Invesco offers an extensive lineup of BulletShares exchange traded funds – the issuer’s version of defined maturity ETFs.

These products are popular with advisors and investors because BulletShares ETFs reach into a variety of corners of the fixed income market, including corporate bonds – both investment-grade and junk – and municipal bonds.

Additionally, BulletShares ETFs are typically cost-effective, offer superior liquidity relative to an individual bond, feature diversification, and lob off monthly income. However, defined maturity ETFs do face expiration dates. For investors holding expiring BulletShares ETFs, now may be a good time to consider where those proceeds should go after the funds are sold.

“Bonds maturing inside the 2021 BulletShares ETFs are held for the remainder of the year in very low yielding corporate or government-backed short-term securities, which have, so far, caused the yield on the 2021 BulletShares to drop more steeply this year than would have likely been the case if short-term interest rates were higher,” notes Jason Bloom, Invesco senior director of global ETF macro strategy. “In light of this compressed yield environment, we believe it makes sense for clients to consider the potential benefits of rolling the 2021 BulletShares now or in the near future to access potentially more attractive yields in later-dated maturities, or even other segments of the debt market.”

Where to Turn in Advance of Expiration Day

While 10-year Treasury yields recently steadied, this is still a tricky fixed income environment for investors to navigate. Inflation is here, and while it may ultimately prove to be transitory, some investors may find Treasury Inflation-Protected Securities (TIPS) disappointing and short on income.

Additionally, there’s growing merit to the notion that the Federal Reserve could move up its timeline for interest rate increases, particularly if the U.S. economy continues its impressive pace of recovery. Should a rate hike arrive sooner than expected, long-term bonds could drag.

“While longer term bond yields have stabilized in recent months, historically high levels of monetary and fiscal stimulus continue to fuel a robust debate in the marketplace over the future path of inflation and interest rates,” adds Bloom.

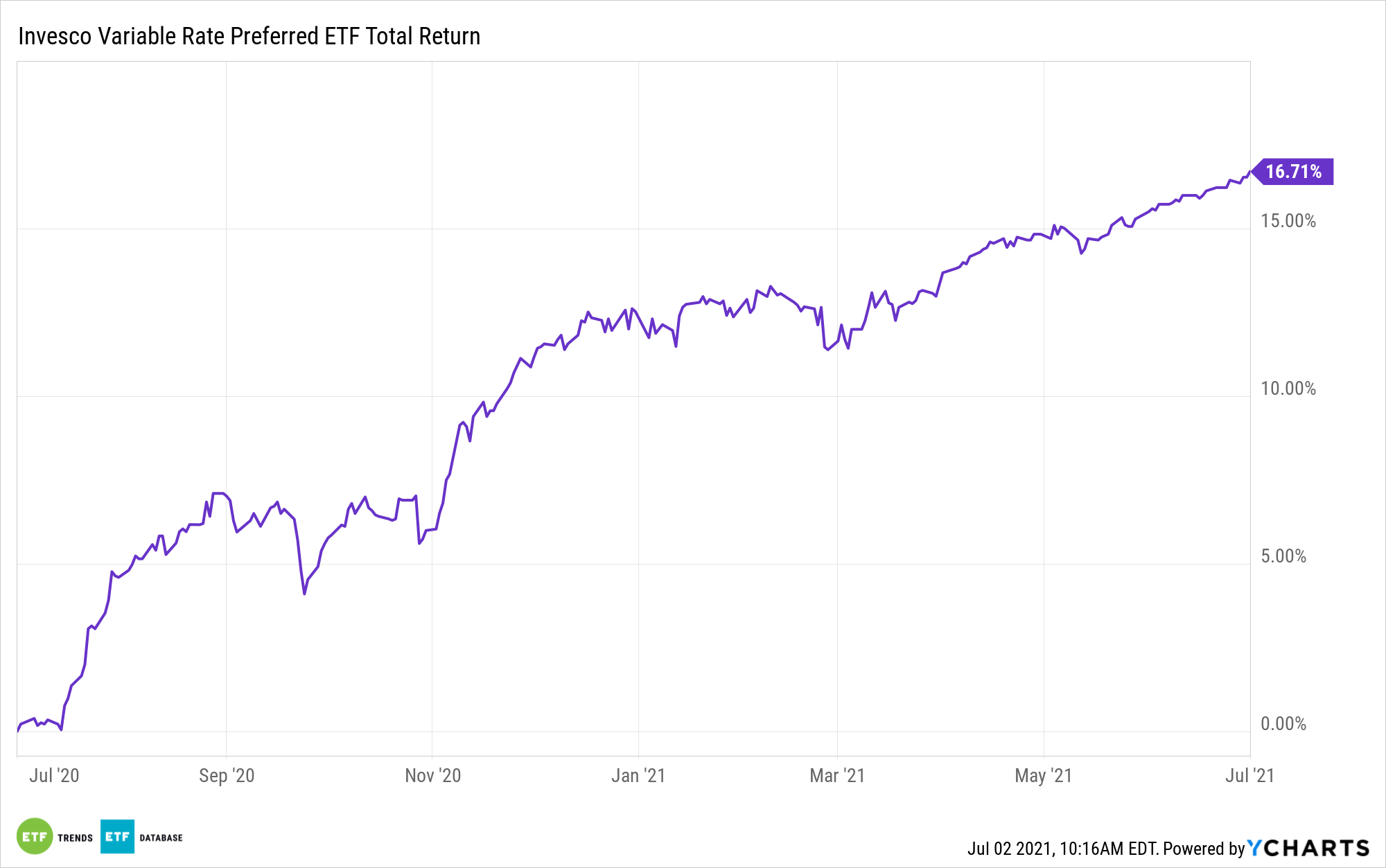

As Bloom notes, ideas for investors to consider as BulletShares expirations draw near include longer-dated investment-grade corporate BulletShares, as well as other fixed income strategies with less interest rate sensitivity such as the Invesco Variable Rate Preferred Portfolio Fund (NYSEArca: VRP).

The $1.77 billion VRP tracks the ICE Variable Rate Preferred & Hybrid Securities Index, which provides exposure to floating and variable rate preferreds, which could prove to be less vulnerable to rising rates than traditional preferred stocks.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Mr. Lydon serves as an independent trustee of certain mutual funds and ETFs that are managed by Guggenheim Investments; however, any opinions or forecasts expressed herein are solely those of Mr. Lydon and not those of Guggenheim Funds, Guggenheim Investments, Guggenheim Specialized Products, LLC or any of their affiliates. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.