By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

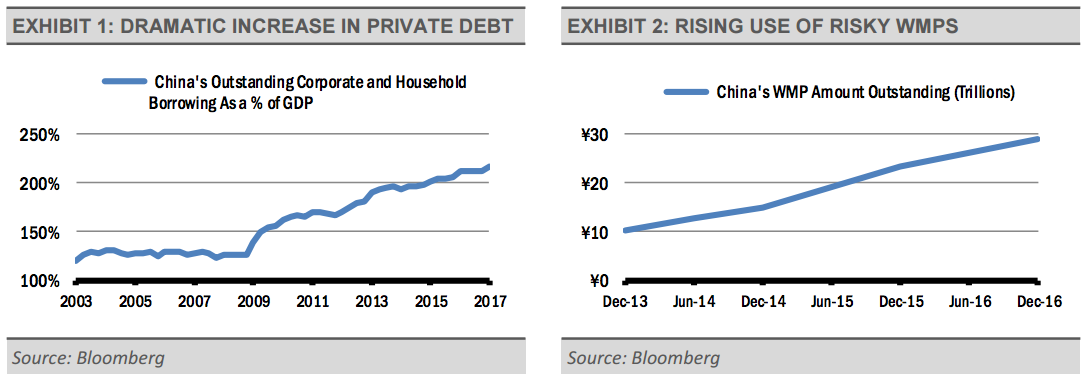

Our outlook for emerging market stocks and bonds has dimmed on a risk-reward basis. Our apprehension is focused on the dramatic increase in China’s level of private sector debt at a time when we view emerging market equity valuations as unattractive. We think the risk-reward tradeoff for emerging market stocks and bonds has become increasingly unappealing.

China’s well-documented real estate boom has been fueled largely by an increase in private sector debt. On one hand, the Chinese government is trying to slow the growing debt issue. On the other hand, the Chinese government is encouraging banks to make loans to other countries with low credit ratings as part of their One Road, One Belt initiative. We think that banks are making risky loans to help advance the government’s political agenda, however, this distortion can have severe effects if these risky loans go bad.

Domestically, retail investors in China have been loading up on “wealth management products” (WMPs), which have attractive yields but are backed by risky assets. Recent estimates suggest that nearly 56% of these assets are invested in China’s debt market, typically using leverage to enhance the return. Their market has grown quickly with small city and rural banks participating much more than the large state banks. Here too, the Chinese government has moved to stem this practice, but the burden on these smaller banks has already increased risk.