For many income investors, closed-end funds are an alluring asset class. These funds typically lob off above-average yields, and there are many instances when close-ended funds trade at discounts to net asset values (NAVs), offering something of a value proposition.

However, picking the right closed-end fund is no less tricky than selecting individual stocks. Fortunately, the Invesco CEF Income Composite ETF (NYSEARCA: PCEF) makes venturing into this asset class easier on investors.

PCEF, which is about 11.5 years old, tracks the S-Network Composite Closed-End Fund Index (CEFX). That benchmark is a basket of closed-end funds, meaning PCEF employs a fund of funds structure. In addition to the monthly income delivered by closed-end funds and PCEF, there are more benefits to investing in the Invesco fund.

“To begin with, closed-end funds are exempt from corporate taxes on the condition that they pass through net investment income (interest and dividends) to shareholders,” says Alerian analyst Roxanna Islam. “Most CEFs pay these distributions monthly—although some also pay quarterly—compared to traditional fixed income instruments, which pay coupons semiannually.”

A Potent Income Solution

With a 30-day SEC yield of 6.46%, the $932.1 million PCEF lives up to its billing as a credible income idea, particularly in today’s low-yield environment. As attractive as that yield and the monthly distribution are, there are more benefits than meet the eye with PCEF, including some tax-related perks.

“CEFs also pay net realized capital gain distributions typically at the end of the year. Some equity and alternative strategy funds, however, expect to earn a large portion of their return through capital gains, rather than dividends or interest,” adds Islam.

Another advantage offered by closed-end funds appears on the fixed income side, which makes up about 64% of PCEF’s lineup. Many closed-end fund managers use leverage – borrowing at lower, short-term rates and reinvesting the proceeds at higher yield long-term rates. That income-boosting strategy is employed by about two-thirds of closed-end funds. As Alerian’s Islam notes, the current climate is also conducive to that strategy.

“Lower interest rate environments, like our current environment, are particularly beneficial for funds that use leverage. As short-term interest rates decrease, the cost of leverage (i.e., the cost to borrow) decreases and the fund’s earnings increase as the spread between borrowing cost and investment rate widens,” said the analyst.

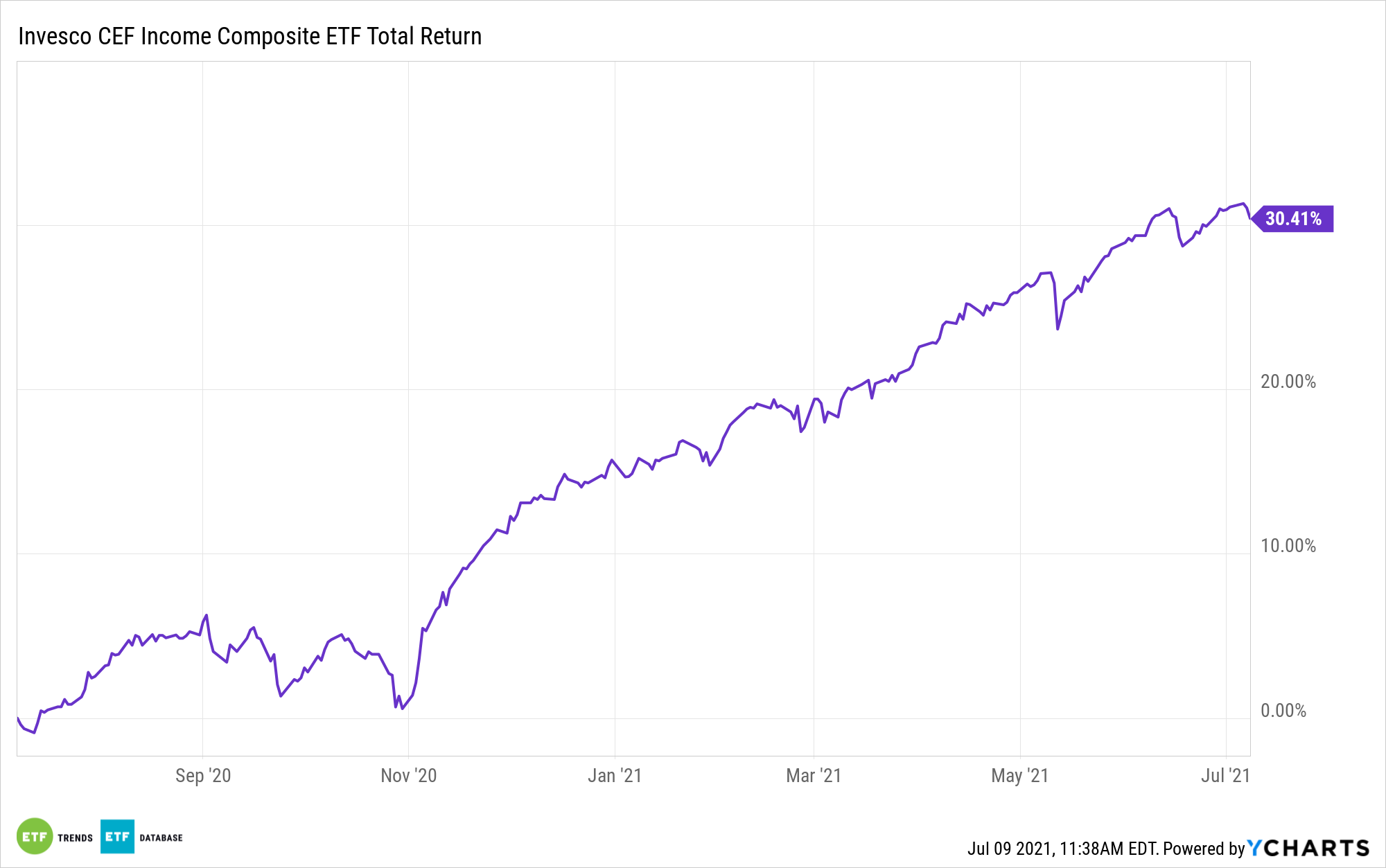

PCEF, which allocates 36.32% of its weight to options income strategies, is up almost 13% year-to-date.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.