Although Treasury yields are rising, interest rates remain low by historical standards, meaning income-starved investors need to get creative. Enter the Invesco Zacks Multi-Asset Income Index ETF (NYSEArca: CVY).

CVY tracks the Zacks Multi-Asset Income Index, which “uses quantitative analysis to select stocks from the Index universe to obtain a representative sample of stocks that resemble the Index in terms of key risk factors, performance attributes, and other characteristics,” according to Invesco.

Securities currently held by CVY include common stocks, master limited partnerships (MLPs), real estate investment trusts (REITs), closed-end funds, and preferred stocks. In other words, CVY is ideally suited for today’s low-yield environment.

“The yield spreads on investment grade bonds have snapped back since the bottom and are now at or near pre-crisis levels,” according to Invesco research. “While spreads can still move tighter by a small margin, the tailwind for investment grade bonds is much lighter than we observed throughout 2020. Investment grade bonds still provide a premium over Treasuries, but the excess income they provide today is offering less of a boost to income-oriented portfolios than in the recent past.”

Call on CVY for Income

CVY’s high yield is driven in part by exposure to energy assets, including master limited partnerships, closed-end funds, and REITs, among other assets.

The fund’s real estate exposure is notable at a time when investors are prizing the defensive sector. The fund’s MLP exposure is useful not only because of the high yields associated with that asset class but due to low correlations to traditional energy equities.

“Real assets have been gaining acceptance recently as alternatives that have the ability to provide elevated income and diversification against inflation,” adds Invesco. “Real estate, the more mainstream of these asset classes, looks attractive from a current income standpoint but faces headwinds going forward with uncertainty due to COVID-19. Infrastructure, while less commonly used, has become more accessible in the past few years. In our view, it is now a viable complement to real estate and may have fewer headwinds going forward.”

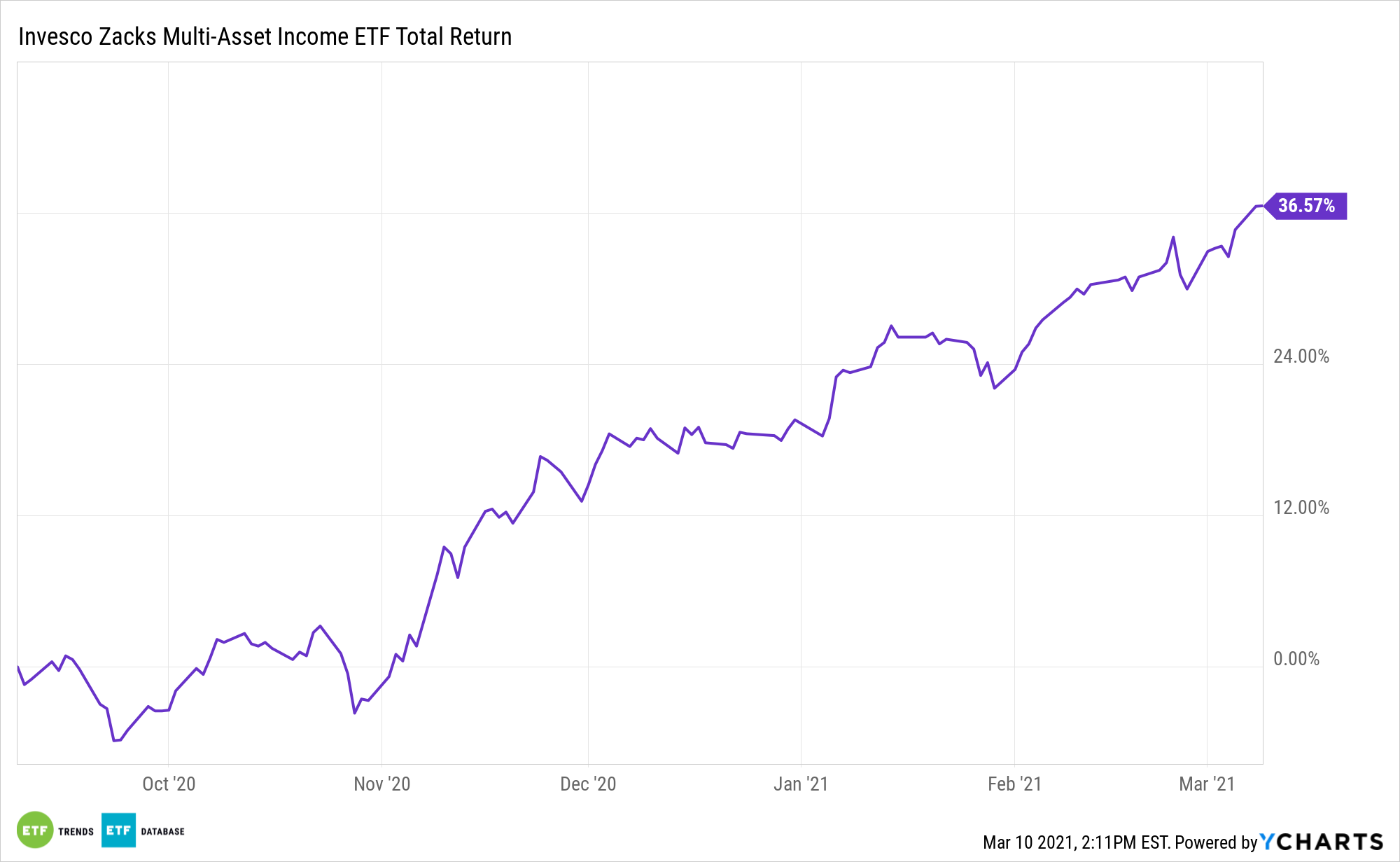

CVY is also a potent idea for investors looking to access the value factor, as most of the fund’s holdings carry the value designation. Up 14.19% year-to-date, CVY yields 3.06%.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.