobs report for January cast doubt about the strength of the recovery. There was only a 49K rise in non-farm payrolls, well below expectations of 105K. Making matters worse, the previous month’s jobs report was revised downward from a loss of 140K to a loss of 225K. The report has not gone unnoticed by the public as policymakers and citizens alike have urged Congress to do more to stimulate the economy. Although the report was generally underwhelming, there were some bright spots. In this report, we will focus on the strength of the labor market recovery and what it could mean for the economy going forward.

On its face, the employment report may be a bit misleading, especially if it is being compared to previous recessions. Due to the pandemic lockdowns, overall employment fell by more than 16% last year, by far the most in history. For comparison purposes, the second largest drop in payrolls was less than half as severe. On top of that, when lockdown restrictions were lifted, employers were forced to adapt to additional restrictions and regulations designed to protect their consumers and workers. Thus, a return to normalcy was never going to be an easy task. That being said, the gains that we have seen so far are astounding, especially given the circumstances.

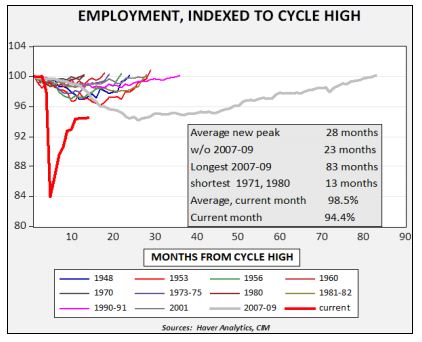

In less than a year since the recession started, the labor market has recovered over half of the jobs lost during the pandemic. This is much better than most economists had anticipated. In his remarks to the CFA Society of St. Louis this month, St. Louis Fed President James Bullard claimed that the U.S. labor market recovery is about four years ahead of schedule. Even industries that struggled prior to the pandemic have seen a vast improvement. Retail Trade, which was one of the hardest hit sectors, has recovered 84% of the jobs lost during the pandemic. On a state basis, the recovery is even more impressive as 28 states have outpaced the national recovery in payrolls. In fact, only five of the remaining 23 states (which includes Washington D.C.) are below one standard deviation of the national average, and four of those states still have restrictions in place that limit business activities. Hence, this recovery has not only been strong but has also been well dispersed throughout the country and will likely improve.

A disproportionate share of the pandemic job losses came in the Leisure & Hospitality sector. By itself, this sector accounted for nearly 40% of the job losses in 2020. However, a deep dive into this data shows hidden surprises. For example, despite reports that restaurants and bars have struggled during the pandemic, dining places have fared far better than other industries within the sector. Since the start of the pandemic, Food & Drink Places have recovered 60% of their job losses, while Arts, Entertainment & Recreation and Accommodation have recovered 39% and 34%, respectively. As the weather improves and restrictions are lifted, we expect payrolls to expand within the Leisure & Hospitality sector as many people (including ourselves) are eager to attend sporting events, musical shows, and concerts again.

A few industries have been able to exceed their pre-pandemic employment levels. For example, the surge in home improvement sales coincided with an all-time high in the number of employees working in Building Material & Garden Supply Stores. Another example can be seen in industries related to housing, where record-low mortgage rates have boosted home buying and residential construction. These outlier industries probably benefited from the fact that many consumers were able to keep their jobs during the pandemic and were willing to use their stimulus checks to purchase goods, homes, and home improvement projects. The additional spending from stimulus not only helped boost sales, but also supported employment.

Although we acknowledge that more needs to be done to aid the recovery, we do believe the labor market is much stronger than most people realize. In our view, the recent stall in payrolls was possibly a blip caused by an unforeseen rise in COVID-19 cases. Therefore, we are optimistic that payrolls will begin to strengthen throughout the year, especially as temperatures begin to rise and vaccines become more readily available. As a result, we anticipate the labor market will still provide a tailwind for equities in the coming months.

Past performance is no guarantee of future results. Information provided in this report is for educational and illustrative purposes only and should not be construed as individualized investment advice or a recommendation. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Opinions expressed are current as of the date shown and are subject to change.

This report was prepared by Confluence Investment Management LLC and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change. This is not a solicitation or an offer to buy or sell any security.