By Chris Konstantinos, Director of Investments, Chief Investment Strategist

SUMMARY

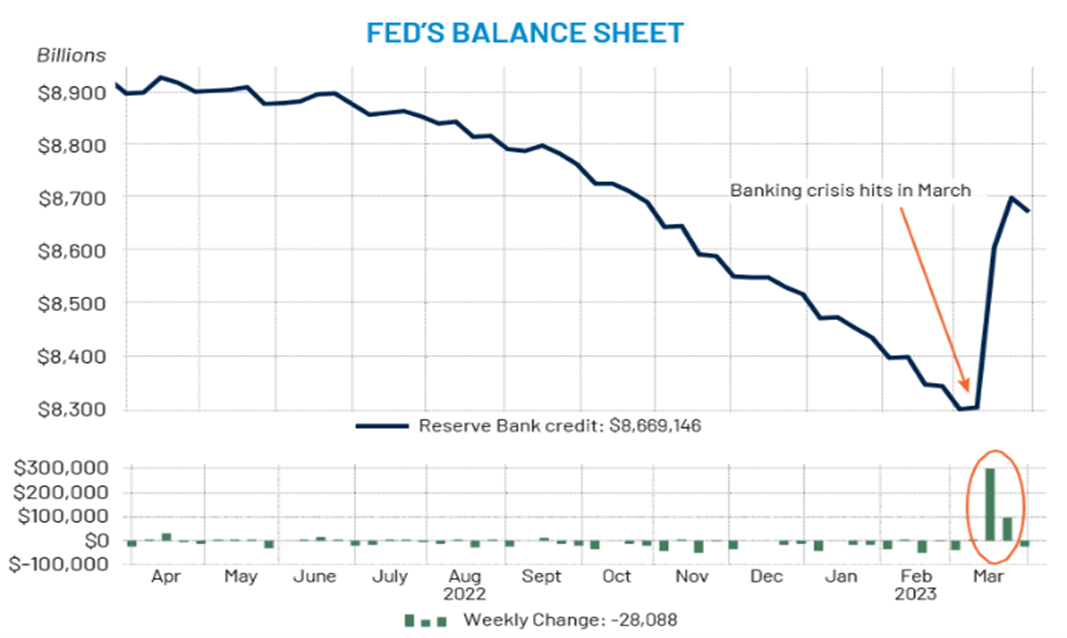

- The Fed has been forced to shore up the US banking system.

- This complicated the Fed’s fight against entrenched inflation.

- Fed policy to stay restrictive in the near-term

A banking crisis came seemingly from nowhere in March 2023, creating uncertainty for many smaller institutions. This would typically be cause for a Fed pause in interest rate hikes, if not outright easing. However, given the disparity between the Fed’s 2023 forecasts for core inflation versus its current level, we believe the Fed will not start cutting rates anytime soon.

In today’s Weekly View, we created a concise synopsis of three visuals from our April 2023 Chart Pack that summarizes a few key takeaways.

The 2023 Banking Crisis; Fed to the Rescue (Again)

The financial crisis in 2008 was a credit issue, as ill-advised real estate loans failed spectacularly. Thus far, 2023’s bank run is not a credit issue, in our view – credit quality remains solid across most banks.

Rather, it is one of interest rate sensitivity. Smaller banks with large government bond holdings have had trouble meeting near-term liquidity needs, as collateral value held in government bonds dropped significantly with interest rates rising.

This is a ‘solvable’ problem for the Fed, in our opinion, as they can accept collateral at par to keep banks solvent. However, this increases the Fed’s balance sheet size (see chart below) and injects short-term uncertainty into the market.

Source: Refinitiv Datastream, RiverFront; data weekly as of 03.31.2023. Shown for illustrative purposes only. Fed funds futures are financial futures contracts based on the federal funds rate and traded on the Chicago Mercantile Exchange (CME) operated by CME Group Inc. (CME). The federal funds rate is the rate banks charge each other for overnight loans of reserves on deposit with the Federal Reserve.

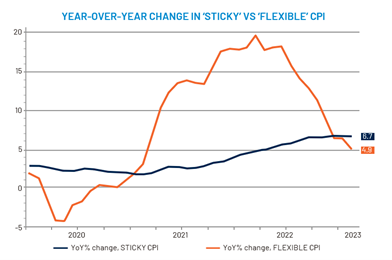

Inflation — ‘Flexible’ Retreating, but ‘Sticky’ Elevated

The Consumer Price Index (CPI) basket can be divided into two groups: ‘flexible’ and ‘sticky’. As their names suggest, prices in flexible CPI – which contains items such as heating and motor fuel, autos, hotel rooms, and food at home – is highly volatile. Sticky CPI, which contains prices of rent, medical care, education, furnishings, restaurants, and recreation, changes more slowly.

According to the Cleveland Fed, the ‘sticky’ price measures may be useful in discerning where inflation may be headed. Comparing these two readings highlights the Fed’s difficult task – while flexible CPI (orange line) has retreated, sticky (blue line) has not shown definitive signs of moderation yet.

Source: Refinitiv Datastream, RiverFront, data monthly, last release February 2023. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Chart right shown for illustrative purposes only.

Wages: Fewer Raises May Mean Lower Future Inflation

There are some encouraging signs that inflation may moderate in the future. This may be related not only to the Fed tightening money supply, but also due to the slowing US economy itself.

Recent business surveys suggest fewer firms are expecting to raise compensation in the future versus its peak last autumn (orange dotted line) … a condition that historically has been correlated with lower core CPI inflation (blue line) over the next 12 months.

However, the percentage of firms planning to raise compensation is still elevated relative to history.

Source: Refinitiv Datastream / Fathom Consulting; Data monthly as of February 2023. NFIB = The National Federation of Independent Business. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Chart left shown for illustrative purposes only.

Conclusion:

The Federal Reserve’s task – maintaining full employment while working to keep inflation close to 2% – has never been easy. But as we move into the second quarter of 2023, the Fed perhaps faces one of their most difficult tests yet. They must simultaneously try to reduce inflation while protecting jobs… and now banks.

We do not believe this Fed wants to repeat the mistakes of the late 1970s and early 80s, whereby the Fed was forced to reverse course and hike interest rates multiple times to finally get inflation under control. Throughout any rate hiking campaign of the past five decades, the Fed has never stopped hiking before the Fed funds rate was above the Consumer Price Index (CPI). By this rubric, we are getting closer.

While we still believe that inflation is moderating, hope is not a strategy. Our asset allocation portfolios remain relatively conservative in our positioning. Our portfolios’ equity weightings are roughly neutral relative to our target benchmarks, with a slightly elevated level of cash for additional flexibility during uncertain times.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Definitions:

The Federal Reserve System (FRS) is the central bank of the United States. Often simply called the Fed, it is arguably the most powerful financial institution in the world. It was founded to provide the country with a safe, flexible, and stable monetary and financial system. The Fed has a board that is comprised of seven members. There are also 12 Federal Reserve banks with their own presidents that represent a separate district.

The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

Federal funds, often referred to as fed funds, are excess reserves that commercial banks and other financial institutions deposit at regional Federal Reserve banks; these funds can be lent, then, to other market participants with insufficient cash on hand to meet their lending and reserve needs. The loans are unsecured and are made at a relatively low interest rate, called the federal funds rate or overnight rate, as that is the period for which most such loans are made.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 2849196

For more news, information, and analysis, visit the ETF Strategist Channel.