By Rob Williams, Director of Research, Sage Advisory

Tactical investment managers adjust portfolios as the market environment changes. What does this mean? At Sage, we believe there is always a beneficial market segment to be in; we believe in staying invested. While we have the flexibility to hold some cash in our portfolios, it’s a route we would reserve only for large market drawdowns (think the 2008 financial crisis). For us, choosing the right market segments is more important than repeatedly trying to time short-term market pullbacks.

The following are four reasons why “going to cash” during market corrections is not the best strategy.

1. “Going to Cash” is not an active risk management tactic.

Cash is a guess on near-term market direction. It is often not the best defense in a down market and sets up the potential to miss the upside when the market rebounds.

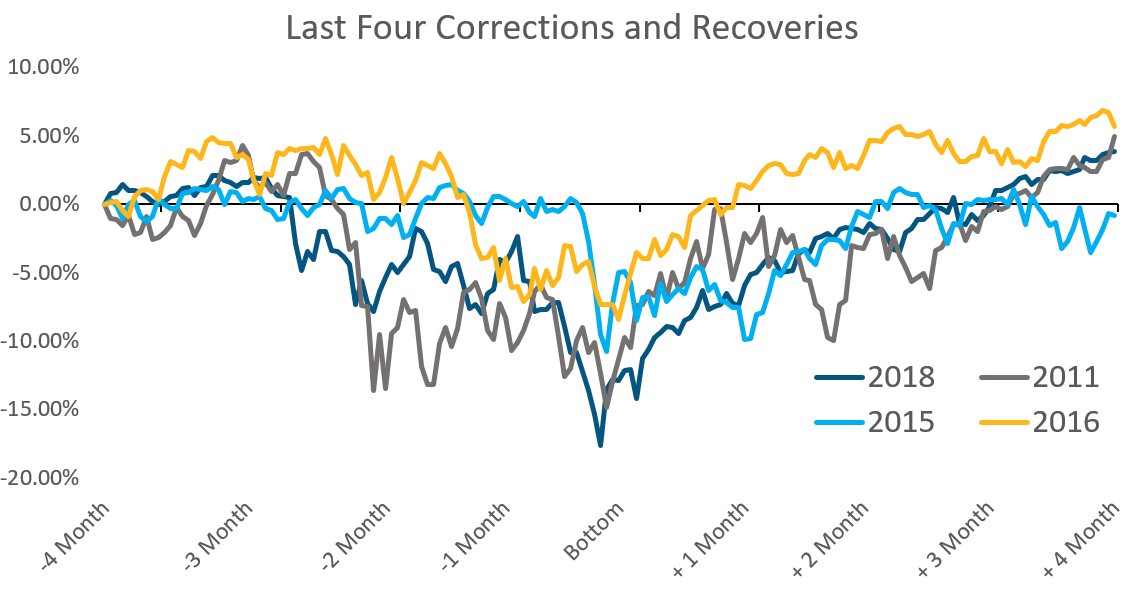

2. Most corrections are short-lived and rebound relatively quickly.

Major downturns happen only every 5 to 10 years, the corrections range between 5% and 20%, and they only last a few months. Since 2010, we have seen four corrections, and they have all followed this pattern.

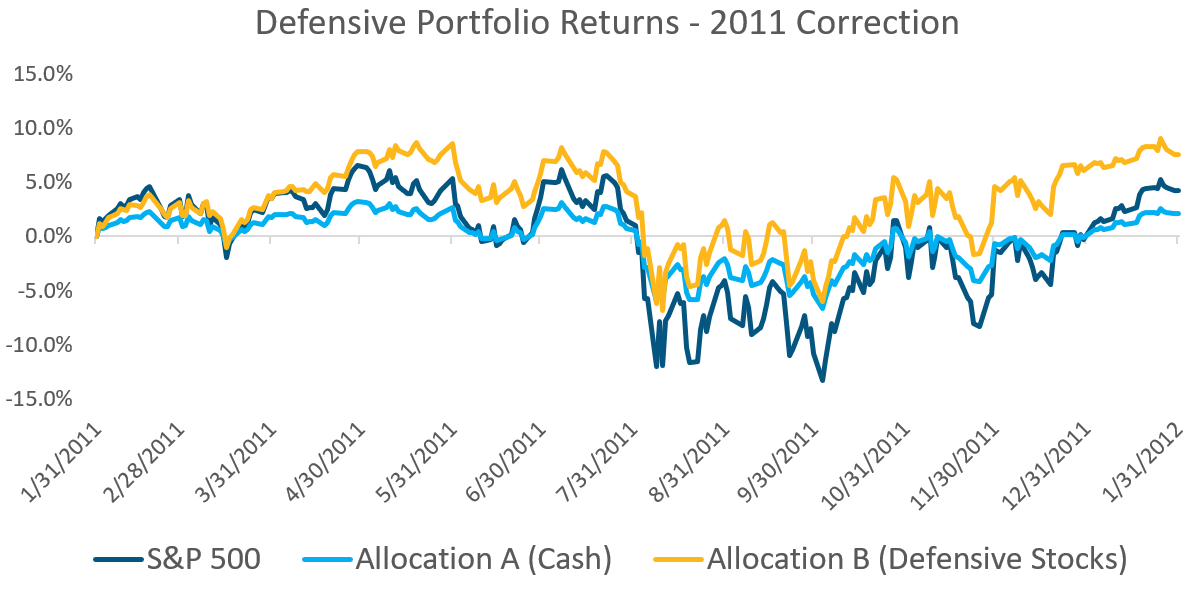

3. Being “tactical” in asset allocation is about portfolio risk, not individual position risk.

Mitigating portfolio risk can be done with other tools besides cash. The following scenario takes place during the 2011 correction and rebound. Allocation B outperforms because it participated in the upside of the recovery; and, importantly, because overall portfolio risk was similar, it protected just as well during the drawdown.

Both portfolio have similar total risk to market (.5 and .6 beta)

- Beta = volatility or risk of allocation to market, .5 = roughly 50% of downside risk

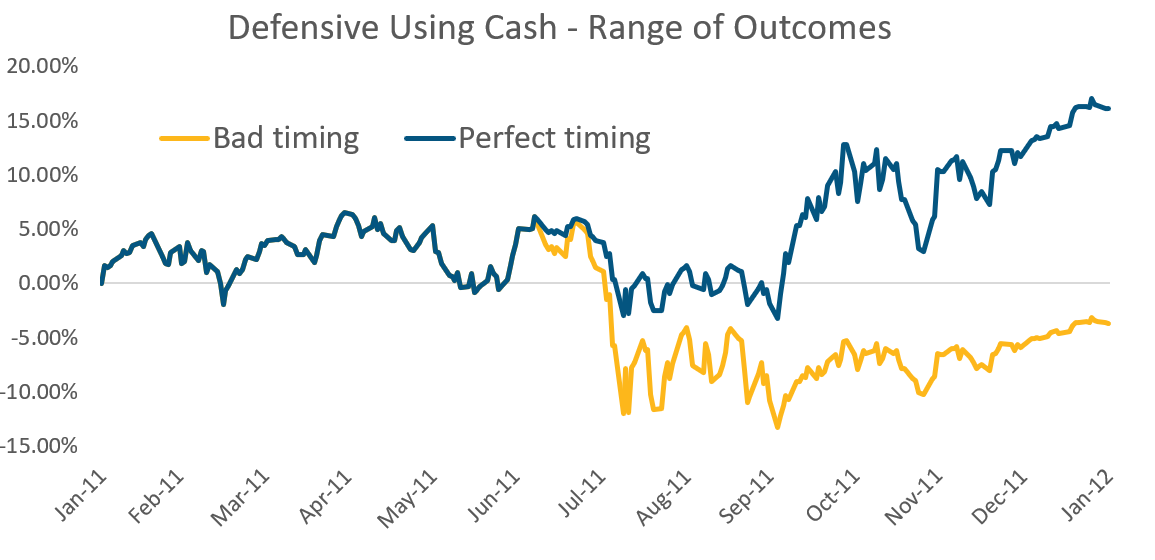

4. Being tactical means smoothing the ride. We do this by limiting the potential negative outcomes. Consider the 2011 correction and rebound. The broad U.S. market recovered quickly, with a six-month window from peak to trough and back to peak. Perfect timing of a 50% cash allocation would lead to strong gains; however, considering the risk of mistiming, the range of outcomes is between -4% to +16%, a 21% difference from best to worst. Alternatively, a 50% tilt to more defensive equities had half that spread, with a +1% to +12% range of outcomes, limiting the size of the potential miss and creating a smoother ride for clients.

This article was written by Rob Williams, Director of Research at Sage Advisory, a participant in the ETF Strategist Channel.

*The source on all charts is Bloomberg.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.