Usually, internet stocks are growth stocks and as such, some previously beloved internet equities are lagging this year as cyclicals the lead.

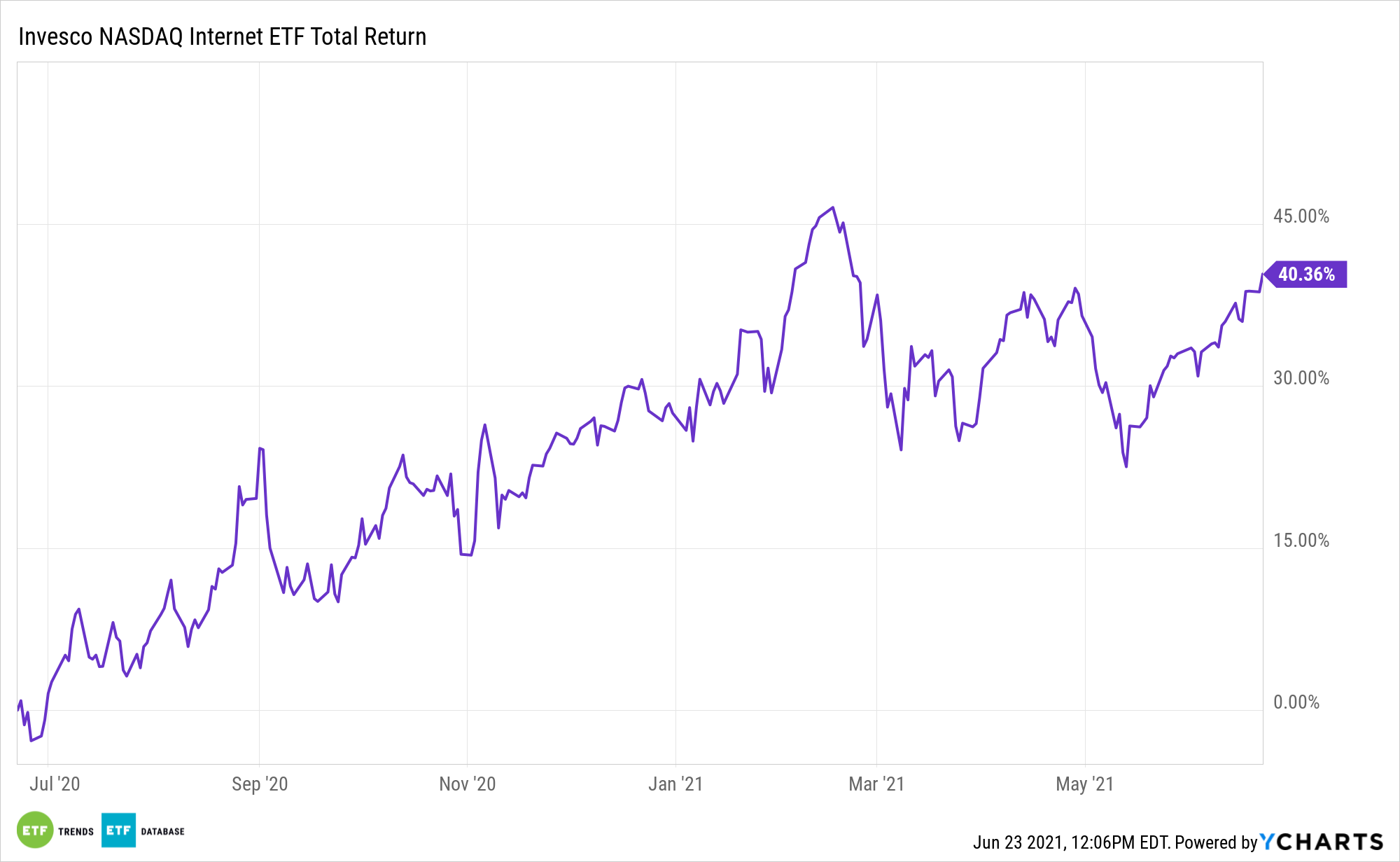

Still, the Invesco NASDAQ Internet ETF (NASDAQ: PNQI), an exchange traded fund that’s heavy on growth names, is higher by 10% year-to-date. Perhaps just as important is the fact that the Invesco fund is higher by almost 9% over the past month. That could be a sign some investors are positioning for a rebound in internet stocks in the second half of 2021.

If Treasury yields continue steadying or even decline and some of the junkier names that have pushed value higher falter, plenty of investors may prove eager to revisit well-known growth fare, including PNQI holdings.

“Bank of America tech analysts Justin Post and Nat Schindler released on Monday a preview of the second half of the year, saying in a note to clients that the themes tech investors need to watch are the economic reopening, regulation and interest rates,” reports Jesse Pound for CNBC.

Bank of America Bullish on Some PNQI Holdings

While some of the FAANG stocks are dithering this year, many are not. Bank of America has a favorite in the group: Google parent Alphabet (NASDAQ: GOOG). That stock is up a stellar 45% year-to-date, supporting PNQI in the process as it’s the Invesco fund’s third-largest holding at a weight of 8%.

The bank is also bullish on online travel names Booking (NASDAQ: BKNG) and Expedia (NASDAQ: EXPE) due to their leverage to the reopening theme. That pair of stocks combines for 3.5% of PNQI’s roster.

“We favor more cyclical companies in our sector (GOOG, BKNG, EXPE) for reopening in 2021 (and have had mixed YTD results),” according to Bank of America.

Up just 7.63% year-to-date, Amazon (NASDAQ: AMZN) is an example of a sluggish FAANG stock, but it could soon be shedding that status.

“We think Amazon is set up for improving 2H sentiment as tougher eCommerce comps pass, concerns on the Bezos change, labor shortages & added fulfillment investment fade, and Cloud possibly accelerate,” notes Bank of America.

The bank has a price target of $4,360 on Amazon, well ahead of the June 22 close of $3,505. Additionally, the notion that e-commerce giant’s shares are poised to accelerate appears to be playing out in real time as the stock is higher by 9.44% over the past month. Amazon is the PNQI’s second-largest holding at a weight of 8.22%.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.