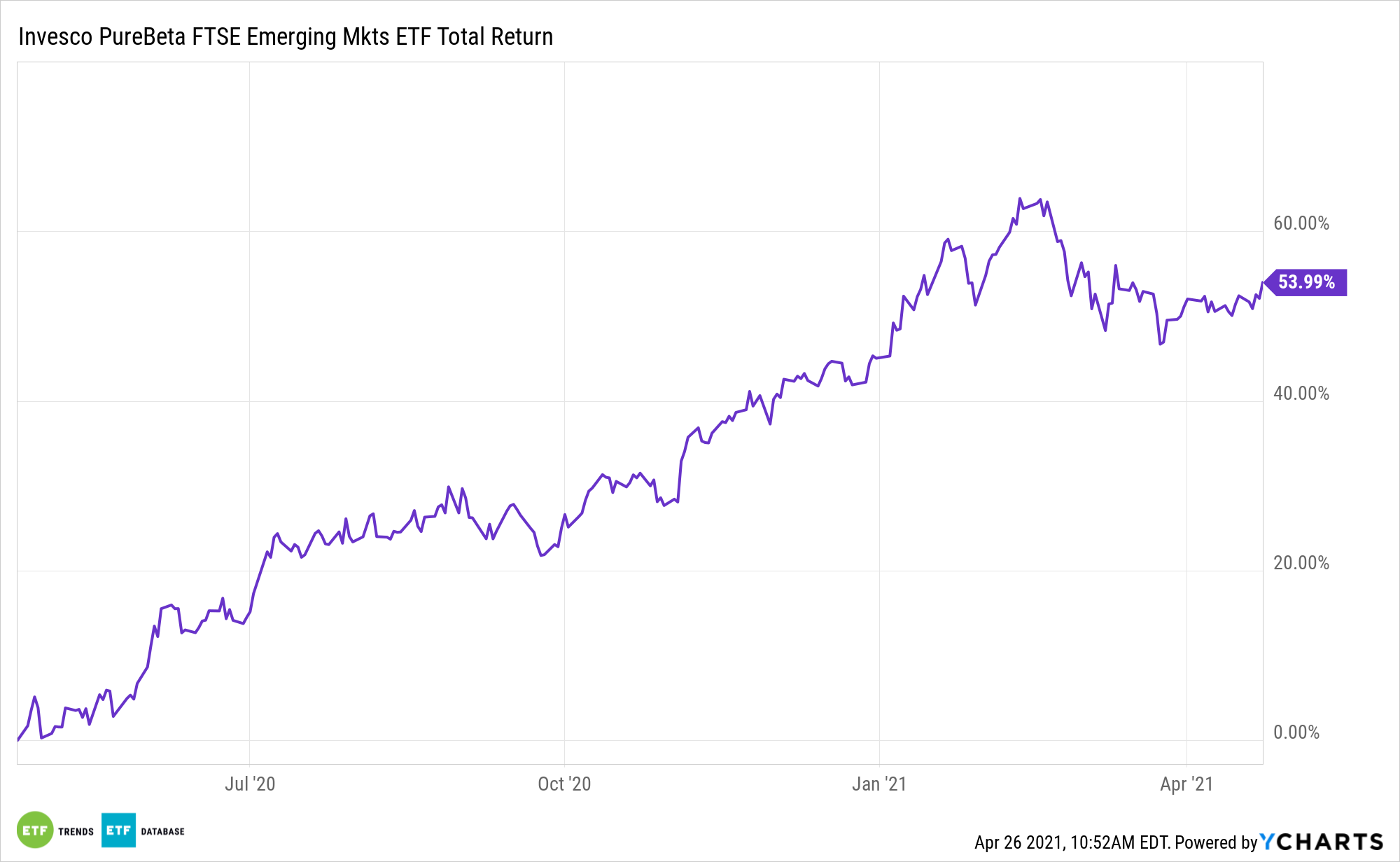

Seasoned investors know it’s practical to take a long-term view of developing economies – a task made easier with cost-effective assets like the Invesco PureBeta FTSE Emerging Markets ETF (PBEE).

PBEE seeks to track the investment results (before fees and expenses) of the FTSE Emerging Index. The fund generally will invest at least 90% of its total assets common stocks that comprise the underlying index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the underlying index.

The index is designed to measure the performance of the large- and mid-capitalization segments of equity markets of countries around the world that are classified as emerging markets within the country classification definition of the index provider.

The Invesco ETF is a relevant consideration at a time when Chinese equities are expected to do the heavy lifting for broad-based emerging markets benchmarks.

“Like the rest of the world, this year is going to be about normalization for China, which means 7% or 8% real economic growth,” said Justin Leverenz, Invesco’s Chief Investment Officer of Developing Market Equities, in a recent podcast. “Thereafter, I think China has the capacity to grow in the next five years somewhere on the order of 4% or 5% real growth. In the context of the relatively slow growth world that we live in, and given that China is a nearly $17 trillion economy, that means that China could be over half of worldwide economic growth — the dominant growth engine for the next half a century, or maybe the next century.”

‘PBEE’ Captures Other Opportunities Too

PBEE holds nearly 900 stocks from 10 developing economies, indicating it helps investors capture a wide variety of emerging markets opportunities. India is one example after China on PBEE’s roster.

“I think the prospects for India for the next five years are considerably better than they were in the last five, and that India, while it will never be China, will be one of the higher growth economies in the world in the next five years,” said Leverenz.

India is PBEE’s third-largest country weight, accounting for north of 11% of the fund. The weak U.S. dollar is another favorable factor for PBEE this year.

“The weak US dollar is favorable for emerging markets. Non-dollar-denominated assets become more valuable to US investors, and more capital tends to move into the developing world,” continues Invesco.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.