By Michael Paciotti, CFA

If you’re afraid of inflation, I think – and if you can bring yourself to have a long horizon – and when I say long, I mean ten to 20 years, not the usual ten to 20 weeks – that locking up resources in the ground is a terrific idea. – Jeremy Grantham

After a decade of robust market gains, 2022 has begun much differently, with inflationary fears and conflict in Ukraine sapping the strength from animal spirits and sending US markets to their first negative quarter since COVID began in early 2020. Drilling down further, while the broader S&P 500 has declined by 4.6%, the tech heavy Nasdaq and US large cap growth stocks have each declined by about 9%. Lost in this was that as of March 14th, both were down nearly 20% to start the year before rebounding in the last few weeks of the quarter. Even safe haven bonds have struggled under the weight of inflationary pressures, declining 5.93%. The lone bright spot, has been commodities, gaining 33% for the quarter.

When I reference the broad term commodities, the first thing that usually comes to mind is oil or gold, and that would be correct. But the list is far more extensive, even within broad energy and metals. It includes things like natural gas and copper, along with allocations to agricultural products like wheat, soybeans, and even softs like sugar, coffee, and cotton. However, the knowledge gap runs much deeper into this fairly nebulous asset class. How do I as an investor access commodities markets? What is spot price vs futures price? What are things like roll and collateral yield, and why are they important? The simple answer is…they all impact the return that you stand to receive when including commodities as a component in a diversified portfolio. My intention for this quarter’s Market Insights, Commodities – Opportunity, Diversifier, or Waste of Time is to provide some context to why investors should include commodities in a diversified portfolio. Additionally, I intend to drill down on some of the concepts that I mentioned, like spot and futures return, along with roll and collateral yield, to make this a bit of a primer on a fairly nebulous asset.

Why own commodities?

As an investor, why should I own commodities? The answer is really the same for any asset in the context of a long-term portfolio strategy. I’m sure the number one reason that comes to mind is to make money. But for portfolios, there’s more. We want to earn profits with as little day to day volatility as we have to tolerate, and earn that rate of return as consistently as possible from year to year. Now, consistency with low volatility does more than help you sleep at night. It is beneficial to growing wealth through compounding.

Given two portfolios of like return, the one with the lower volatility will always compound to the higher ending value. This isn’t an opinion, it’s math. Take a simple example. You have a dollar. If you earn a zero percent return for two years, what do you have? One dollar, of course. If you begin with that same dollar and in year one you earn 10% and in year 2 you lose 10%, how much do you have? 99 cents. Both have an average of zero….the difference is that the second portfolio has a volatility of +/-10%. Suffice it to say it is in all of our interests to get as much return as we can with as little volatility as possible.

Given two portfolios of like return, the one with the lower volatility will always compound to the higher ending value. This isn’t an opinion, it’s math. Take a simple example. You have a dollar. If you earn a zero percent return for two years, what do you have? One dollar, of course. If you begin with that same dollar and in year one you earn 10% and in year 2 you lose 10%, how much do you have? 99 cents. Both have an average of zero….the difference is that the second portfolio has a volatility of +/-10%. Suffice it to say it is in all of our interests to get as much return as we can with as little volatility as possible.

While this seems like common sense, I think it’s a point that investors struggle with. It’s easy to pick out a lagging asset and say this isn’t doing well, let’s move on to something that is doing better. Or ask why do we own this? It has done horribly for the past several years. But, eliminating a struggling asset and replacing it with one doing well defeats the purpose. If all things do well together, they are likely to also perform poorly together, even if you appear diversified.

While commodities have risk and return characteristics that sit somewhere between equities and bonds, the primary argument for owning commodities within a portfolio is centered around correlation. Since commodities tend to deliver returns in a different pattern than equities and fixed income, adding them to a portfolio can reduce overall portfolio risk, while having a minimal impact on return over long horizons. Said differently, the efficiency of the portfolio in capturing return by spending risk improves.

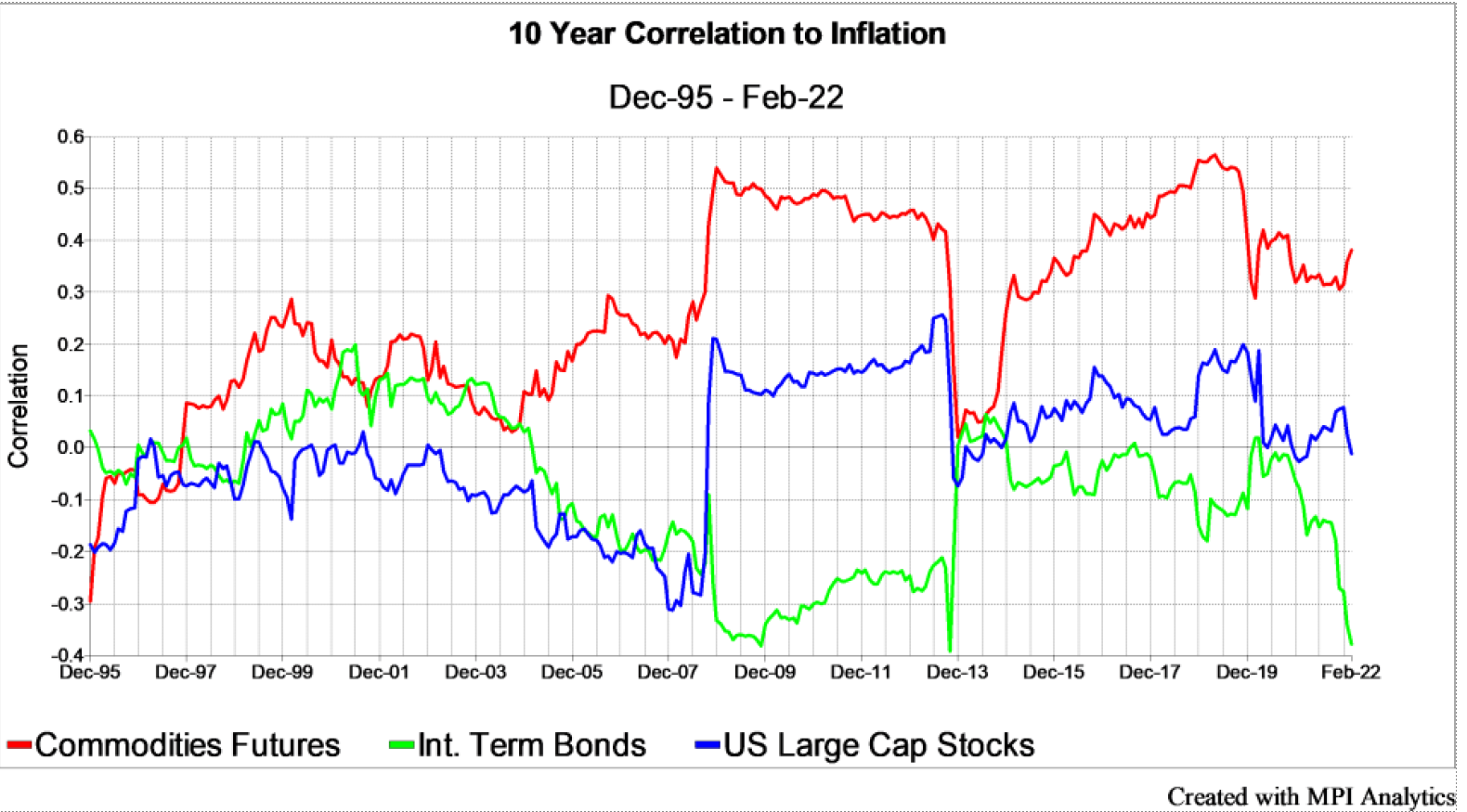

In addition to their overall ability to diversify stock and bond portfolios, commodities have a rather unique characteristic of being positively correlated to inflation (as seen in Chart 1). That is, while most assets perform poorly during periods of rising inflation, commodities tend to perform well during these periods. Despite what popular media outlets would have you believe, stocks are not, I repeat not, a hedge against inflation. In fact, there are few things that will put a dent in equity valuations quite like inflation. I suspect that the confusion comes from the fact that stocks are usually a high returning asset that generally outpaces inflation over time. They do not do well as inflation rises though, as the term hedge would imply. In fact, since 1925 there have been only 2 rolling 24-month periods where inflation was above 4% and the PE multiple was over 20x. Those were the 24 months ending April and May of 1969, essentially the same period, just separated by one month. This, of course, does not bode well for stocks today, as both conditions currently exist, which, as history would tell us, is likely unsustainable.

Stocks as Inflation Hedge? Not so Fast.

Chart 1

While the common perception is that stocks are the best hedge against inflation. This is not true. As seen here, stocks have virtually no correlation to inflation, while commodities provide consistently positive correlation to inflation. This can be beneficial, as positive correlation indicates that commodities tend to rise as inflation heats up. By contrast, there have been only two periods in the last century, where inflation has risen above 4% while stocks maintained a TTM PE of 20x. Inflation is not conducive to elevated valuations.

Commodities 101

Before discussing the economic characteristics of real assets, it’s important to identify the methods of access to these markets. The first and most obvious is via direct investment. In this scenario, investors would directly purchase real assets like oil, gold, or forestry. Simply stated, buy physical barrels of oil, gold bars, or buy land and timber. A simplified version of this would be to participate in private partnerships where a general partner would be responsible for the acquisition, disposition, and management of such ventures. While there are many benefits to direct investment, the fact remains that it is impractical for most individual investors. This simplification comes with a cost, both in terms of actual fees and with regard to access to capital, as most private offerings require long-term commitments or lock-ups of capital.

For most, access to real assets comes in the form of buying commodities related stocks (i.e., mining or forestry companies) or through commodities futures. While both are fairly common, commodities stock performance is derived from both the operation of the business and equity markets, as well as returns from commodities prices. Said differently, they tend to look and act much more like the overall stock market because, in essence, they are stocks. This reduces and, in many cases, eliminates the diversifying benefits of owning commodities. In our view, this only makes sense when one has a positive view on both equity markets, as well as the underlying commodities.

That leaves commodities futures. While commodities futures overcome many of the aforementioned obstacles present with direct investment and commodities stocks, they are not without limits. When investing in futures, performance is less about the near-term appreciation and depreciation of the underlying investment (the spot price) as it is about unexpected changes in the future spot price. For example, let’s say we make a direct investment in oil at $90. If the price next year is $100 we have a profit of $10. By contrast, let’s say we make that same investment in oil via a 1-year futures contract, where the spot price today is $90 and markets expect the price of oil to be $100 in one year. An investor in futures has essentially made zero return because the $10 increase in spot price was expected in the futures market and imbedded in the contract price. This works both ways though. In the same scenario if the price today is $90 and markets are expecting prices to decline to $85 over the next year, but they only decline to $88, a futures investor will make $3, while the direct investor will lose $5. In short, futures investing is more about the actual price change relative to the expected price change.

In addition, to the movements of spot price vs. the expected change in spot price, investors in futures accrue two additional sources of return. First, since futures are a derivative investment (a short-term claim on a real asset), investors via futures must post collateral. This collateral is typically invested in some sort of cash or fixed income investment and accrues a rate of return that is inherent to whatever collateral portfolio is chosen. While yields on fixed assets have been very low in recent years, in inflationary environments, they tend to be higher.

The final source of return is referred to as roll yield. According to John Maynard Keynes, the futures market is comprised of hedgers and speculators, each important to a normally functioning market. The hedgers own or need to purchase real assets perhaps for commercial use (i.e., an oil company may wish to hedge a decline in oil prices). Hedgers, not wanting to be impacted by a sharp decline in in the price of a product that could impact their business, seek to offload this risk to someone else. Enter the speculators. The speculators will take on this risk, but require a return on their investment. Let’s say our oil company wants to hedge oil costs over the next year. They have no idea where prices may end up; they could be $140 or $20 per barrel. To manage this uncertainty, they could sell a futures contract. Let’s say the market is expecting a price decline from $100 to $90. A speculator may allow them to lock in a price of $88. As a result, the oil company is now guaranteed not to sell their product below $88. If things happen exactly as expected, the speculator would earn a $2 profit. This act of buying at a discount to the expected future spot price, and then moving toward that spot price at contract expiration is called roll yield. Roll yield is in essence the insurance premium the speculators receive for taking on the risk, much like the premium earned by an insurance company for providing fire or auto insurance.

Now, it’s important to note, roll yield is not always positive and typically depends on the shape of the futures curve, which can be described as being normally backwardated or in contango. Normally backwardated curves are those where the spot price (current price) is higher than the price of the futures contract. The curve is inverted or downward sloping under this scenario. This typically occurs in markets where supply is short in the near-term, resulting in a premium price to reflect the shortage.

Commodities & Inflation

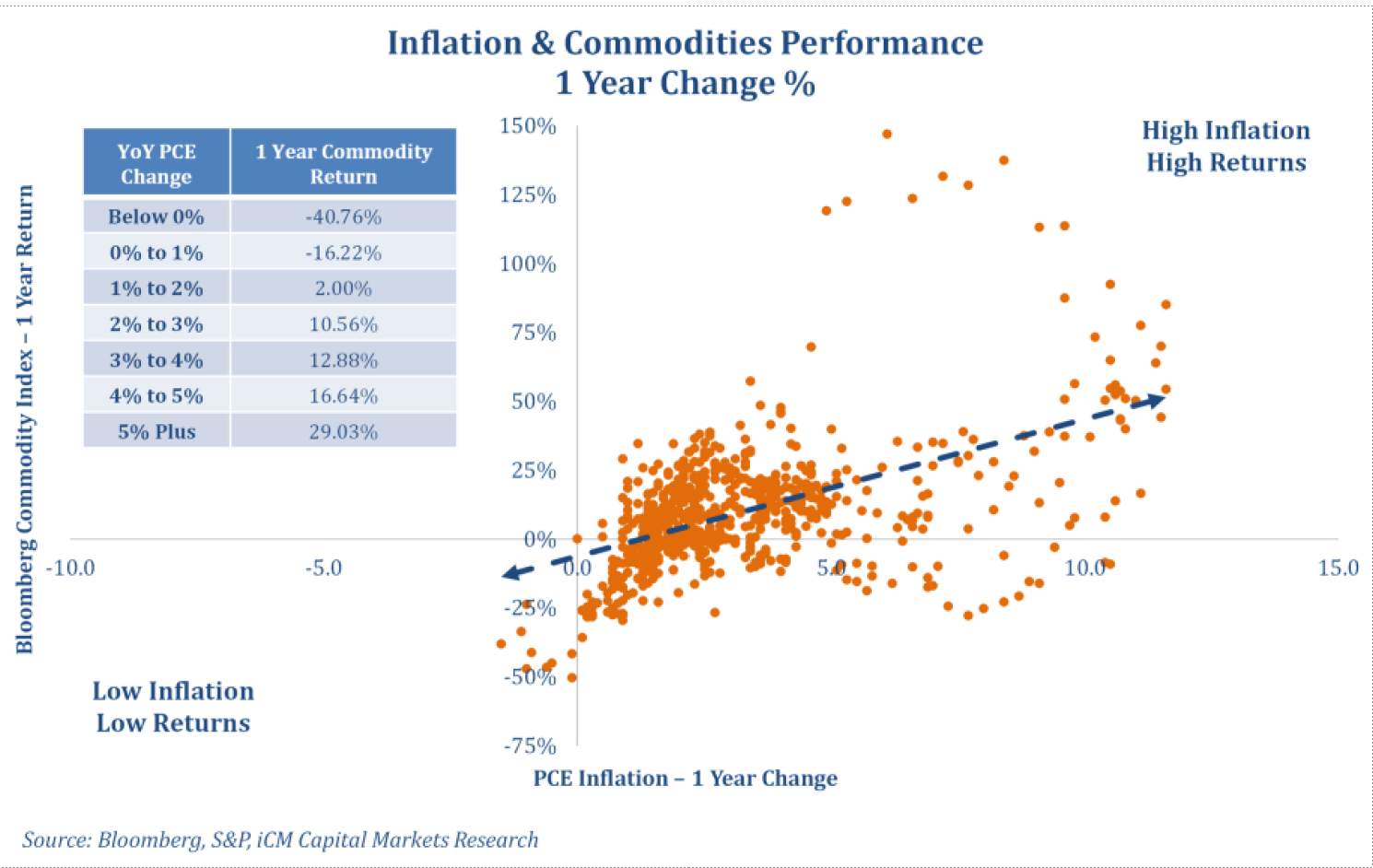

Chart 2

Commodities tend to perform best, when inflation runs its hottest. This further supports the case for owning this nebulous asset as portfolio diversifier.

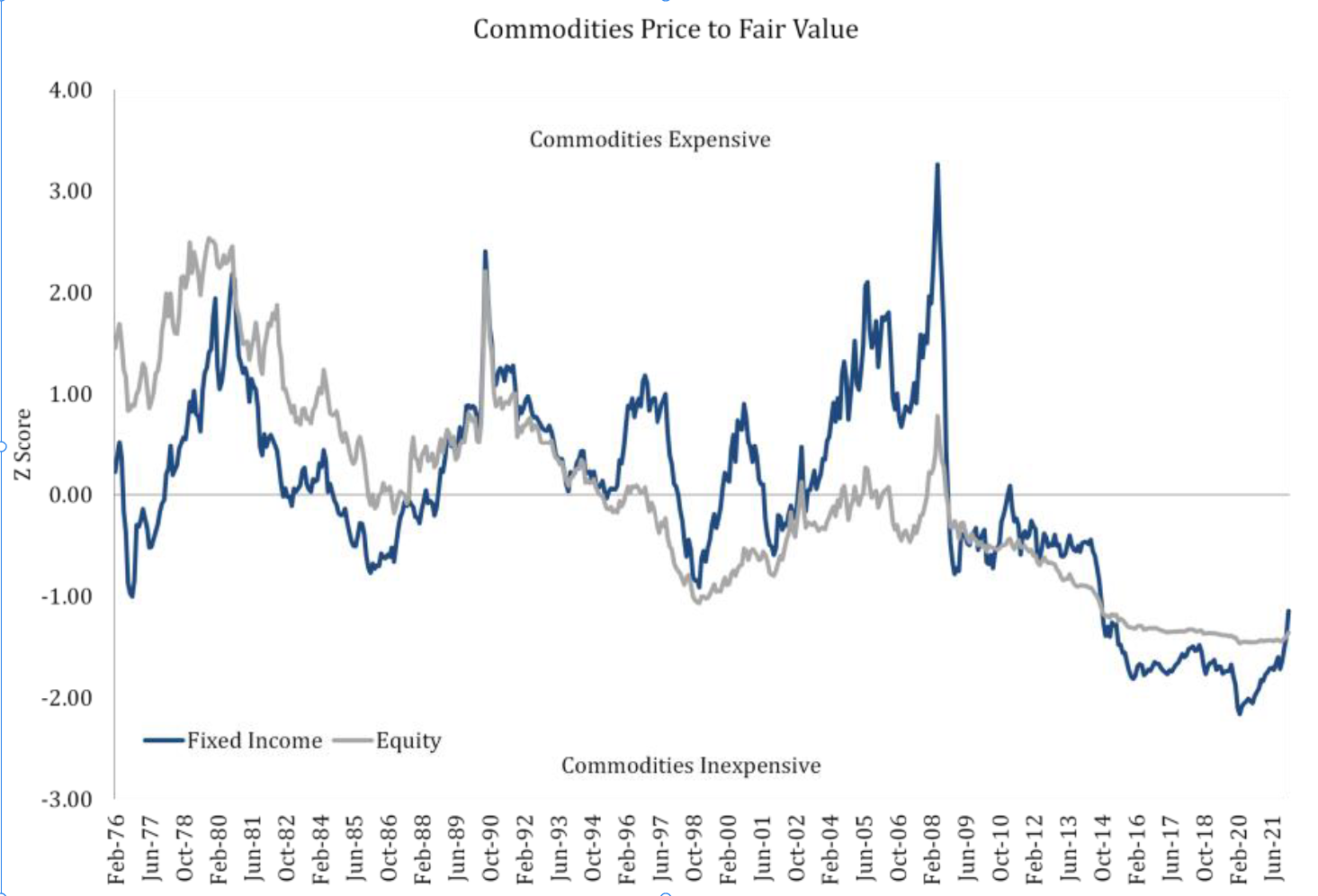

Source: Bloomberg, S&P, iCM Capital Markets Research. After a decade of fits and starts, commodities are meaningfully undervalued relative to both stocks and bonds.

Conversely, markets that trade in contango exhibit an upward sloping curve, where the spot price is below each future price. This typically occurs within markets of abundance and can be considered the storage cost. An extreme example of this occurred in the early days of COVID when the world shut down and oil briefly traded at or below zero. Was oil truly worthless at this time or was the market anticipating that demand would be low, thus lengthening and increasing storage costs? In essence, no one wanted it because you had to pay to store it. This matters because the shape of the curve impacts roll yield, with roll being positive in backwardated markets and

negative in markets that are deeply in contango.

Why is this important today?

Over the past two years, commodities have done exceptionally well, gaining nearly 60%. More recently the dispersion of returns between commodities and other broad assets has become quite pronounced, with the S&P 500 declining 4.6%, the tech-heavy Nasdaq declining 8.95%, US bonds declining by nearly 5.93%, while the S&P GSCI has gained 33.13%, restoring investors’ interest in the once forgotten asset. Despite these stellar near-term results, or their prior poor intermediate- term results, commodities serve an important role as a diversifier. This may be lost in the performance thus far in 2022. Both stocks and bonds are negative, since the root of their struggles lies in inflation. By contrast, and as seen in Chart 2, commodities have historically shined brightest when inflation runs hottest. With stocks continuing to suffer from near historically high valuations and correspondingly low expected returns for the foreseeable future, it only further increases the luster of this asset class.

2022 has gotten off to a rocky start. As we entered the year, markets were already dealing with seemingly sticky inflation due to an issue with the supply chain that is not likely to be resolved as quickly as once expected. Toss in the conflict between Russia and Ukraine, which in addition to global political tensions and humanitarian issues, have further disrupted the supply of oil, wheat, neon, and palladium, with the latter being important components for both semiconductors and catalytic converters, both necessary components in the production of cars and trucks. Tight supplies only further support the investment rationale for the asset. While we are optimistic about its prospects, our enthusiasm must be taken in the context of supporting its inclusion in an already diversified portfolio, with the benefit of a long holding period. Regardless, of the near-term results, however weak or strong, we must remind you to remain focused on the long-run and steadfast in your conviction that once you have a plan in place, unless your circumstances change unexpectedly, staying the course is often the best strategy. As always, we remain focused on the environment and are uniquely suited to respond to the challenges ahead, whatever they may be. Thank you as always for your continued trust and confidence.

For more news, information, and strategy, visit the ETF Strategist Channel.

2nd Quarter 2022 Market Insights is intended solely to report on various investment views held by Integrated Capital Management, an institutional research and asset management firm, is distributed for informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. Integrated Capital Management does not have any obligation to provide revised opinions in the event of changed circumstances. We believe the information provided here is reliable but should not be assumed to be accurate or complete. References to specific securities, asset classes and financial markets are for illustrative purposes only and do not constitute a solicitation, offer or recommendation to purchase or sell a security. Past performance is no guarantee of future results. All investment strategies and investments involve risk of loss and nothing within this report should be construed as a guarantee of any specific outcome or profit. Investors should make their own investment decisions based on their specific investment objectives and financial circumstances and are encouraged to seek professional advice before making any decisions. Index performance does not reflect the deduction of any fees and expenses, and if deducted, performance would be reduced. Indexes are unmanaged and investors are not able to invest directly into any index. The S&P 500 Index is a market index generally considered representative of the stock market as a whole. The index focuses on the large-cap segment of the U.S. equities market.

The TekRidge Center

50 Alberigi Dr. Suite 114

Jessup, PA 18434

Phone: (570)344-0100

Email: [email protected]

www.icm-invest.com