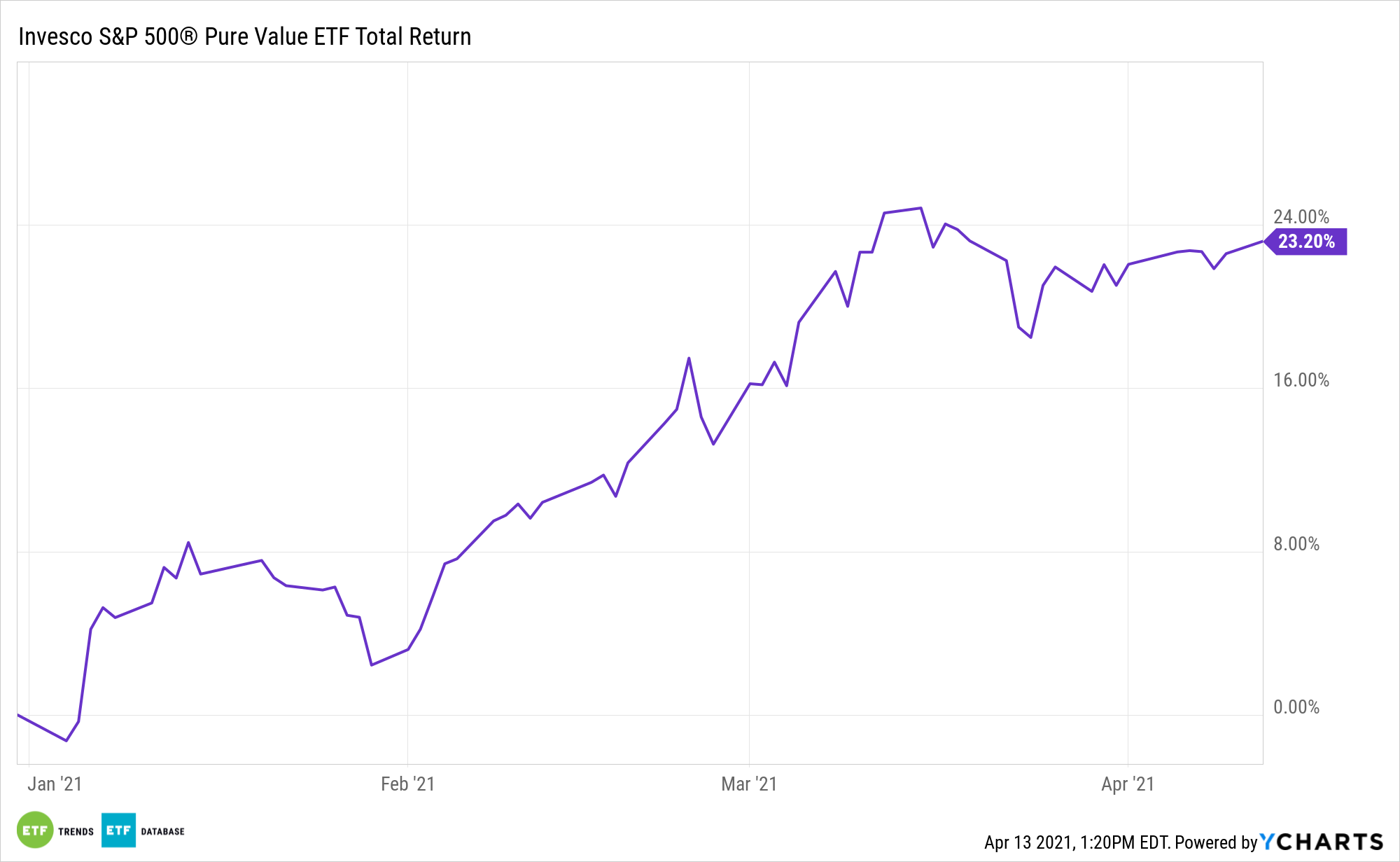

The Invesco S&P 500® Pure Value ETF (RPV) is one of this year’s best-performing factor-based exchange traded funds. Good news for investors that missed RPV’s hot start to the year: there could be more to come.

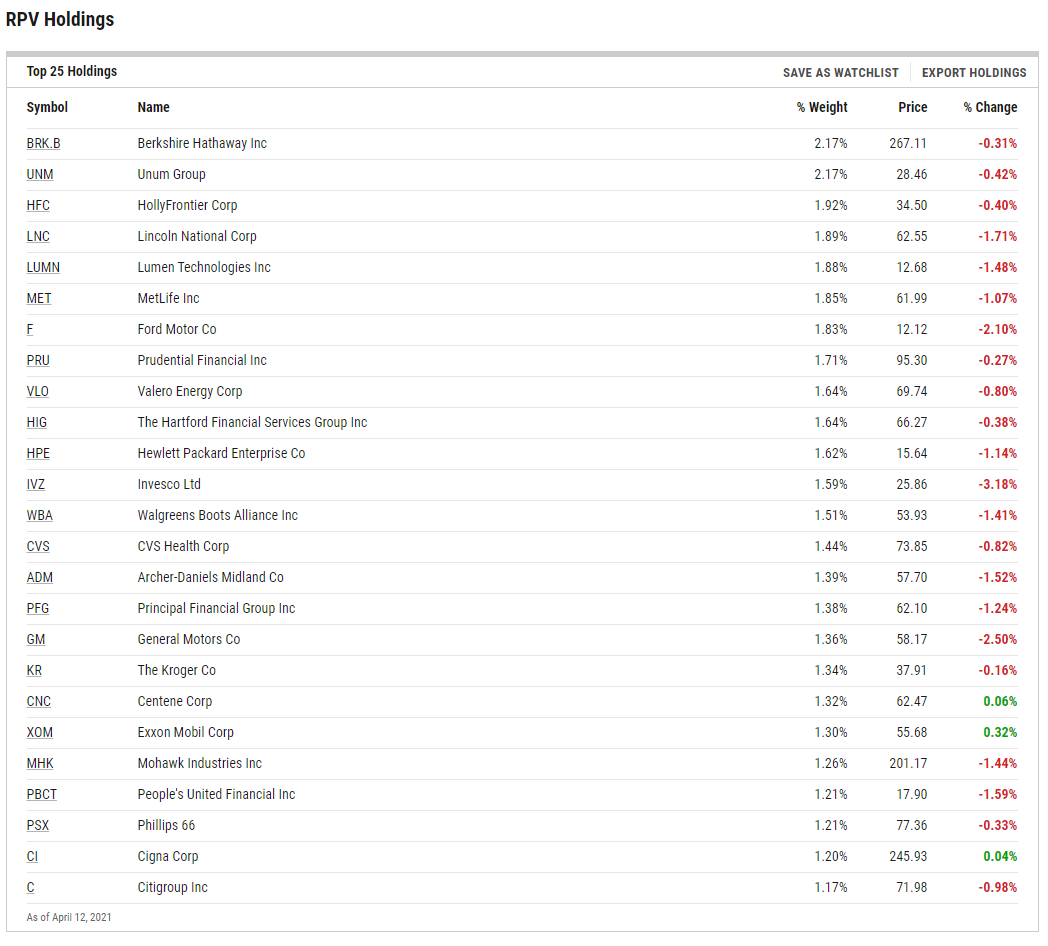

RPV holdings and value stock ETFs usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets. On the other hand, growth-oriented stocks tend to run at higher valuations since investors expect the rapid growth in those company measures.

The asset seeks to track the investment results (before fees and expenses) of the S&P 500® Pure Value Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index. Data suggest RPV has room to run despite its stellar start to 2021.

“The broad market rally over the past year has now lifted stocks in nearly every sector, and it might be time for investors to focus on finding individual winners to keep growing their portfolios, according to Goldman Sachs,” reports Jesse Pound for CNBC. “The firm’s research analysts said in a note on Wednesday that value investors should, in the current environment, take a closer look at companies’ individual financial results to find some gems.”

Value’s Still in the Driver’s Seat

Value has been shining for some time, but its fundamentals aren’t reversing course yet.

“While the backdrop of higher rates, higher inflation breakevens and a steeper yield curve has been supportive, given the run since mid-February and the temporary nature of Value rallies in recent years we expect that fundamentals may play an important role in the sustainability of a further move higher,” according to Goldman Sachs.

RPV’s index assigns two scores – one for value and one for growth – based on the characteristics of the issuer. The “value score” is measured using three factors: book-value-to-price ratio, earnings-to-price ratio, and sales-to-price ratio. The “growth score” is measured using three other factors: three-year sales per share growth, the three-year ratio of earnings per share change to price per share, and momentum (the 12-month percentage change in price).

The exchange traded fund is also worth considering in the new inflationary environment.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.