Jobs, economic growth, and inflation have been the focus as the recovery progresses. Starting with the employment picture, there are a multitude of factors that influence employment reports and impact the change in the number of jobs. These factors include labor force supply and demand, incentives to work or not, additional responsibilities such as childcare, and even seasonal adjustments to the numbers contained in the reports themselves. With so many exceptionally strong influences exerting pressure coupled with a pandemic induced decline and subsequent recovery, spasms in the monthly numbers should be expected. Still, most of the evidence suggests that we should also expect strong economic growth and higher inflation ahead.

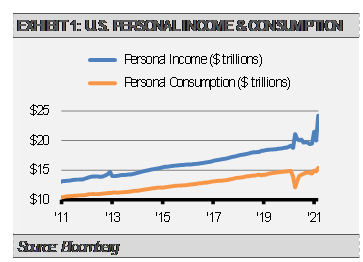

For example, we are seeing some exceptional strength in the balance sheets of U.S. consumers. Household net worth is at an all-time high while personal income has outpaced personal consumption recently (exhibit 1). A hallmark of a strong economy is improving job numbers and confident consumers willing to spend. We expect this trend to continue based on the current stage of the recovery.

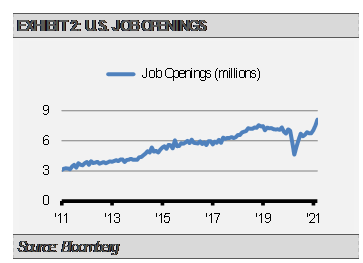

Additionally, business surveys continue to suggest that business confidence is high, activity is booming, and demand for more workers is at record levels. The National Federation of Independent Businesses (NFIB) found in their April survey of members that a record 44% have job openings they could not fill. Furthermore, the Job Openings and Labor Turnover Survey (JOLTS) shows job openings making a new all-time high, besting the previous record set in 2018.

Over time, we think these labor force challenges will resolve themselves and the fundamental strength of the U.S. economy will prevail. Consumer spending is rising on the backs of higher household income and net worth. Business surveys make it clear that finding skilled and unskilled workers is difficult at the moment, which is possibly contributing to the increase in hours worked by current employees. These challenges to businesses are in addition to the well-documented supply chain shortages.

Still, like the supply chain shortages, we expect labor force shortages to be worked out over the coming months as the number of workers vaccinated continues to rise, schools reopen, wages increase, and unemployment subsidies decrease. We anticipate some volatility along the road but, ultimately, solid economic growth. We are primarily focusing on risk management in this environment while still finding attractive investment opportunities in equities, fixed income, and alternative investments.

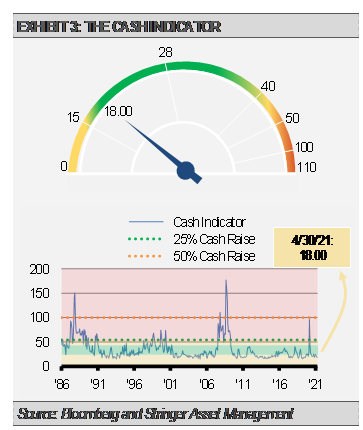

THE CASH INDICATOR

The Cash Indicator (CI) has been very helpful in allowing us to distinguish between normal equity market volatility and something resembling a crisis. The CI level has been near the low end of its historical range, which suggests that the equity markets may have been overly complacent and due for a shock. However, the fundamental backdrop remains strong, and the CI is far below crisis levels.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.