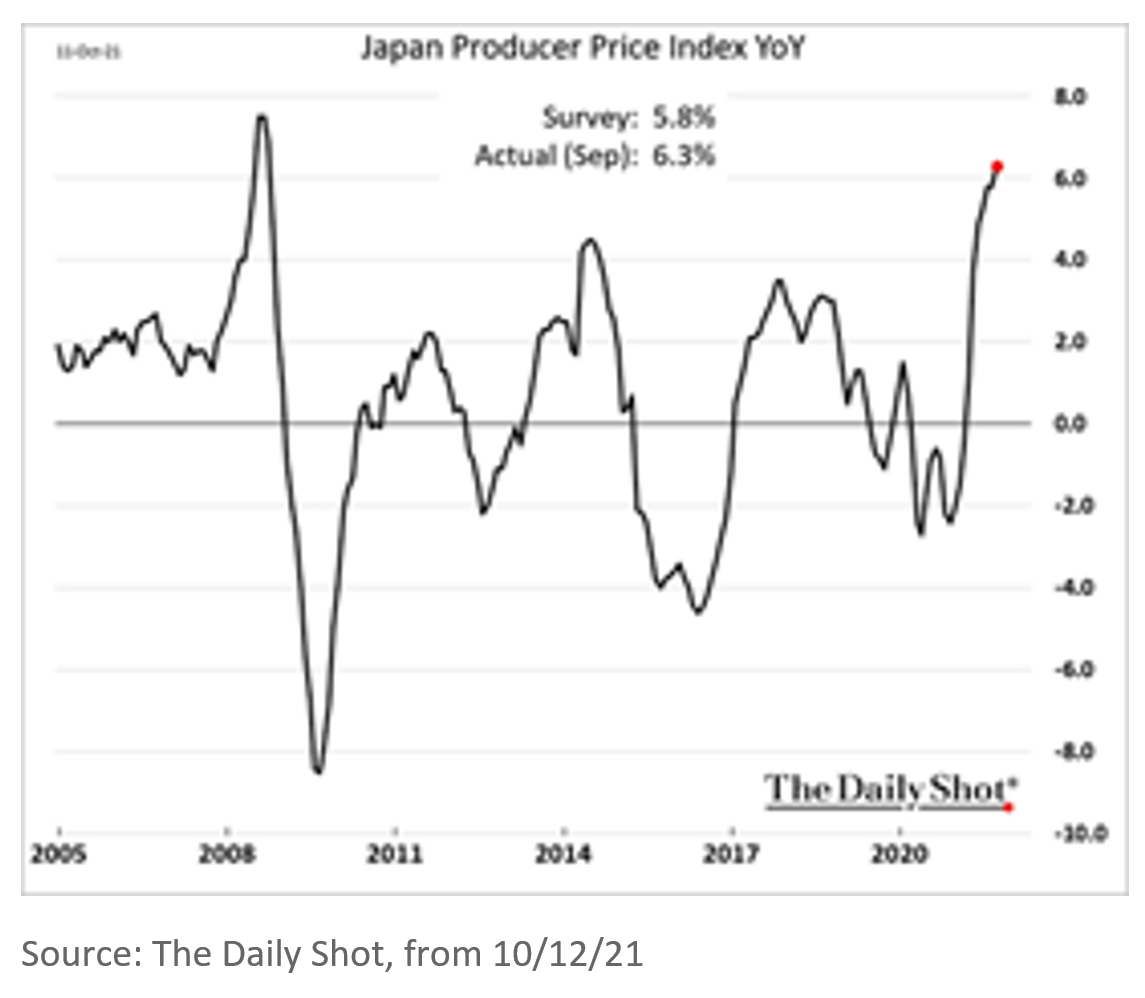

The U.S. added only 194,000 jobs in September per Friday’s DOL report, far below the expected 500,000. Labor force participation also declined, keeping payrolls well below the pre-covid trend, exacerbating labor shortages, and laying the groundwork for more wage inflation. The disappointing report sent Treasury yields—and overall inflation expectations—higher Friday, but has the past year anchored rate expectations artificially low? And how will investors react when they rise in earnest? Commodities meanwhile have broken out and, paired with continued supply chain concerns, are adding fuel to the inflationary fire. On the international stage: China has added power rationing—yet another factor likely to exacerbate global supply chain shortages—to its real estate woes, and producer prices are at a decade+ high in Japan. Could inflation be on the horizon for the world’s yet-unaffected third-largest economy?

1. Despite a record number of job openings, new jobs dramatically disappointed last month:

Source: The Daily Shot, from 10/11/21

2. While the unemployment rate dropped to 4.8%. It looks like the pandemic pushed ~8 million workers out of the workforce resulting in labor shortages in many industries…

Source: The Daily Shot, from 10/11/21

3. Will wages become a major driver of inflation?

Source: The Daily Shot, from 10/12/21

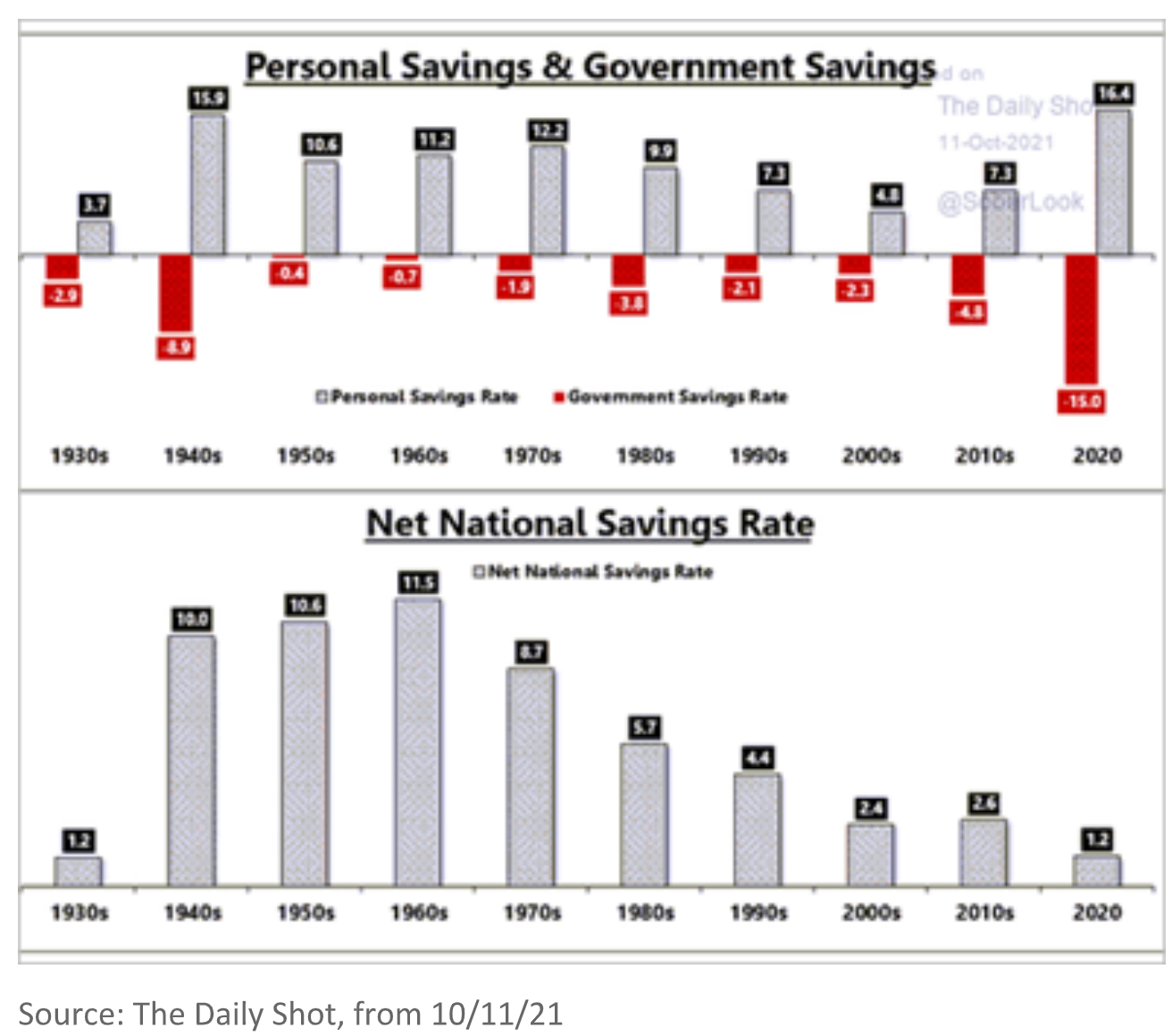

4.Individually, Americans saved at a staggering pace in 2020. Collectively? Not so much…

Source: The Daily Shot, from 10/11/21

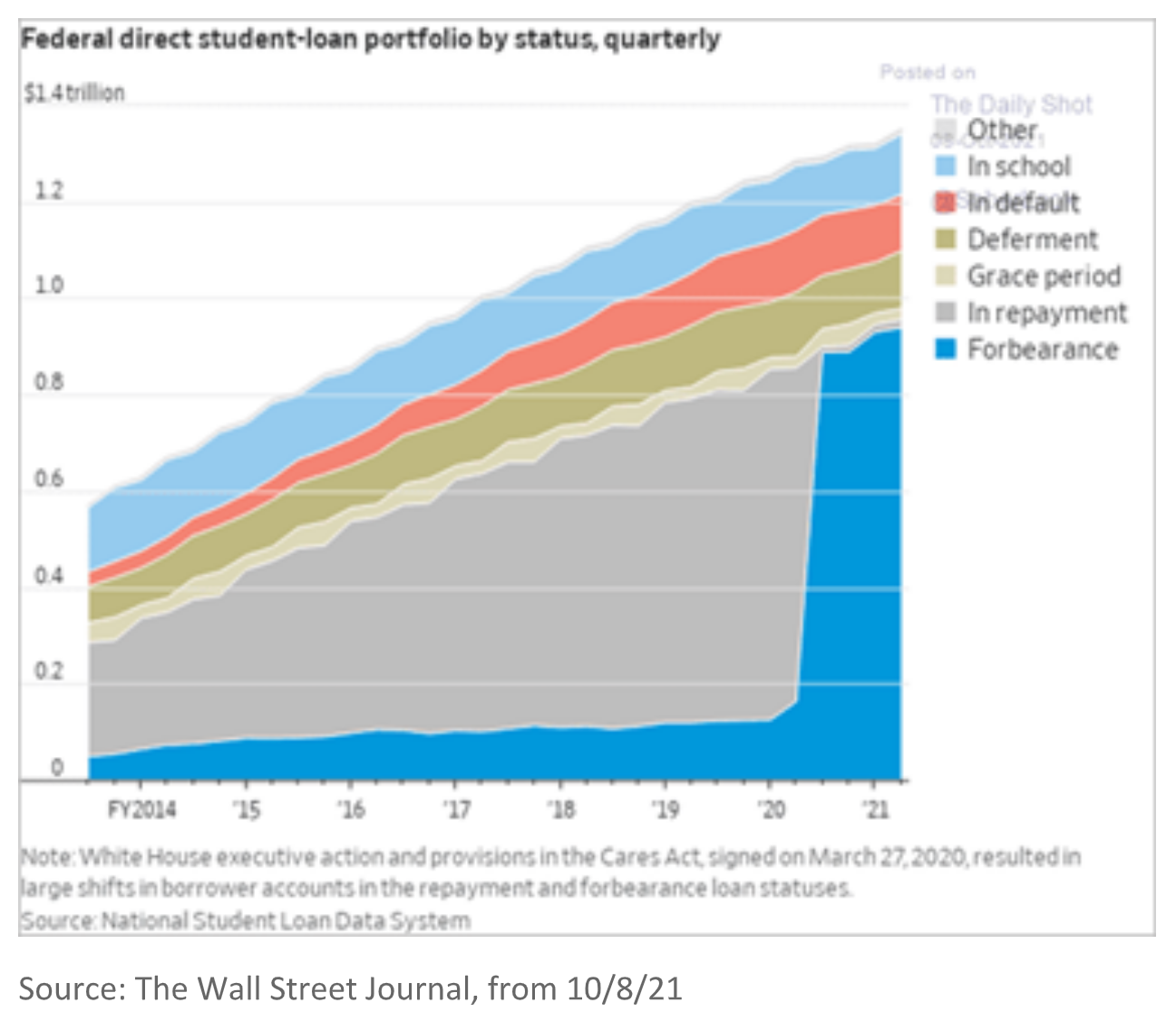

5.Another source of U.S. debt? Hey, what’s another trillion?

Source: The Wall Street Journal, from 10/8/21

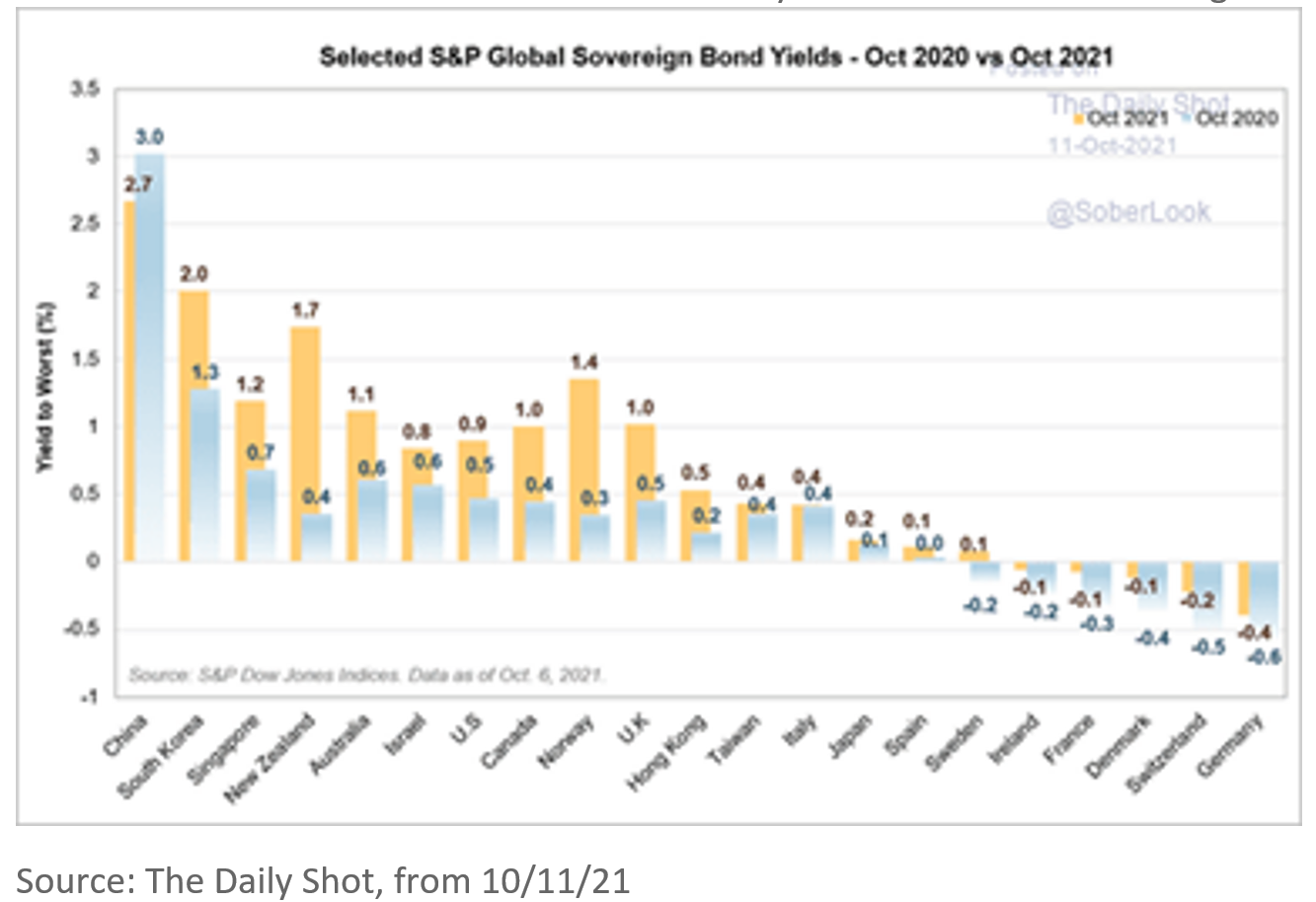

6. Interest rates continue to grind higher:

Source: The Chart Store, from 10/10/21

7. Yes, interest rates have risen. But rates got so low that, in a vacuum, there is little worry about rates rising within reason. The issue may be that the world is now used to and expecting ultra-low rates to continue. These investors may be in for a rude awakening.

Source: The Daily Shot, from 10/11/21

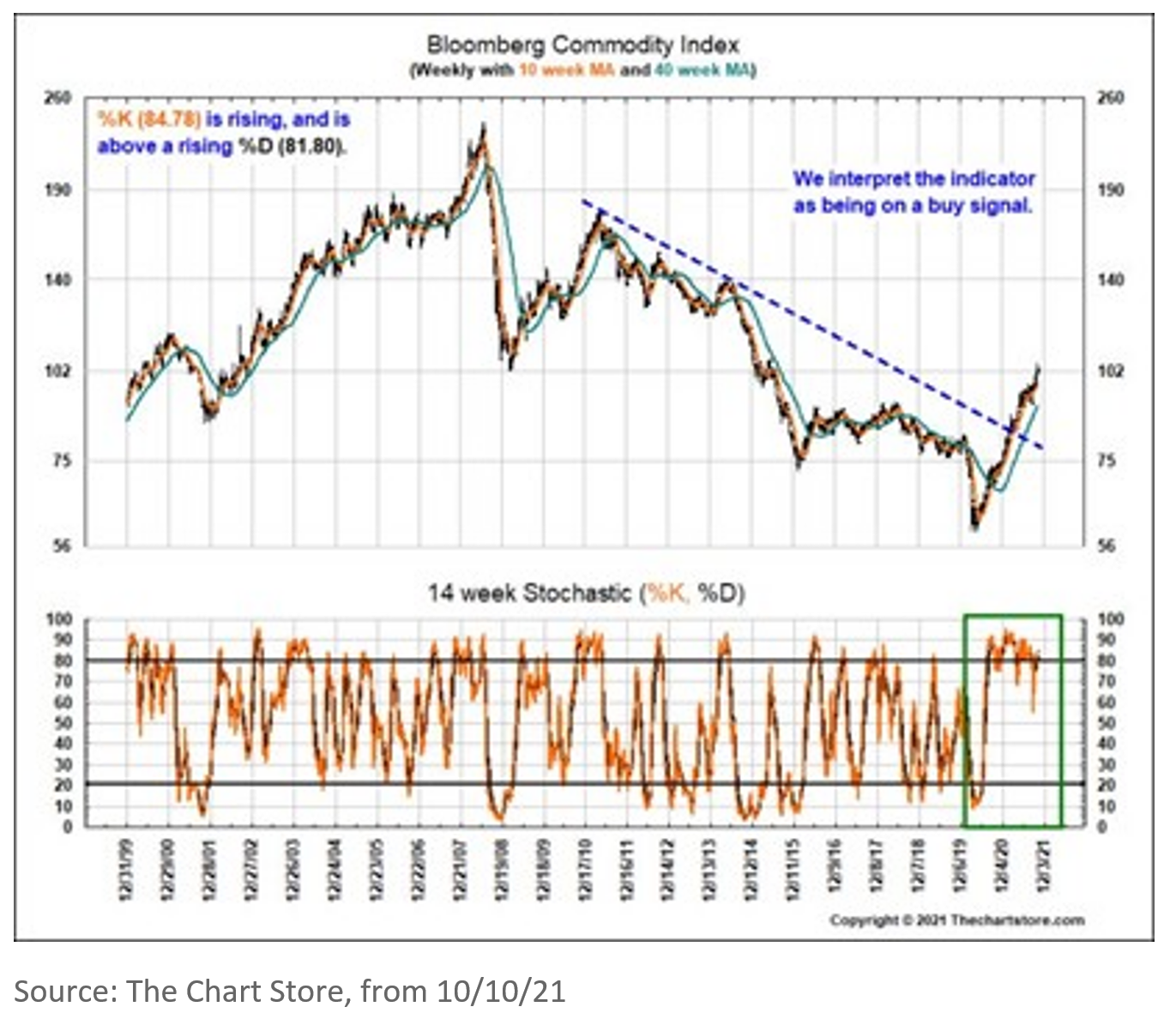

8. Despite a strengthening USD, commodities have broken out:

Source: The Chart Store, from 10/10/21

9. China’s trade war with Australia and their ban on Australian coal have backfired. Coupled with high demand, China is now rationing power in many provinces.

Source: The Daily Shot, from 10/12/21

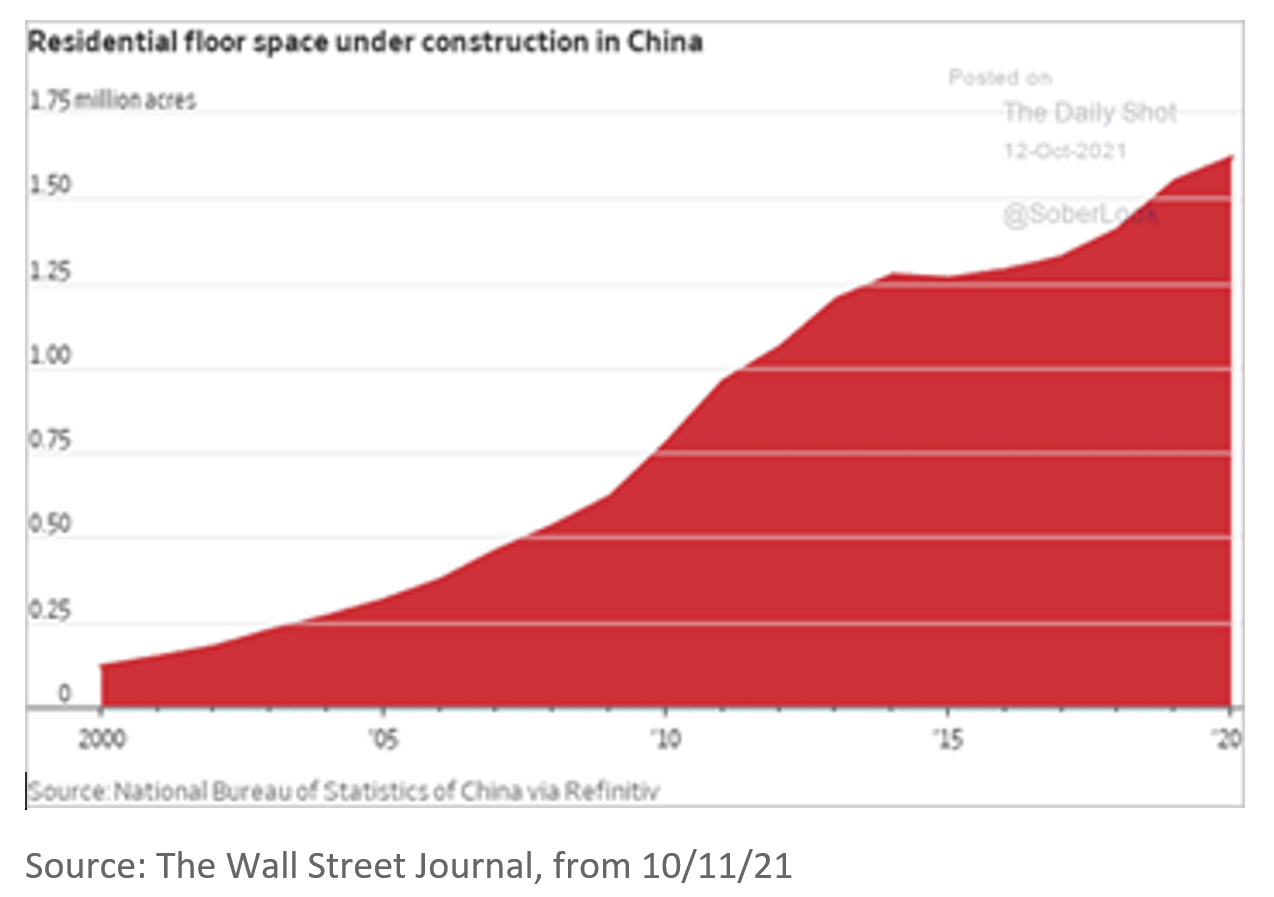

10. The Chinese real estate debt contagion is spreading. We’ve previously commented that this is the largest market, of any kind, in the world. Right now, China has ~1.6 million ACRES of new residential construction underway. Delaware, the entire State, has only 1.27 million acres.

Source: The Wall Street Journal, from 10/11/21

11. PPI in Japan is nearing multi-decade highs:

Source: The Daily Shot, from 10/12/21

This article was contributed by Beaumont Capital Management, a participant in the ETF Strategist Channel.

For more insights like these, visit BCM’s blog at blog.investbcm.com.

For more news, information, and strategy, visit the ETF Strategist Channel.

Disclosure: The charts and info-graphics contained in this blog are typically based on data obtained from 3rd parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.