The month of December is now off and running. The end of the year is typically good for stocks. In fact, the S&P 500 has ended “up,” in the month of December, 75% of the time, since 1950, which is the most of any month. December, on average, is the third-best performing month, averaging a 1.50% increase. Since 1950, the worst December for the S&P 500 was -9% in 2018. The second worst December was -6% in 2002, which was near a bottom of a bear market.

So, here is the question: will Santa bring market optimism, or will the Bear continue to heave lumps of coal? Let’s briefly discuss the case for each.

The Bear Market

This is a bear market until proven otherwise. The following are some concerns:

- Volatility remains high. High volatility is the number 1 characteristic of a bear market. Currently, the Canterbury Volatility Index, sits at CVI 126. Volatility over CVI 75 is considered to be risky, and therefore is bearish.

- We continue to see “outlier days.” An outlier day is defined as any trading day beyond +/-1.50%.* Last week, the S&P 500 had 2 outlier days. There have been 74 total outlier days in 2022. In a normal bull market year, you would only expect to see 10-20 outliers.

- The market leadership has shifted towards the Dow Jones. A positive development for the markets would be for the Nasdaq (tech oriented) index to have leadership, as it indicates that investor sentiment favors taking on more “risk.” Right now, the top sectors are more “defensive.” According to Canterbury’s risk-adjusted ranks, the top 3 US sectors are Industrials, Health Care, Consumer Staples, and Financials.

The markets have rallied off their October lows, but as we have seen time and time again this year, these bear market rallies have yet to be sustained. A sustainable rally will include decreasing volatility, broad market participation, and a stair-step upward pattern, as opposed to sharp declines and sharp rallies.

Signs of Improvement

It is important to note that we are also seeing some positive developments in the markets’ behavior. Below are two strengthening market characteristics:

- The S&P 500 contains 11 sectors. Of those sectors, five are now in bullish “Market States.” The five sectors are Industrials, Health Care, Financials, Basic Materials, and Energy. These traditionally “defensive” sectors have seen substantial rallies in the last few months. They are also seeing a meaningful decline in volatility.

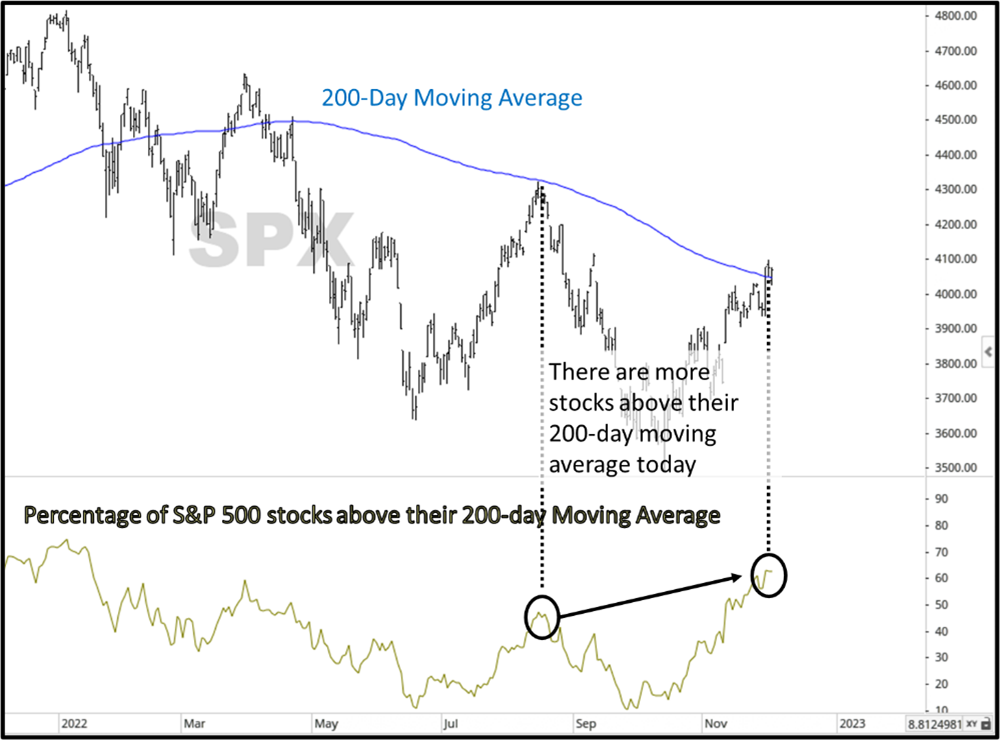

- The S&P 500 is hovering around its 200-day moving average. The 200-day moving average, is considered by many to be the dividing line between a bull market and a bear. The last time the S&P 500 was at its 200-day moving average, it bounced off and failed to break above. The failure to break through the average line was followed by a decline to new lows. Today, looking at the index components, 62% of S&P 500 stocks have broken through their 200-day moving average. The 62% “breakouts, is a much higher percentage than we saw at the previous August market peak. This is a positive development.

Source: Canterbury Investment Management. Chart created using Optuma Technical Analysis Software

Bottom Line

The purpose of this update is to highlight two points:

- We are still in a bear market. Volatility remains high, outlier days are occurring frequently, and market leadership favors traditionally defensive sectors.

- There are some signs of improvement. We are seeing more sectors enter “bullish” Market States, and several individual stocks are crossing above their 200-day moving averages.

Bear markets are full of sharp rallies. The question remains as to whether, or not, this rally is different than the previous ones. December may be a “better” month historically, but volatility is bearish and can disregard the record of many Christmas rallies of the past. At the time of this writing, the market is yet again experiencing another outlier day, this time to the downside. This all comes at a crucial point as the S&P 500 hovers just below its 200-day moving average. Will it break through this time, or will it bounce off and start a new leg down? Stay tuned.

Navigating a bear market requires a diligent process to adapt the portfolio holdings to changing market conditions. Rotations during bear markets can occur frequently and be unpredictable. Right now, it is about weathering the market’s movements, adjusting the portfolio holdings, and continuing to monitor for shifting characteristics that will cause the market to go from the highly volatile bear to a low volatility bull. While some positive characteristics are developing, there are still obstacles to overcome.

This video was submitted by Canterbury Investment Management, a participant in the ETF Strategist Channel.