Low volatility and reduced beta are popular factor applications in the world of ETFs, but high beta funds are also shining through the Invesco S&P 500 High Beta Portolio (NYSEArca: SPHB).

The ETF tracks the S&P 500 High Beta Index, which “consists of the 100 stocks from the S&P 500 Index with the highest sensitivity to market movements, or beta, over the past 12 months. Beta is a measure of relative risk and is the rate of change of a security’s price,” according to Invesco.

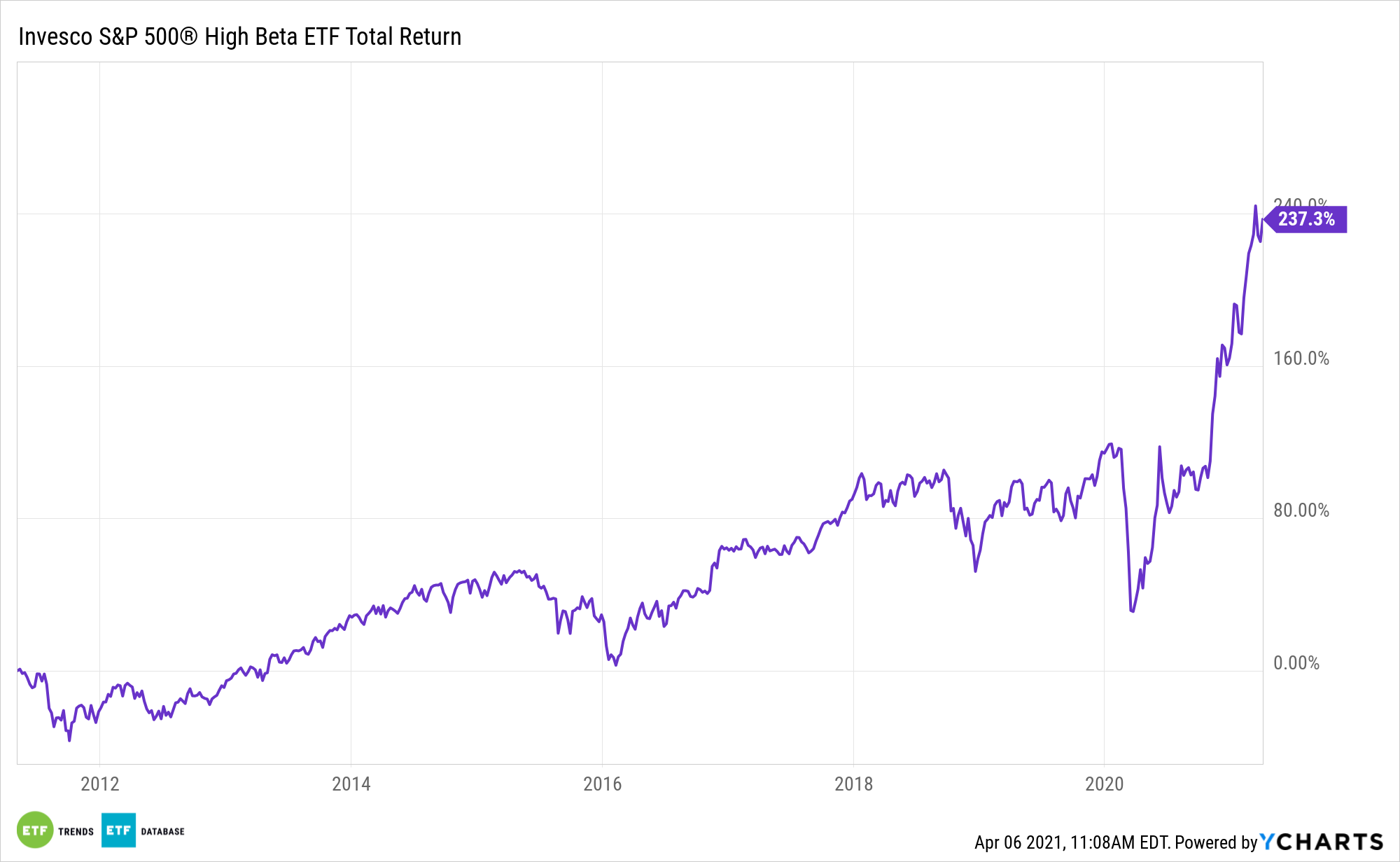

SPHB’s underlying index recently turned 10 years old, meaning asset allocators have ample time to gauge the fund’s track record.

“In the back-tested period from 1991 through March 2011, Low Volatility outperformed the benchmark S&P 500 with lower risk, while High Beta underperformed with higher risk,” according to S&P Dow Jones Indices. “In the live period, Low Volatility underperformed while maintaining its goal of lowering volatility. High Beta’s live relative performance and risk were both comparable to those of the back-tested period.”

Sizing Up SPHB

With the economy and corporate earnings steadily improving, investors may turn to a high beta strategy to capitalize on continued growth.

“All strategies should be tested through different market environments, particularly strategies like low volatility and high beta that explicitly seek to provide a particular pattern of relative returns,” adds S&P. “Low volatility strategies seek to attenuate, and high beta strategies to amplify, the performance of the overall market. The behavior of both is therefore highly dependent on the market’s returns.”

In some ways, SPHB is an ideal ETF to consider as 10-year bond yields rise because the cyclical sectors that comprise SPHB’s lineup often prove durable with rising rates. The technology, industrial, and materials companies are among cyclical sectors that typically strengthen in a rising rate environment as investors turn away from safer assets and shift into riskier areas of the market.

SPHB allocates over 65% of its weight to financial services, energy, and consumer discretionary stocks. All three of those sectors are cyclical groups.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.