Thought to ponder…

“While I am not sure what my focus on truncating downside risk has cost me over time in terms of lost opportunity, I am certain that I have not maximized return. But at least I can be sure that I will be around for future opportunities.“

– Steven Drobny, The Invisible Hands

The View From 30,000 Feet

It’s been six weeks since the collapse of Silicon Valley Bank. Since then, the markets have gone from panicking over the prospects of a systemic banking crisis, fear of an imminent recession and expectations for the Fed to cut rates immediately, to coming around to the Fed’s view of one more rate hike and no rate cuts till late 2023 / early 2024, buying into the story of immaculate disinflation (disinflation with limited negative impact to employment and growth) and a soft-landing. The relative quiet from the SVB storm has opened the door for focus on other topics, such as earnings, the debt ceiling debate, and economic data that provides a murky picture of a slowing economy with persistent pockets of strength, driving continued vigilance from the Fed.

- 2023 S&P500 earning projections diverging from Fed Fund policy projections

- The debt ceiling debate re-enters the spotlight as Speaker McCarthy puts forward his wish list

- What a softening employment market looks like in the context of prior Unemployment cycles

- The most Frequently Asked Question from client’s this week: Should you be worried about the fearmongering forecasters who keep pointing to the Conference Board’s Leading Economic Indicators?

2023 S&P 500 Earning Projections Diverging from Fed Fund Policy Projections

According to Factset’s aggregation of analyst estimates, earnings are expected to trough in Q1 2023 and then begin to climb the remainder of the year.

According to Fed Funds Futures, the Fed Funds rate is expected to peak in Q2 2023, remain steady until November and then begin to fall late in 2023.

These two assumptions are run opposite of one anoter. If the economy is forecast to fall into a recession in the second half of 2023, prompting the Fed to cut rates, earnings will not be increasing. Earnings do not increase during a recession when the economy is contracting, they fall.

Another way to think about it is, if the Fed is cutting rates, why are they cutting rates? They are cutting rates because:

- There is an issue with financial stability

- They are concerned about disinflationary forces

- They are worried about economic growth (sustaining full employment)

None of these three factors are consistent with rising earnings.

Bottom Line: Either you believe the Fed will cut rates because of a weakening economy or you believe earnings will move higher because of economic strength, but you can’t believe both.

Market Expectations of Earnings Growth Does Not Align With Falling Fed Funds Forecasts

The Debt Ceiling Debate Re-enters the Spotlight as Speaker McCarthy Puts Forward his Wish List

Speaker McCarthy put forward the first proposal for solving the debt ceiling problem that was promptly rejected by the White House, in what is expected to be a drama between members of Congress and the Administration that concludes in July. The debate centers around two major issues: Raising the Ceiling and Controlling Spending.

- The debt ceiling debate began three months early because McCarthy and markets are concerned that tax receipts from April and June payments will be insufficient to provide the government the capital they need to operate until mid-summer.

McCarthy proposal is to increase debt ceiling by 5t and reduce budget by 4.5t, (10-years) reductions include:

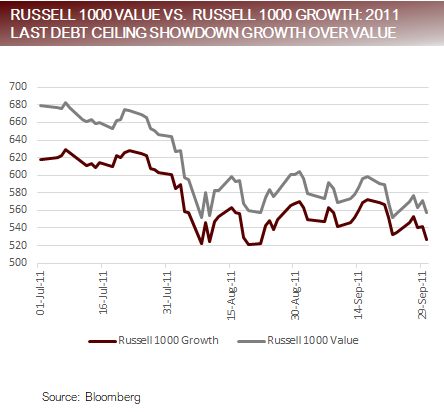

Bottom Line: There’s no scenario where the debt ceiling problem does not get solved. The ceiling will be raised, the questions are which programs will be cut and if McCarthy can influence a spending It looks like the ultimate deadline to finish negotiations will be mid-July. The most recent memorable debt ceiling standoff was in 2011, when on August 5, 2011, Standard & Poors downgraded US Sovereign Debt. During that episode, CDS on US 5yr Debt traded over 60 bps and the S&P500 fell over 16%. On course to out do 2011, CDS on US 5yr broke through 54 bps on Friday, the highest level since 2011. Keep in mind, the economy was careening towards a recession in the summer of 2011, which was abated when Bernanke gave a Jackson’s Hole speech at the end of August promising a fresh round of QE.

As Debt Ceiling Showdown Intensifies Growth Set to Outperform Value

What a Softening Employment Market Looks Like in the Context of Prior Unemployment Cycles

In the last 50 years there have been 6 unemployment cycles. Excluding the pandemic, the data is remarkably consistent across unemployment cycles.

- Average increase in unemployment: 2% from beginning level

- Average time from trough to peak in unemployment: 36 months

Bottom Line: According the Fed’s Summary of Economic Projections, unemployment will rise from 3.5% to 6% in 2023 and hold there in 2024 before beginning to fall in 2025. If this were to happen it would be the first time in the last 50 years that unemployment would only rise 1.1%. Historically, once unemployment begins to rise it keeps going well beyond 1%. Each of the employment cycles over the last 50 years has been associated with a recession. On average, by the time unemployment rose 0.4% the economy was in recession, and unemployment continued to rise another 3.8% thereafter before peaking.

Labor Market Still Strong, but Weakening at the Margins With a Long Way to Fall

FAQ: Should You Be Worried About the Fearmongering Forecasters Who Keep Pointing to the LEI?

Bottom Line (Top Line) – Yes, you should be worried. There is very little argument among strategists that there is a recession coming. The question is, when it will arrive? If you’re willing to concede there is a recession coming in the next 12 months, you have to ask yourself, do you believe you can squeeze the last little bits of juice out of the markets before tactically timing the top, or is it better to reduce risk in advance, clip a fat coupon in Treasuries, and wait out the storm? (refer back to Thought to Ponder beginning of this week’s piece).

The Conference Board’s Leading Economic Indicators is made up of 10 different indicators, with about 85% of the weight divided among employment, new orders, the yield curve and consumer sentiment.

Dating back to 1960, when the year-over-year change was less than -5.0 the economy enters a recession 100% of the The LEI is currently at -7.8, breaching the important -5.0 level at the end of January.

There is no one perfect indicator. Focus Point has its own leading market indicator that uses 28 indicators, divided among Liquidity, Valuation, Economic Momentum Technical and Volatility. The Focus Point Leading Market Indicator, began flashing warnings signals when it entered negative conditions in April of 2022.

Pick your poison, whether you believe in the Conference Board’s Leading Economic Indicators or Focus Point’s Leading Market Indicator, or the host of dozens of other indicators that are flashing warning signals, if you are trying to eek out the last incremental gains before the recession, you are picking up nickels in front of a steam You may be right for a while, but the probability is that you’re going to get flattened.

Conference Board Leading Economic Indicator – Weightings and Forecasting Track Record 100%

Putting It All Together

As concerns about a systemic crisis in the banking system fade, attention has shifted to earnings, economic indicators that are perceived to drive the Fed’s coming course of action and a brewing storm forming around the debt ceiling debate.

Our Three-Legged Stool thesis of strength in the labor market, strong Balance Sheets (excess cash reserves) and persistently strong earnings, continues to prop up the equity markets. Although there is still strength in each of these legs, the weight on the stool is crushing, with indicator after indicator predicting that the legs will eventually break.

This is a fascinating set up because the Three-Legged Stool strength is providing a basis for an already expensive market to continue higher, but with so many indicators and the Fed all forecasting a recession, having equity exposure feels like picking up nickels in front of a steam roller because the probability is that the stool will eventually break.

Circling back to the quote at the beginning of this week’s piece. If your objective is to maximize return, playing the momentum of the markets may be reasonable, but if the indicators are correct, risk exposure should be very tactical because when the stool breaks the downside is likely significantly deeper than the upside from current valuations. Even a shallow recession has historically meant earnings reductions in the range of 20% and trough P/E’s significantly lower than today’s values.

For more news, information, and analysis, visit the ETF Education Channel.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2023, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

Important Disclosures

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied.

FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.