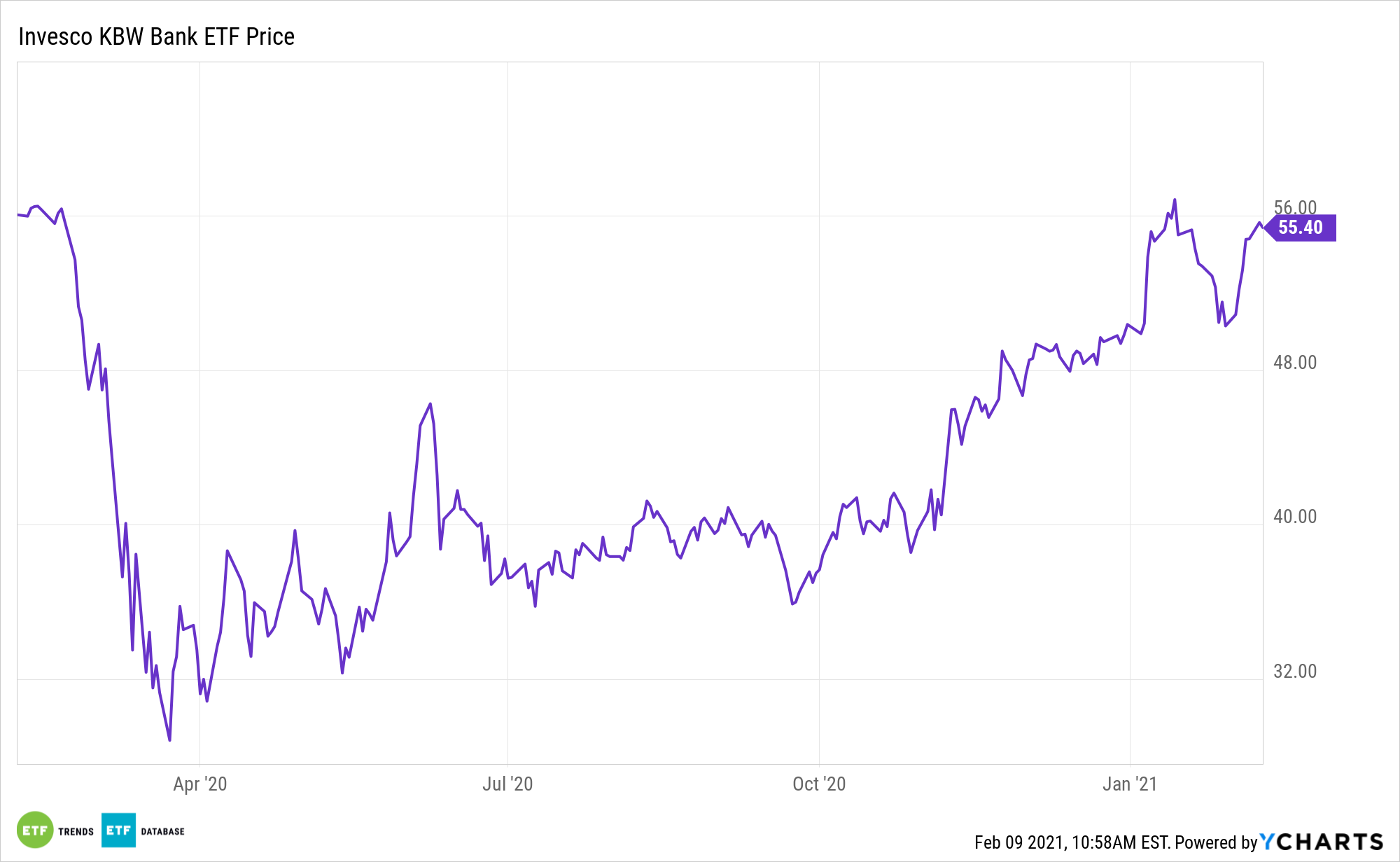

Investors looking for an avenue for tapping the value factor rebound at the sector level may want to consider financial services and the Invesco KBW Bank ETF (NASDAQ: KBWB).

KBWB tracks the widely followed KBW Nasdaq Bank Index.

“The Index is a modified-market capitalization-weighted index of companies primarily engaged in US banking activities. The Index is compiled, maintained and calculated by Keefe, Bruyette & Woods, Inc. and Nasdaq, Inc. and is composed of large national US money centers, regional banks and thrift institutions that are publicly traded in the US,” according to Invesco.

KBWB contains a who’s who of the domestic economy’s big bank players, including JP Morgan, Wells Fargo, and more. The fund serves as an ideal play on the U.S. financials world.

“The outlook for financial stocks is picking up, setting the stage for a broader comeback in value indexes and exchange-traded funds,” reports Daren Fonda for Barron’s.

KBWB’s Value Thesis

For some time, financial services stocks have been viewed as a value destination, but low interest rates weighed on the thesis for the sector. With cyclical stocks rebounding and the economy showing some signs of life, KBWB is looks more attractive.

Value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets. On the other hand, growth-oriented stocks tend to run at higher valuations since investors expect the rapid growth in those company measures, but investors more are growing wary of high valuations.

Value investing is a popular long-term investment strategy. Value stocks have historically outperformed growth stocks, or companies with high earnings expectations, in almost every market over the long-haul, but that trend reversed in a big way during the 2010s. KBWB could lead a positive reversal.

“Banks and other financials are getting a lift from a few factors: A steepening yield curve is fueling optimism that net interest margins, critical to bank profits, will recover sharply. Large banks have a green light from regulators to resume share repurchases. The sector is also rising on hopes that the economy will recover sharply in the latter half of 2021—fueling loan activity and keeping credit losses down,” according to Barron’s.

Some analysts believe bank stock performance is about to take a turn for the better after falling behind amid pandemic-induced revenue concerns due to low interest rates and weak loan growth, along with credit concerns. Plus, there are some near-term catalysts for KBWB and friends, including solid credit quality.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.