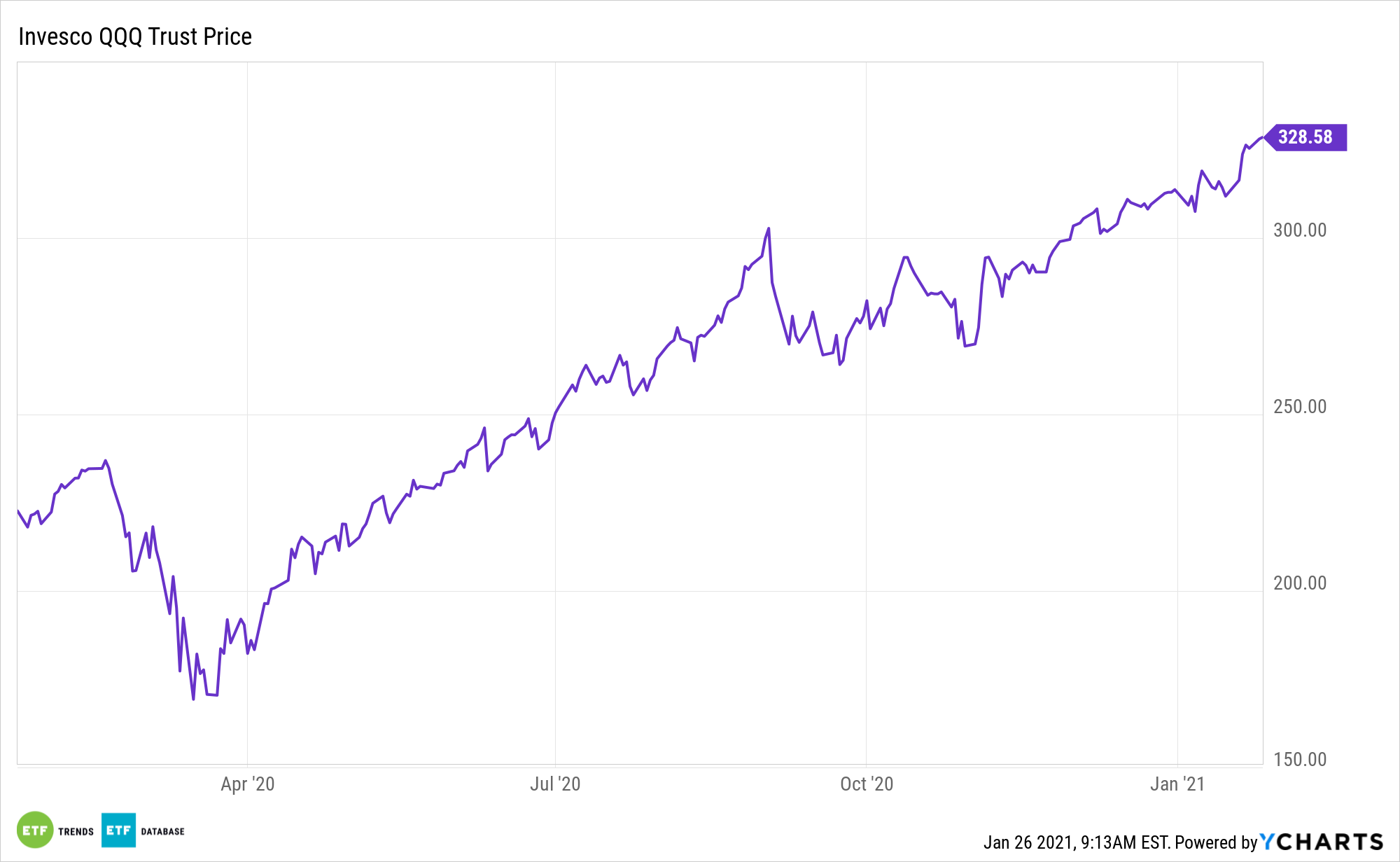

One of the primary benefits of the Invesco QQQ Trust (QQQ) is its overweight position in technology stocks. Good news: many market observers are forecasting more upside for the sector this year.

QQQ tracks the widely followed Nasdaq-100 Index (NDX), which is dominated by the technology, communication services, and consumer discretionary sectors. Those exposures are meaningful in the current market environment.

“If part of the thesis for further stock gains is massive central bank liquidity, tech should benefit from this trend, particularly if volatility continues to fall,” according to BlackRock. “Since 2008 tech has generally outperformed when financial conditions are improving. The average outperformance is approximately 30-35 basis points (bps) a month. In months when volatility, measured by the VIX Index, is falling, average outperformance doubles. Why? Because long-duration assets, i.e. companies where cash flows are in the more distant future, benefit when financial conditions are easy and rates exceptionally low.”

QQQ Thriving: The Methodology behind the Gains

The growth style may be gaining momentum as investors turned to upbeat economic and earnings data, causing many to adopt a risk-on attitude. Since growth stocks show high multiples, investors may expect that the companies will sustain a high growth rate.

Many QQQ components are using technology to disrupt the industries they are in. These companies use innovation and technology to create competitive advantages across multiple sectors and industries beyond tech. The coronavirus pandemic also highlights opportunities with tech stocks and QQQ.

“The pandemic accelerated several existing trends. As a result, many habits acquired during the pandemic are unlikely to fade,” notes BlackRock. “A good example of this is online shopping. Looking at domestic credit card data reveals an interesting pattern. As you would have expected, the share of spending going to online retailers spiked early in the pandemic. Less obvious was the staying power of this trend. Even as lockdowns eased, online retailer’s wallet share remained elevated relative to the pre-pandemic norm. In other words, even as consumer mobility returned, many households came to appreciate the convenience of services such as online grocery delivery.”

Finally, the consumer side of tech looks compelling for investors.

“Household tech spending increased by more than $100 billion, or 25%, in the six months between May and November. While some of the end-of-year bump was a function of early holiday spending, the trend is clear and has been in place for some time,” finishes BlackRock.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.