Finally, mid cap stocks are beginning to really perform. More recently, the quality factor is coming back into focus.

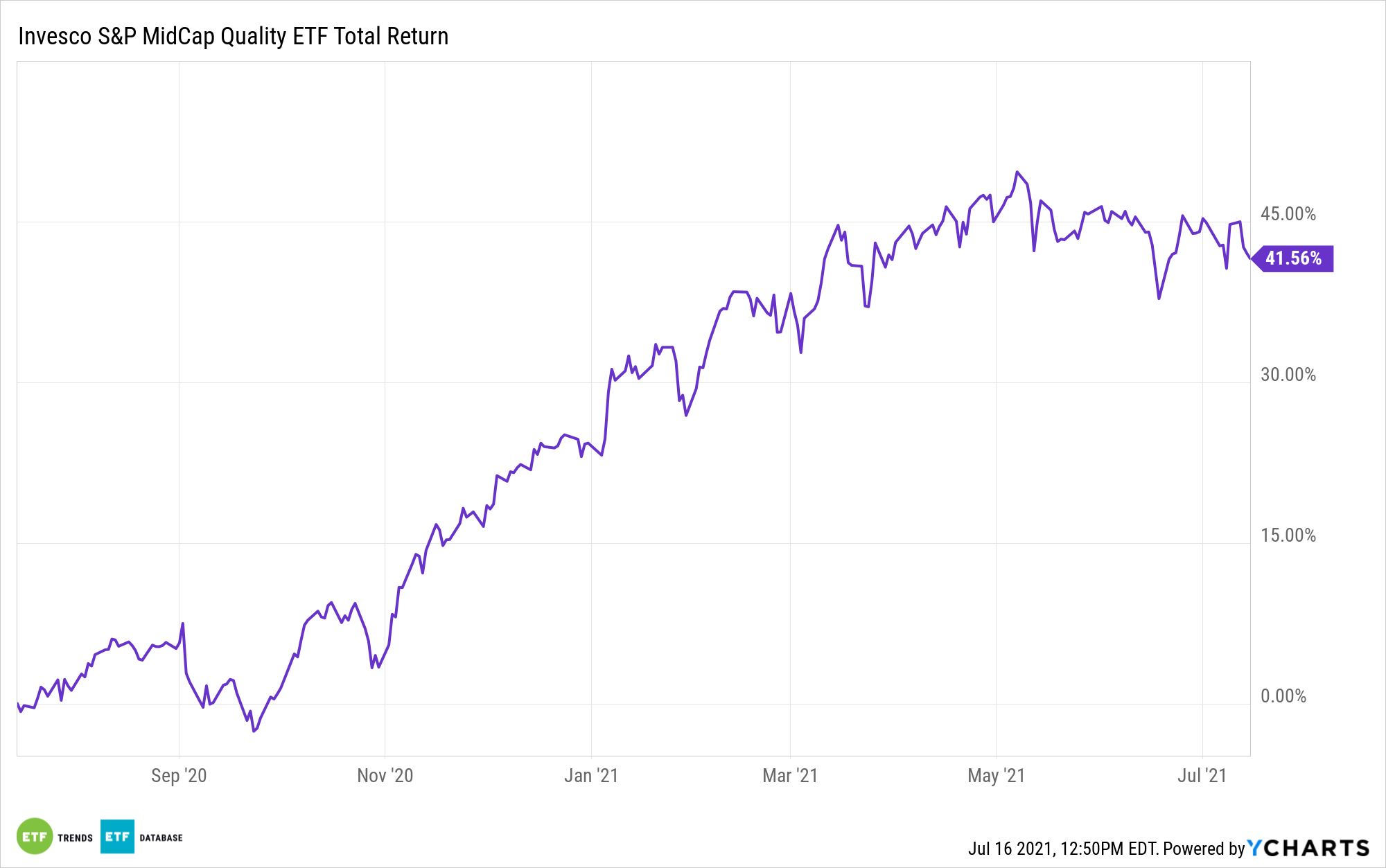

Combine those two strategies with the Invesco S&P MidCap Quality (NYSEARCA: XMHQ). The $276 million XMHQ follows the S&P MidCap 400 Quality Index, the quality alternative to the popular S&P MidCap 400 Index. Proving that the bar is high to be considered a quality name, just 82 of the 400 members of the S&P MidCap 400 Index make the cut for entry into XMHQ.

With that discerning nature, XMHQ is an ideal way for investors to access smaller stocks at a time when cyclicals could rebound and the quality factor is back in style. Plus, it’s not pricey to access XMHQ’s benefits.

“While some cyclicals still have room to run, we see an opportunity to also turn attention to quality stocks as the cycle’s next beneficiaries,” according to BlackRock. “Not only are quality stocks the cheapest we’ve seen them since the dot-com era of the late 1990s, but our research finds that they also have a history of outperformance in the midcycle phases of a recovery.”

XMHQ Cyclical, Quality Credentials

With over 48.5% of its lineup allocated to financial services and consumer discretionary stocks, XMHQ has legitimate cyclical credibility.

The 30.28% weight to financials levers the fund to a potential rebound in 10-year Treasury yields. Additionally, banks are back to boosting dividends, enhancing XMHQ’s quality tilt.

XMHQ also makes for an ideal long-term investment because, over long holding periods, both mid cap and quality stocks tend to outperform.

“Beyond the short-term tactical opportunity, we see a long-term structural case for maintaining a quality bias. A look at monthly data dating back to 1978 revealed that the higher-quality cohort of stocks outperformed the broad market 60% of the time. On a rolling 12-month basis, our research found the outperformance rate was 76%,” adds BlackRock.

The asset manager points out the periods in which quality stocks typically don’t perform well are immediately following recessions. That actually makes XMHQ all the more relevant today because there’s mounting evidence suggesting that the U.S. economy is moving from the recovery phase to the expansion phase of the economic cycle – periods that are usually favorable for owning quality stocks.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.