On the heels of President Biden’s victory last November and the Democrats taking a slim majority in the Senate, expectations were in place for another boffo year of returns for renewable energy stocks, including solar equities.

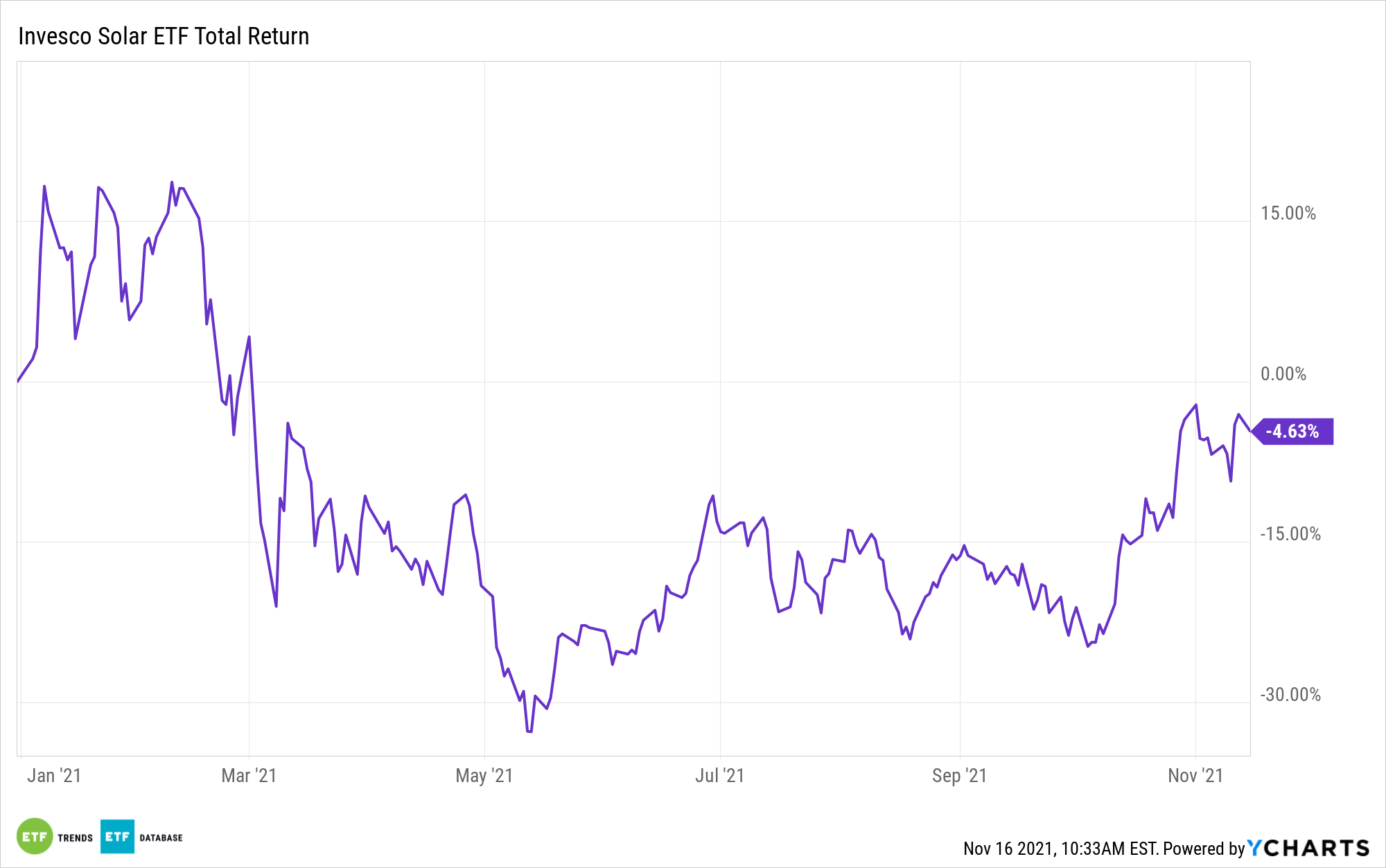

Those expectations didn’t become realities, as evidenced by the fact that the Invesco Solar ETF (TAN) is off nearly 5% year-to-date. Undoubtedly, that’s a disappointing performance given the current political environment. It’s also one that belies some alluring fundamentals among solar stocks, including TAN components.

“Demand for renewables generation is soaring amid the rocketing gas prices and the solar sector is looking particularly healthy,” reports Proactive Investors. “Solar industry acquisitions are surging as solar panel installations continue to grow strongly in the US and Europe, with demand for solar electricity expanding and renewable energy investment hitting new records.”

Positive commentary on solar stocks emerges just as TAN is showing signs of life. In recent weeks, the Invesco exchange traded fund took a big bite out of its year-to-date loss, sporting a one-month gain of nearly 14% entering Monday. As of Nov. 12, TAN was up 23.62% over the prior 90 days. Those statistics could be signs that investors are betting on a solar resurgence in 2022.

Investors making that wager can take heart in the ongoing expansion of renewable energy.

“US renewables production has reached an all-time high in the first half of the year with solar generation rising by almost 25%, while investment in the sector has hit a record high following a record 26 GW of clean energy projects coming online,” according to Proactive Investors.

Following the recently completed COP26 conference in Scotland, investors are again reminded that renewable energy is a global industry, and it’s going to take commitments from governments the world over to reduce carbon emissions and fight climate change. Fortunately for investors, TAN and the solar industry itself are levered to global trends, including trends in both developed and emerging markets.

“Strong demand from the US and Europe for solar panels is also driving changes. Many of the panels installed are produced in China from CO2 and carbon intensive factories, but some Chinese manufacturers are well-placed to respond to demand with factories which run on hydropower,” notes Proactive Investors.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.