Four rate hikes in 2018 have fueled a stronger U.S. dollar, putting a damper on gains for international markets and their local currencies. However, that shouldn’t discourage investors from allocating capital overseas to not only gain the diversification benefits, but to also take advantage of any upside overseas as certain countries are not in a late market cycle compared to the U.S.

However, if an investor does decide to invest internationally, he or she should be aware of the currency risks associated with these investments and consider the necessary alternatives to hedge appropriately. In essence, investing overseas without considering currency movements would be akin to flying blind since currency returns could significantly alter returns depending on the market environment.

An option to consider include exchange-traded funds (ETFs) that can dull the effects of a rising U.S. dollar on international markets, such as the IQ 50 Percent Hedged FTSE Intl ETF (NYSEArca: HFXI). A stronger dollar plus U.S. equity volatility has certainly diminished returns for international and emerging markets in 2018, but a more dovish-sounding Federal Reserve could create more opportunities abroad.

“For those seeking exposure to international equities, it is important to understand how exchange rate movements can affect equity returns in these markets,” noted a whitepaper from New York Life Investments.[1] “Currency hedging offers a way to invest internationally, while managing against the risk a stronger U.S. dollar can impose on foreign-based equity returns.”

International Markets as a Value Proposition

Investors might be sitting on their hands when it comes to international market exposure as a result of ongoing trade talks between the United States and China. Trade negotiations going awry can certainly send markets abroad in the wrong direction, but it doesn’t mean investors should avoid them entirely.

The U.S. stock market has been the default play for many investors during the historic, decade-long bull run, but the latest bout of volatility in the fourth quarter of 2018 may have steered them off course, and investments abroad could be an attractive opportunity when you consider value compared to price.

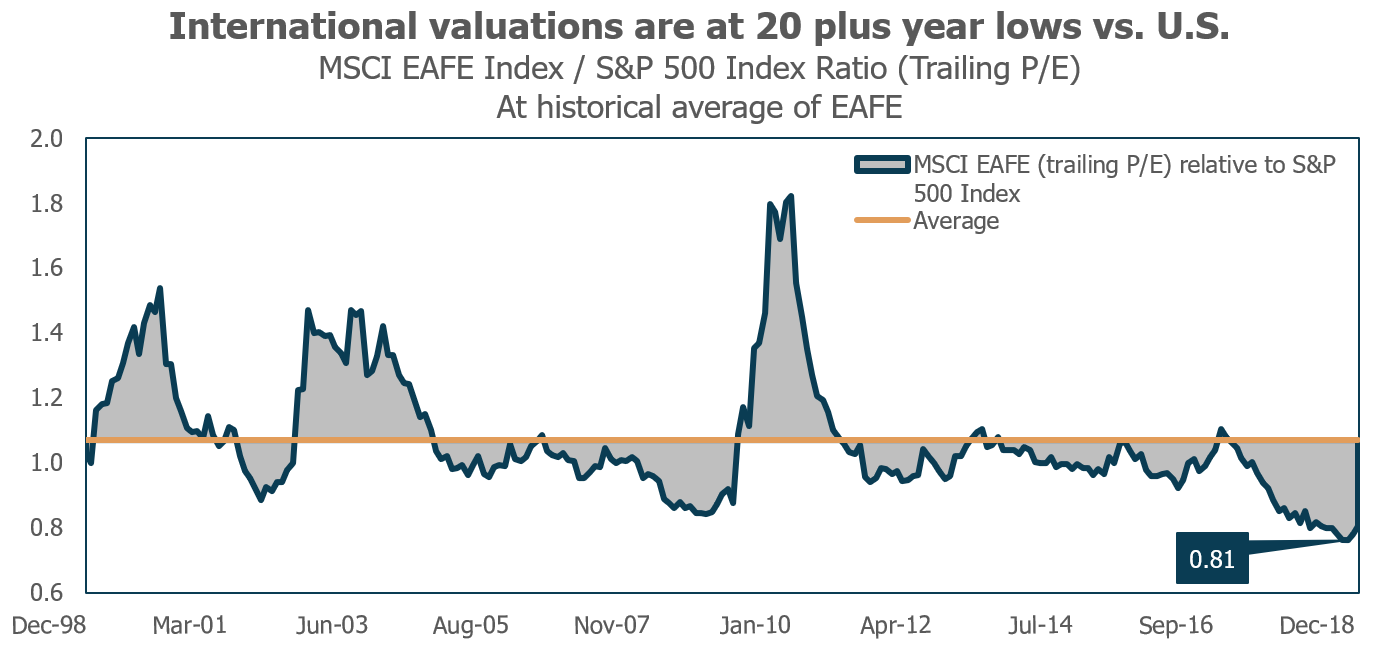

“The proper allocation to international equities will vary by investor, but the benefits generally center on enhanced portfolio diversification and access to dynamic investment opportunities not available by limiting one’s opportunity set to only U.S. securities,” the white paper noted. “Moreover, now may be an attractive time to consider increasing one’s allocation to international equities as valuations are at 20 plus year lows relative to U.S. equity valuations”

Source: FactSet, as of 12/31/18. Relative valuations based on trailing 12-month P/E. Past performance is no guarantee of future results, which will vary. It is not possible to invest directly in an index.

Currency Hedging in an ETF Wrapper

Currency hedging via international developed markets through an ETF like HFXI has allowed investors to lessen the effects of a rising US dollar as opposed to their unhedged peerswithout sacrificing all of the potential gains from a US dollar falling as opposed to their hedged peers. HFXI seeks investment results that correspond generally to the price and yield performance of its underlying index, the FTSE Developed ex North America 50% Hedged to USD Index, which is an equity benchmark of international stocks from developed markets, with approximately half of the currency exposure of the securities included in the underlying index “hedged” against the U.S. dollar on a monthly basis.

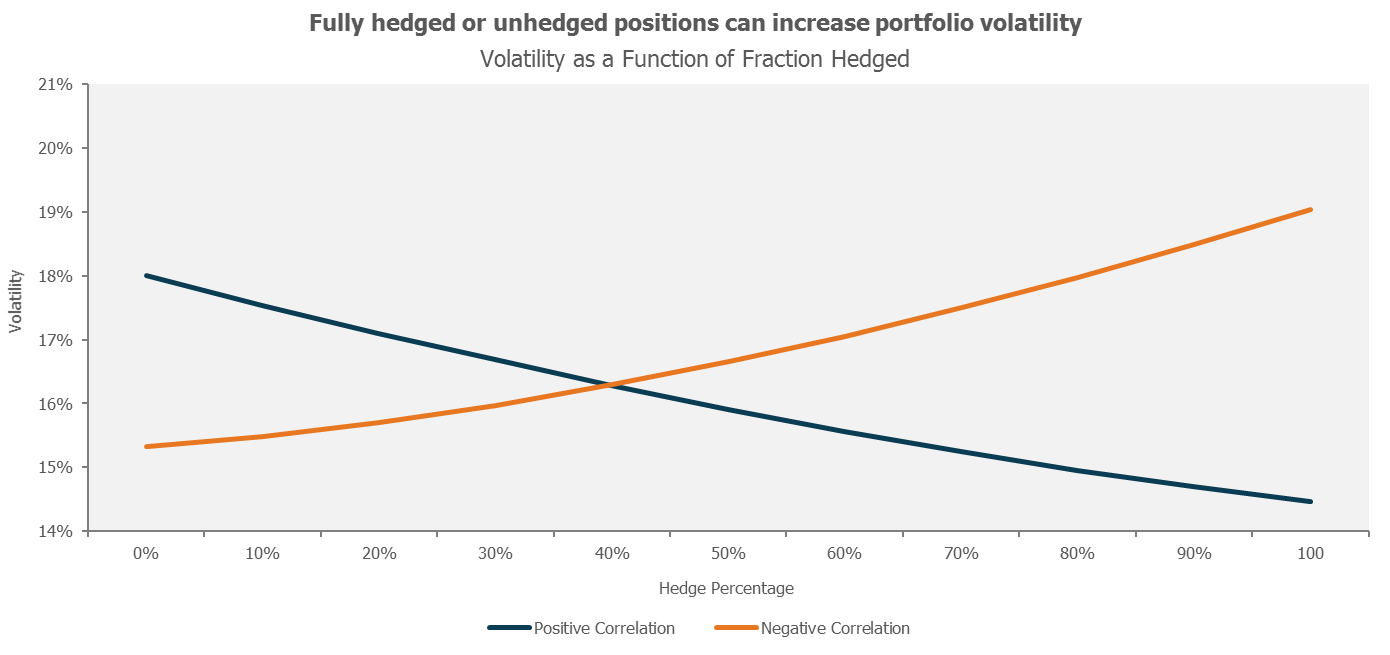

“Currency hedging can help manage the risks of large currency movements, but the extremes of either 100% hedged or 100% unhedged strategies introduce an inherent view on the direction of the U.S. dollar,” the white paper noted. “The challenges around this are twofold. First, a fully hedged portfolio has historically curtailed returns when the U.S. dollar weakened, relative to international currencies, whereas an unhedged portfolio has historically underperformed when the U.S. dollar strengthened.”

“Second, whereas a fully hedged currency position is often assumed to help mitigate volatility, it can actually increase an investment’s risk profile, depending on the specific dynamics of the underlying currencies,” the whitepaper added.

Source: New York Life Investment Management. This chart is for illustrative purposes only and is meant to represent the effects of positive and negative correlation between “hedge Percentage” and “volatility.” Past performance is no guarantee of future results, which will vary. Index returns shown may not represent the results of the actual trading of investable assets. An investment cannot be made directly into an index.

The 50 Percent Hedge Advantage

HFXI’s 50 percent hedging strategy offers distinct advantages over those that incorporate a more extreme 100 percent strategy. According to the whitepaper, fully-hedged portfolios may not maximize returns when the dollar falls against international currencies.

Due to the fickle nature of predicting currency movements, it’s difficult to forecast whether a fully hedged or unhedged strategy will provide higher returns. An additional downside to full currency hedging is an investor assuming more risk despite the strategy’s inherent focus of muting volatility. The unpredictable nature of the currency markets can produce variations in correlation between currency and equity markets of that particular country.

As such, investors may want to consider employing HFXI’s 50 percent hedging strategy.

“Our research into the interaction between currencies and equity returns shows that a neutral 50% currency hedge on an international equity portfolio can offer a pragmatic balance for buy-and-hold investors,” the whitepaper outlined. “It can help gain international equity exposure and mitigate the effect of exchange rate fluctuations, without being actively bullish or bearish on the direction of the U.S. dollar or foreign currencies.”