Are the meme stocks back? GameStop (NYSE: GME) surged 25.57% last week, accounting for nearly all of the stock’s May gain of 26%.

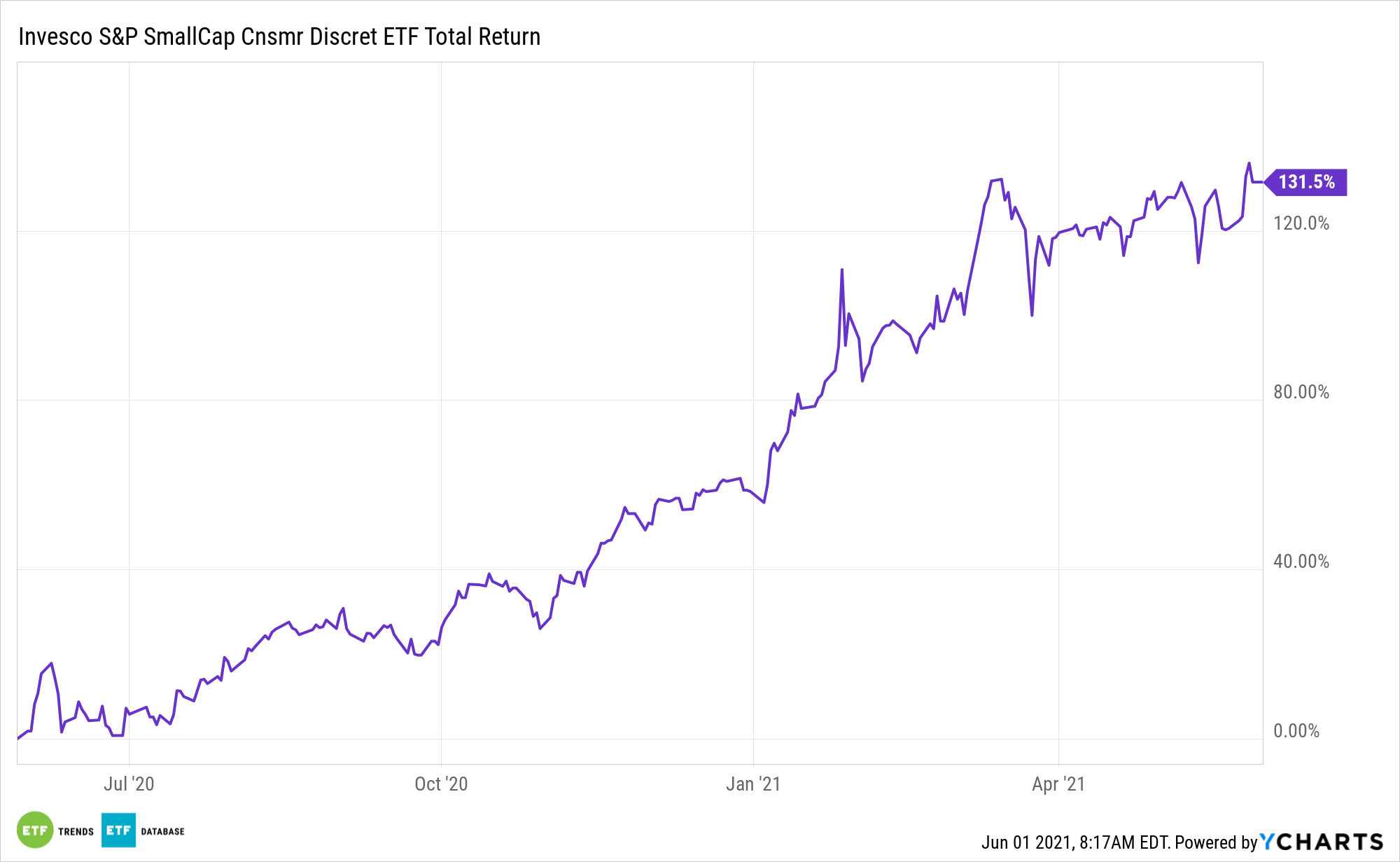

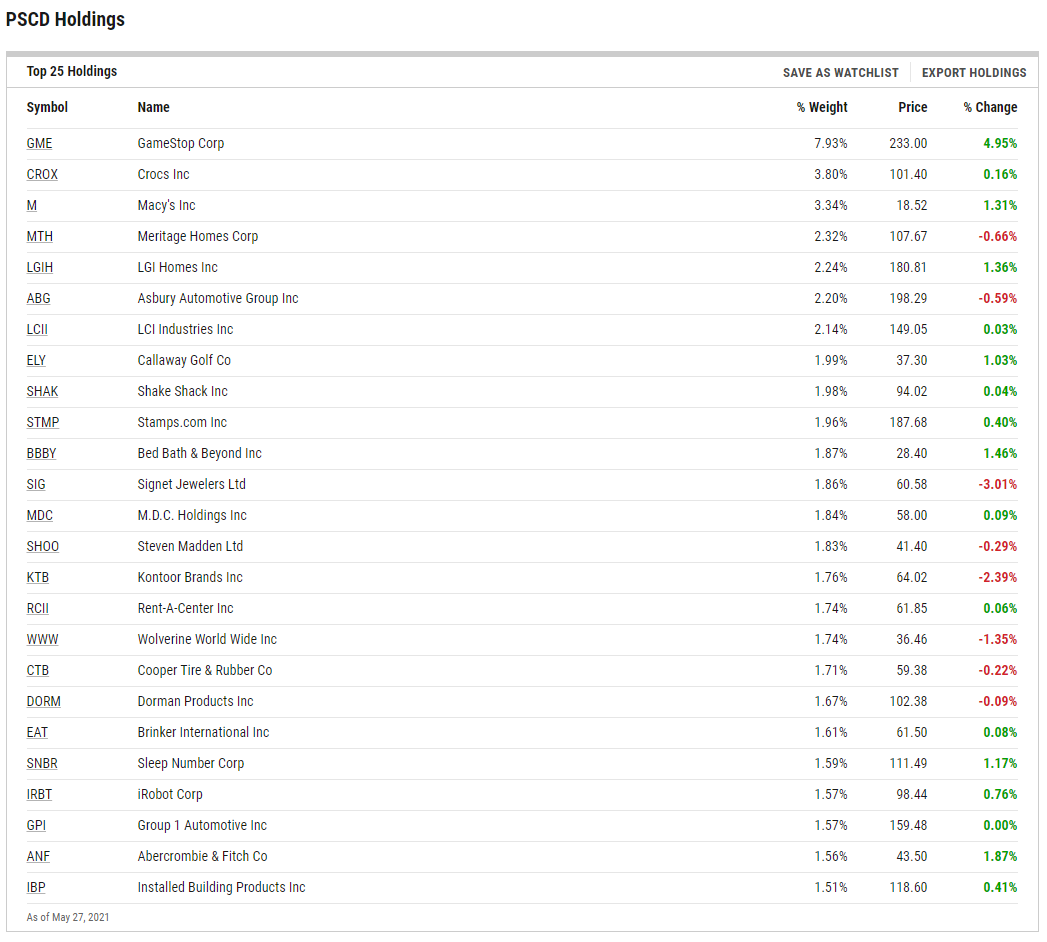

Lingering enthusiasm for GameStop shares is beneficial to some exchange traded funds, including the Invesco S&P SmallCap Consumer Discretionary ETF (PSCD). However, meme stocks, including the video game retailer, aren’t for the faint of heart given their continuing volatility.

PSCD offers more than just exposure to a high-flying meme stock. It provides investors with some leverage to a resurgence by brick-and-mortar retailers – a market segment that was recently left dead owing to the surge in market share taken by e-commerce purveyors. Yet many analysts see upside for traditional retailers.

“The surge in online shopping at the beginning of the coronavirus pandemic led to a series of rash proclamations about the demise of brick-and-mortar U.S. retail,” write Morningstar analysts Preston Caldwell and Jamie Katz. “Since then, much of the pandemic’s initial boost to e-commerce adoption has already faded away, and we expect mass vaccination to bring further convergence to the pre-pandemic trend.”

The Outlook for ‘Omnichannel Retailers’

The Morningstar analysts highlight potential with omnichannel retailers – brick-and-mortar operators that have growing or strong online businesses.

Several PSCD holdings, including Macy’s (NYSE: M) and Bed, Bath & Beyond (NASDAQ: BBBY) fit the bill. Adding to the case for PSCD as dual-threat play on online and brick-and-mortar retailer is that the latter, owing to retailers’ ability to adapt to the online world, proved stronger than expected.

“The biggest surprise has been the rise of omnichannel (e-commerce sales by traditional retailers), which has astoundingly outperformed online retailers during the pandemic. We think this outperformance will continue into the next decade,” said the analysts. “Omnichannel outperformance was an entirely new development, as before the pandemic, omnichannel sales were growing at about the same rate as online retailers’ sales.”

Beyond retailers, PSCD has credibility as a re-opening play. More than 11% of PSCD’s 90 holdings are classified as “hotel, restaurant, and leisure” names. The bulk of those positions are in restaurant operators.

That’s worth noting because after months of takeout, DoorDash, and Uber Eats, Americans want to get back to dining out. Several of the ETF’s holdings, including Cheesecake Factory (NASDAQ: CAKE), are operators of traditional dine-in restaurant chains.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.