Interest rates are low, providing an ideal environment for owning high dividend stocks, but investors should also prepare themselves for less than sanguine market moments. The Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) leverages both concepts.

SPHD seeks to track the investment results (before fees and expenses) of the S&P 500® Low Volatility High Dividend Index (the “underlying index”). The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The index provider compiles, maintains, and calculates the underlying index, which is composed of 50 securities in the S&P 500® Index that historically have provided high dividend yields with lower volatility. To get a piece of SPHD, ETF investors are looking at a reasonable net expense ratio of 0.30%.

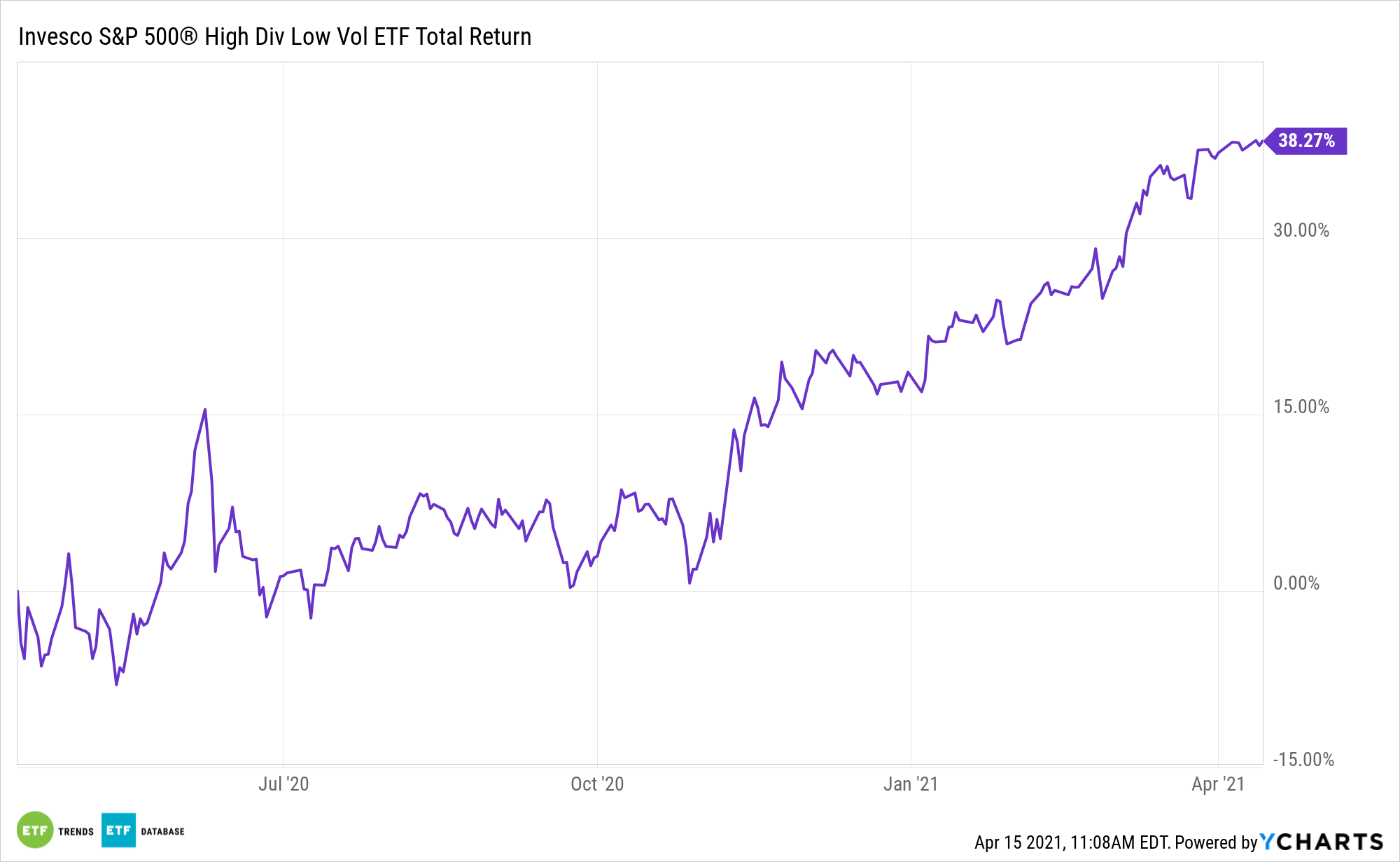

Even with its low volatility approach, SPHD isn’t leaving performance on the table this year. Year-to-date, the Invesco fund is up 15.33% while yielding 4.20%.

An Undoubtedly Alluring Approach for ‘SPHD’

SPHD has more to like: it taps into this year’s cyclical/value resurgence.

While they generally have solid fundamentals, value stocks may have lost popularity in the market and are considered bargain-priced compared with their competitors. Value fans believe this time may be different for value stocks, pointing to improving investment sentiment measures, abating fears of a recession, rebounding corporate profits, and lessening trade tensions between the U.S. and China.

SPHD also offers inflation-fighting qualities. Inflation fears have been permeating the markets as of late, especially if the economy bounces back quicker than anticipated amid a vaccination rollout. The Federal Reserve, despite its vow to keep rates low, has hinted that rates could rise should the economic climate warrant the change. A rise in rates could help profits for financials when it comes to loan products.

Moreover, SPHD’s payout outlook appears solid as more domestic dividend companies are boosting payouts.

“Companies that suspended their dividends have started to pay again, while others who decreased their dividends or left them unchanged in 2020 have resumed increasing payments,” said Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices. “The dollar amount of dividend increases in U.S. common stocks in Q1 2021 was the largest since Q1 of 2012 as reductions significantly declined in the quarter.”

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.