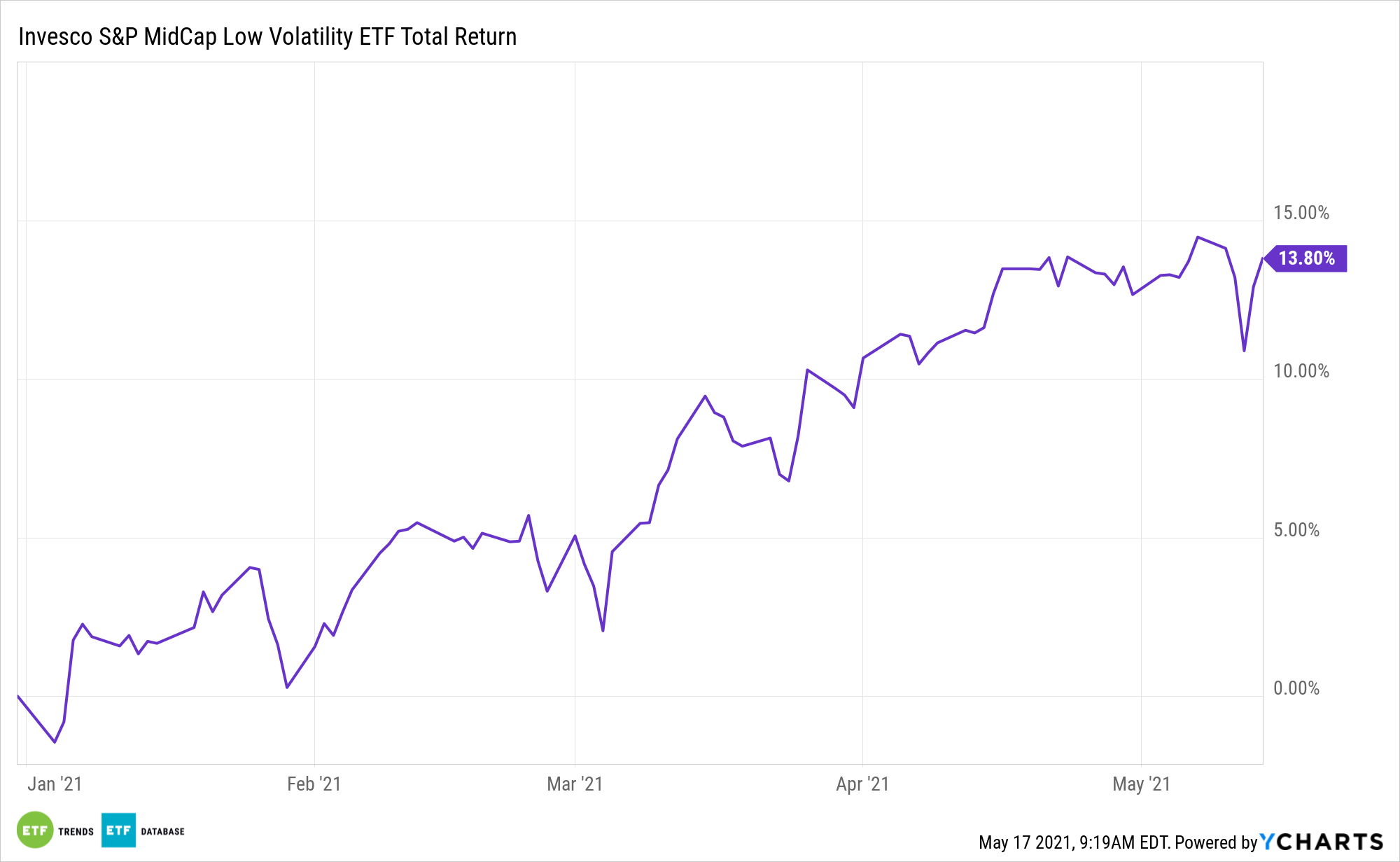

With mid caps soaring this year, volatility reduction may not be top of mind for many investors. Yet those those looking for engagement with an asset class with reduced turbulence can consider the Invesco S&P MidCap Low Volatility ETF (NYSEArca: XMLV).

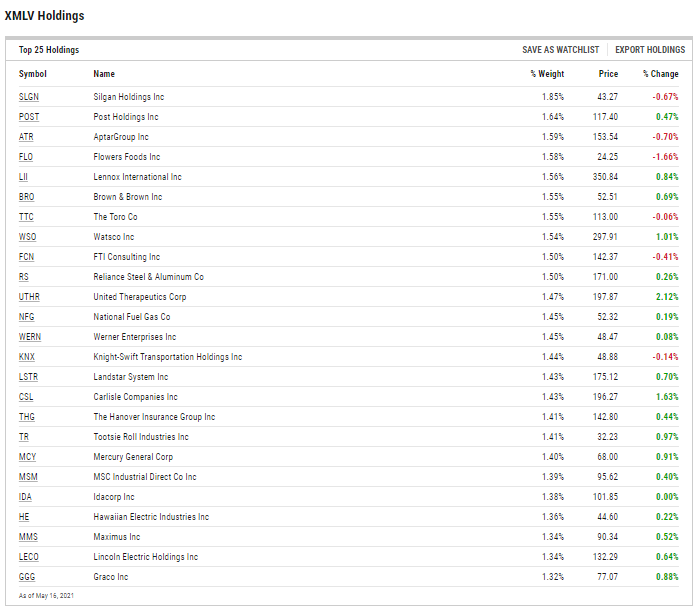

XMLV follows the S&P MidCap 400 Low Volatility Index, which is home to the 80 members of the S&P MidCap 400 with the lowest trailing 12-month volatility.

“Volatility is a statistical measurement of the magnitude of up and down asset price fluctuations over time,” according to Invesco.

XMLV’s mission to avoid volatility is relevant because mid caps are an ideal asset class for long-term investors.

“Mid-caps outperform: $1 in mid in 1978 equals $199 today, outperforming small-caps ($181) but especially large ($139),” according to Bank of America research.

A Mid Cap Miracle?

Another point in favor of XMLV, particularly over the near-term, is that mid caps are usually responsive to GDP increases. That’s relevant as the economy emerges from the effects of the coronavirus pandemic.

“Mid-caps are more sensitive to GDP growth, with a history of outperforming large caps during economic expansions,” notes Bank of America. “The BofA US Economics team forecasts high economic growth to continue into 2022 and beyond, and we note that mid-caps have a history of outperforming large-caps during periods of faster economic growth. Our current growth outlook implies one of the best periods for mid-caps vs. large in modern history.”

It’s often said that mid caps are the market’s “sweet spot.” These same stocks are too often overlooked.

“Mid-caps have been responsible for 31% of total US corporate EPS since 1995, have been responsible for 39% of total equity market returns since 1978 and boast higher average annualized returns than large and small-caps. However, mid-caps have enjoyed less than 5% of the combined large, mid and small-cap ETF inflows. The group is under-owned relative to their economic contribution,” adds Bank of America.

Cyclical sectors, such as financial services, industrials, and materials, are expected to drive mid caps higher this year. That’s good news for XMLV because that trio combines for almost 42% of the ETF’s roster.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.