2023 may be another difficult year for investors who hope to relive the speculative markets of 2020 and 2021. Consensus seems poised for a signal from the Fed that they will lower interest rates which could reignite investors’ interest in more speculative investments.

However, the Fed seems very hesitant to prematurely remove tighter monetary policies. With inflation the highest in 40 years, the entire credibility of central banking is being challenged. The odds, therefore, seem to favor too much tightening of monetary policy rather than too little.

For other investors, however, 2023 could be a rewarding year in the early stages of secular outperformance. Stock market volatility always signals a change in leadership. Prior leadership is typically geared to a specific economic environment and volatility occurs when the macroeconomy changes. Volatility is a changing of the guard during which the old leadership exits, and new leadership emerges that is better suited for the new economic environment.

History shows that investors are usually slow to adopt the new leadership as the economy changes. Rather than repositioning their portfolios for the new economic backdrop, they cling to the old leadership hoping that the economy returns to its pre-volatility state.

Such investor denial seems to characterize today’s consensus. Many investors want the Fed to change course or “pivot” simply because they want low interest rates to again spur speculation supporting the outperformance of investment themes like Technology, Innovation, Disruption, Venture Capital, cryptocurrencies, SPACs, meme stocks, and the like.

Chart 1 below shows that Bitcoin’s performance has been closely tied to Fed policy. When money is free, as it was during the immediate post-pandemic period, investors tend to wildly speculate. However, speculation tends to fade when interest rates increase, and investors are increasingly forced to make rational choices.

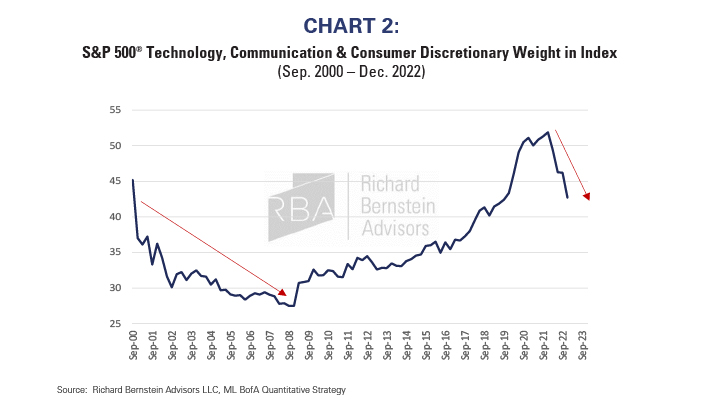

Despite significant underperformance during 2022, the Technology, Communications, and Consumer Discretionary sectors still comprise over 40% of the S&P 500®’s weight (See Chart 2) and 38% of the MSCI All-Country World Index. The sectors’ underperformance so far reflects leadership is changing, but it has not changed.

Theme #1: Play defense. Worry later about playing offense.

There are two main inputs to equity valuation: 1) earnings and 2) interest rates. Investors have so far seemed to focus on #2 (the Fed and interest rates) and relatively ignore #1 (earnings).

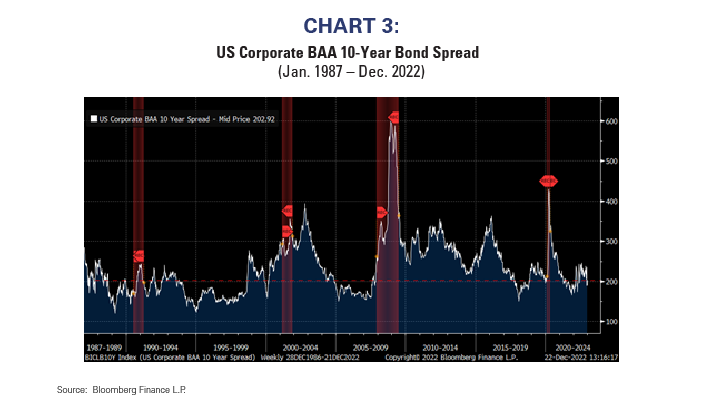

The US, and many other countries, are in the early stages of profits recessions, yet both equity and fixed-income markets have been very slow to anticipate the potential falloff in corporate profits. Chart 3 shows corporate bond spreads through time. Although spreads have widened a bit in anticipation of corporate cash flows coming under pressure and an increasing probability of default or bankruptcy, the spread remains very low relative to historical recession periods.

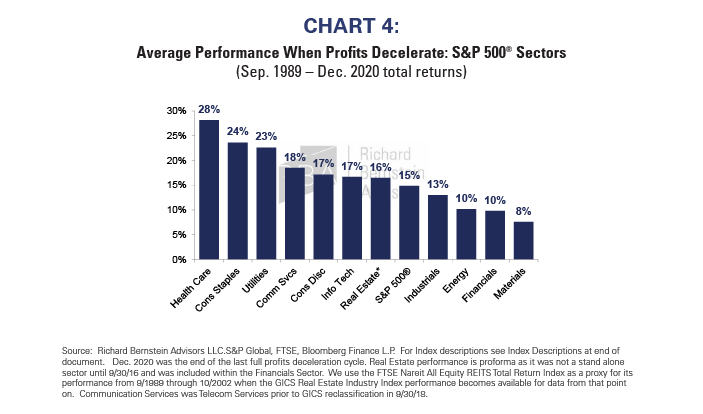

An apparent limited fear of a potential profits recession suggests investors should start 2023 playing “defense”. Investment discussions continue to highlight a false dilemma of growth vs. cyclicals and omit the third option of defensive sectors. Defensive sectors tend to outperform during profits downturns, and our portfolios are overweight those sectors (see Chart 4).

Some investors remain fearful of missing out on a positive shift in fundamentals, i.e., the second half of 2023 will be a stronger period for the economy and for markets. One must remember that “being early but being there at the bottom” always sounds like a prudent strategy, but is actually a strategy for underperformance because one never knows when “the bottom” will occur and waiting implies underperformance.

If there is a fundamentally-based turn in the economy and in the stock market, such bull markets last for years and not for weeks or months. Missing out on the first month or two tends not to hurt long-term performance. In fact, our past research has consistently shown that being 6 months late is preferable to being 6 months early. (For example, see RBA Quick Insights “What did I miss?,” June 2nd 2020)

Theme #2: Diversify geographically

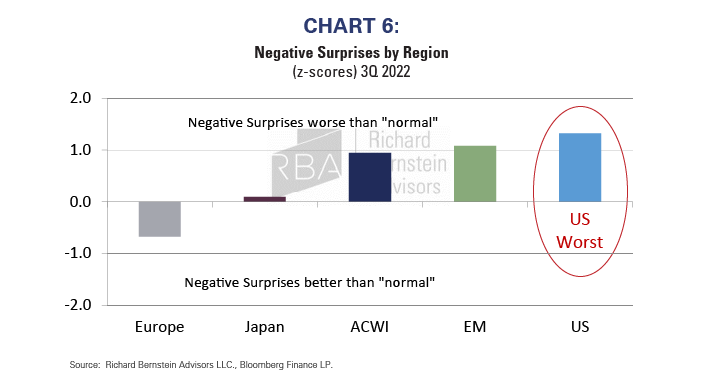

Investors probably should not be geographically myopic, and consider increasing geographic diversification. Ten years ago, emerging markets were investors’ favorites, but global profit fundamentals signaled the potential for long-term US outperformance. Today, consensus favors US equities, but profit fundamentals for the US are among the worst for major regions of the global equity markets.

Negative earnings surprises are a reliable indicator of corporate health. Although positive earnings surprises have through time offered less insight because companies frequently guide analyst expectations down to then beat the lowered expectations, negative earnings surprises contain significant information because negative surprises indicate companies are having trouble managing their businesses. No company ever guides to a negative surprise.

Charts 5 and 6 examine negative earnings surprises by region today and from 5 years ago. In 2017 the US had the best profit fundamentals when using this gauge, but today they are the worst.

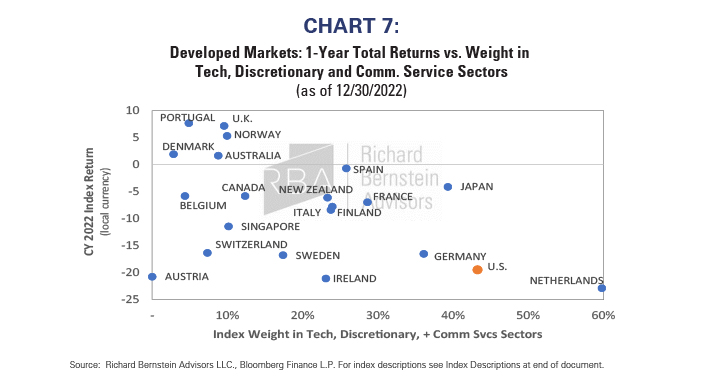

In addition, the US equity market is dominated by the most speculative sectors: Technology, Communications Services, and Consumer Discretionary. The sector exposures of some non-US markets are often considerably more defensive, which might support outperformance as global profits cycles decelerate.

Chart 7 shows 2022 country performance relative to the percentage of the country’s market capitalization that is in the three more speculative sectors. Country performance has been closely related to sector exposure and sector performance.

In fact, despite the USD’s strength in 2022 over 70% of non-US equity markets outperformed the US in USD terms as shown in Chart 8.

We continue to have lower-than-normal exposure to US equities within our portfolios because of the combination of US sector weights and the deterioration in US profits fundamentals.

Theme #3: Accept that the world is changing

Long-term investment themes appear to be changing as well. Some growth investors rationalize ongoing investments in significantly underperforming sectors or themes by claiming they are long-term investments. However, the long-term structure of the US and global economies appears to be changing, and such changes could foster a different set of long-term investment themes.

The Energy sector is currently the #2 sector for dividend yield in the US and it is the #1 sector for long-term growth. In fact, its long-term projected earnings growth rate is roughly twice that of the Technology sector! Chart 9 shows comparisons of sectors’ dividend yields to bottom-up long-term earnings growth projections. The Energy sector seems to stand out in this chart, whereas the former leadership (Technology, Communications Services, and Consumer Discretionary) don’t seem to offer unique growth opportunities.

The global economy is changing, leadership is changing, and analyst projections are changing. Growth investors should not become mired in the old growth themes and should be on the lookout for new ones. After all, relatively few investors ten years ago were looking at Technology as a primary growth sector.

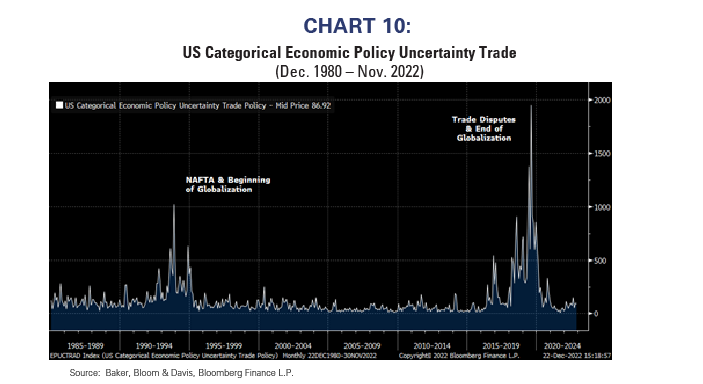

Geopolitics seem increasingly unstable, and it seems globalization is contracting. Whether it is the Ukraine/Russia war, US/China controversies, refugee trends, extremist politics in many countries, and other factors, the trend toward reduced globalization seems to be gaining strength.

This isn’t unique as globalization has historically expanded and contracted. Chart 10 shows a measure of trade uncertainty, i.e., a proxy for expectations regarding successful globalization. Uncertainty spiked at the beginning of the recent era of globalization with the passage of NAFTA. Uncertainty spiked again more recently when there were increasing trade disputes, which one could argue was the beginning of the end of globalization.

Increasing globalization was perhaps the main catalyst for US secular disinflation. Inflation occurs simply when demand outstrips supply, and increasing globalization provided an increasing number of suppliers. Increased competition put downward pressure on prices.

If globalization retreats, then global competition might contract. Some are arguing that certain industries’ critical production should be limited to US producers. That might be important for national security and other considerations, but secular inflation might replace secular disinflation as the “supply of suppliers” decreases.

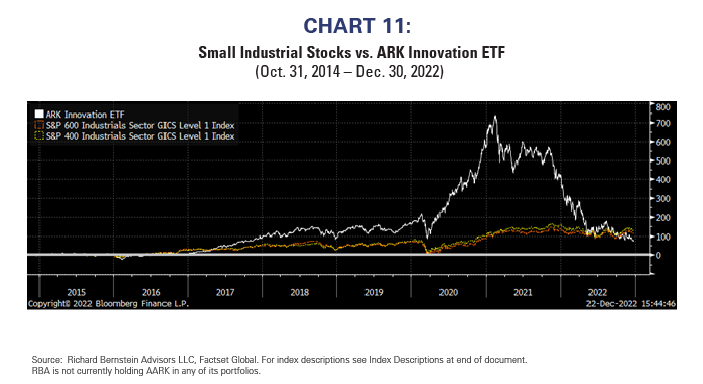

The US has woefully under-invested in real, productive assets for decades. Energy infrastructure, manufacturing capacity, transportation infrastructure, electrical grid capacity, and other critical public and private goods need significant re-building and modernization. As globalization contracts, investment in such real assets could prove critical to the ongoing stability and health of the US economy.

We’ve joked many times about how investors look to “cute wiener dogs in the metaverse” as the future of the US economy. Joking aside, if that is the future of the US economy, then the US economy will probably suffer because other nations will be investing in the production of goods and services that people actually need. We believe the underlying capitalistic tendencies of the US economy and the resulting trends in the investment of real productive assets will improve US competitiveness and provide interesting long-term investment opportunities.

Chart 11 perhaps supports our contention. Without hype and fanfare, small cap industrial stocks have outperformed ARKK by about 300 bp/year since ARKK’s inception in 2014, and mid-cap Industrials have outperformed by about 400 bp/year. Perhaps there is a message in that outperformance regarding the true future trends of the US economy?

2023: It won’t be back to the future

Consensus is still focused on the leadership of the last 5-10 years. However, the global economy is changing and leadership within the financial markets is likely to reflect that changing economy. Investors missed the first 5-10 years of the bull market in US equities, and they seem poised to miss the first 5-10 years of new opportunities in non-US markets and real productive assets.

Investors should probably never invest purely for short-term or long-term opportunities. Every secular theme can be influenced by the cycle, and every cyclical theme can be influenced by secular forces. Our portfolios at RBA attempt to balance the cyclical AND the secular economic influences.

We strongly doubt 2023 will somehow return to the speculative nature of 2020’s and 2021’s markets. Rather, we think the markets will continue to gravitate toward newer themes.

INDEX DESCRIPTIONS:

The following descriptions, while believed to be accurate, are in some cases abbreviated versions of more detailed or comprehensive definitions available from the sponsors or originators of the respective indices. Anyone interested in such further details is free to consult each such sponsor’s or originator’s website.

The past performance of an index is not a guarantee of future results.

Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index would require an investor to incur transaction costs, which would lower the performance results. Indices are not actively managed and investors cannot invest directly in the indices.

S&P 500®: S&P 500® Index: The S&P 500® Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad US economy through changes in the aggregate market value of 500 stocks representing all major industries.

Sector/Industries: Sector/industry references in this report are in accordance with the Global Industry Classification Standard (GICS®) developed by MSCI Barra and Standard & Poor’s.

Country performance: MSCI All Country Indices: The MSCI All Country indices are a set of free-float-adjusted, market-capitalization-weighted indices designed to measure the equity-market performance of each country included in the MSCI All Country World Index.

S&P Small Cap Industrials: The S&P 600 Industrials Sector GICS level 1 Index. S&P Global’s Smallcap Industrials Index is a capitalization-weighted index. The index was developed with a base value of 100 as of December 31, 1993.

S&P Mid Cap Industrials: The S&P 400 Industrials Sector GICS level 1 Index. S&P Global’s Midcap Industrials Index is a capitalization-weighted index. The index was developed with a base value of 100 as of December 31, 1990.

Bitcoin: According to Bloomberg Finance L.P. Bitcoin was proposed in a white paper in 2008 by a pseudonymous software developer going by the name of Satoshi Nakamoto. It is a decentralized, fully independent, digital or virtual currency also known as a cryptocurrency. No institution controls the Bitcoin network and it is not tied to a country as transactions can be performed cryptographically without the need for a central issuing authority.

ARK Innovation ETF (ARKK): The ARK Innovation ETF is an actively managed exchange-traded fund incorporated in the USA. The Fund will invest in equity securities of companies relevant to the theme of disruptive innovation. Relevant themes are those that rely on or benefit from the development of new products or services in scientific research relating to Genomics Revolution, Web x.0, and Industrial Innovation.

About Richard Bernstein Advisors

Richard Bernstein Advisors LLC is an investment manager focusing on long-only, global equity and asset allocation investment strategies. RBA runs ETF asset allocation SMA portfolios at leading warehouses, independent broker/dealers, TAMPS and on select RIA platforms. Additionally, RBA partners with several firms including Eaton Vance Corporation and First Trust Portfolios LP, and currently has $14.9 billion collectively under management and advisement as of November 30, 2022. RBA acts as sub‐advisor for the Eaton Vance Richard Bernstein Equity Strategy Fund, the Eaton Vance Richard Bernstein All‐Asset Strategy Fund and also offers income and unique theme‐oriented unit trusts through First Trust. RBA is also the index provider for the First Trust RBA American Industrial Renaissance® ETF. RBA’s investment insights as well as further information about the firm and products can be found at www.RBAdvisors.com.

Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. RBA information may include statements concerning financial market trends and/or individual stocks, and are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. The investment strategy and broad themes discussed herein may be inappropriate for investors depending on their specific investment objectives and financial situation. Information contained in the material has been obtained from sources believed to be reliable, but not guaranteed. You should note that the materials are provided “as is” without any express or implied warranties. Past performance is not a guarantee of future results. All investments involve a degree of risk, including the risk of loss. No part of RBA’s materials may be reproduced in any form, or referred to in any other publication, without express written permission from RBA. Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor’s investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment’s value. Investing is subject to market risks. Investors acknowledge and accept the potential loss of some or all of an investment’s value. Views represented are subject to change at the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC does not undertake to advise you of any changes in the views expressed herein.

© Copyright 2023 Richard Bernstein Advisors LLC. All rights reserved.

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS