By Solomon G. Teller, CFA, Chief Investment Strategist, Green Harvest Asset Management

It’s a basis-point investment world these days: trading commissions have receded or disappeared altogether; fund management fees have been declining; and interest rates and bond yields have all fallen significantly. It’s no wonder that many investors are increasingly focused on increasing after-tax returns by reducing the largest remaining drag to investing – taxes. Tax Loss Harvesting (TLH), a form of what we at Green Harvest call Tax Benefit Capture, is a critical tool to potentially help lower overall tax cost. Fortunately, with lower trading costs, improved technology and proliferation of investment choices, the effectiveness of TLH strategies has arguably never been better. Lingering misconceptions about TLH persist, however. Here are three:

“TLH means investing in losers.” You don’t have to lose money to benefit from TLH. This is a frequently encountered misunderstanding, and it’s understandable given that TLH suggests the goal is to harvest losses. But this has the causality backwards. The primary goal of a TLH program, coupled with an indexing allocation, is first and foremost to provide the return of the index. A TLH program should minimize tracking deviations with the benchmark but enables tax benefits by taking advantage of the inevitable declines that individual risk assets experience.

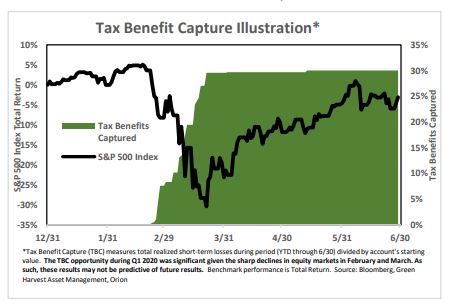

“You can wait until year-end to TLH or even do it ad-hoc.” The 2020 record-paced stock market dip and subsequent record-paced recovery should put this misconception fully to bed. Investors with a broad equity exposure at the start of the year had a prime opportunity to TLH in March and April. See chart on right for illustration of a Green Harvest U.S. Equity account originally invested on 12/31/2019 where nearly 30% of the starting value of the account was harvested before June. Anyone waiting until year-end, or even trying to harvest without a plan during this tumultuous period, would likely have missed much if not all of the opportunity.

“You can wait until year-end to TLH or even do it ad-hoc.” The 2020 record-paced stock market dip and subsequent record-paced recovery should put this misconception fully to bed. Investors with a broad equity exposure at the start of the year had a prime opportunity to TLH in March and April. See chart on right for illustration of a Green Harvest U.S. Equity account originally invested on 12/31/2019 where nearly 30% of the starting value of the account was harvested before June. Anyone waiting until year-end, or even trying to harvest without a plan during this tumultuous period, would likely have missed much if not all of the opportunity.

“To TLH you have to be out of the market.” One of the goals of a smart TLH program is to maintain consistent investment exposure. Again, in the V-shaped 2020 stock market decline and rebound, stocks swooned in just over a month and swiftly rebounded. Selling in March to capture a tax benefit and then holding cash in expectation of buying back in at similar prices could have been disastrous to performance. Portfolios constructed with ETFs have a distinct advantage over individual securities with regards to TLH and staying invested. ETFs enable simultaneous substitution of one ETF for another similar ETF – there’s no need to be out of the market waiting for the 30-day wash sale period to end.

Investors with ongoing realized capital gains from business, alternative assets or active managers (and the like) should not let these misconceptions lead to missing out. It’s time to evaluate and consider embracing a robust tax Benefit Capture program to take advantage of whatever opportunities the rest of 2020 and beyond has in store.

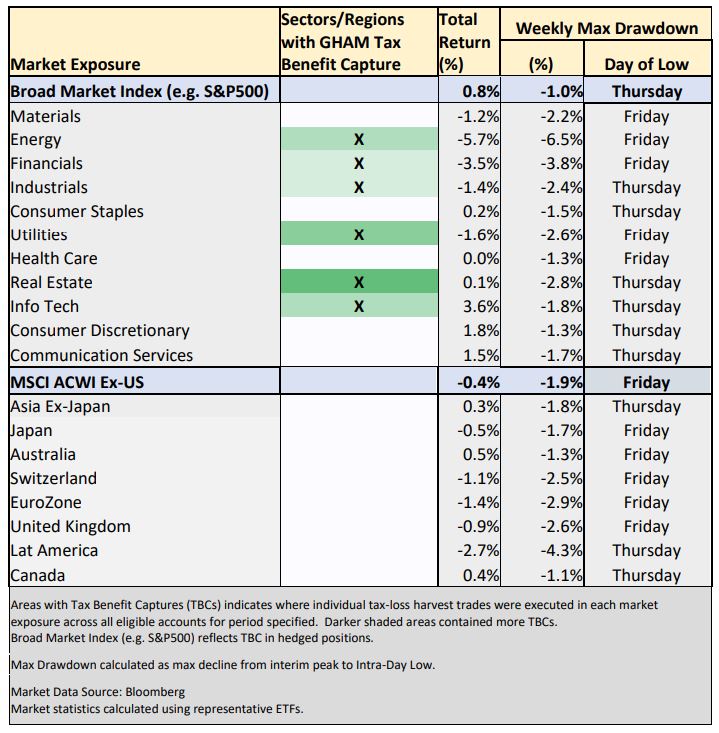

Tax Benefit Capture Heat Map for period spanning August 17 – August 21, 2020:

Disclaimers:

Performance quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when the portfolio is liquidated. Current performance may be higher or lower than that quoted. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

GHAM does not provide tax advice. Although GHAM does not employ a Certified Public Accountant on its staff, we have, and continue to work with outside accounting firms and outside tax counsel that provide ongoing guidance and updates on all relevant tax law. Federal, state and local tax laws are subject to change. GHAM is not responsible for providing clients updates on any changes in tax laws, rules or statutes.

Reasons to harvest capital losses, sources of capital gains and the suggestion that mutual funds distribute capital gains are for example purposes only and not meant to be tax, estate planning or investment advice in any form or for any specific client.

All performance and estimates of strategy performance, after tax alpha, after tax alpha opportunities and other performance figures are derived from data provided from multiple third-party sources. All estimates were created with the benefit of hindsight and may not be achieved in a live account. The data received by GHAM is unaudited and its reliability and accuracy is not guaranteed.

The availability of tax alpha is highly dependent upon the initial date and time of investment as well as market direction and security volatility during the investment period. Tax loss harvesting outcomes may vary greatly for clients who invest on different days, weeks, months and all other time periods.

All estimates of past returns of broad, narrow, sector, country, regional or other indices do not include the impact of advisor fees, unless specifically indicated. Past performance and volatility figures should not be relied upon as an indicator of future performance or volatility.

This material is not intended to be relied upon as legal, investment or tax advice in any form or for any specific client. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person. All investments carry a certain degree of risk, and there is no assurance that an investment will perform as expected over any period of time.

As a convenience to our readers, this document may contain links to information created and maintained by third party sites. Please note that we do not endorse any linked sites or their content, and we are not responsible for the accuracy, timeliness or even the continued availability or existence of this outside information. While we endeavor to provide links only to those sites that are reputable and safe, we cannot be held responsible for the information, products or services obtained from such other sites and will not be liable for any damages arising from your access to such sites.