Inflation continues rising, and while the August increase by the Consumer Price Index (CPI) was relatively modest, it’s further confirmation that rising prices are proving pesky this year.

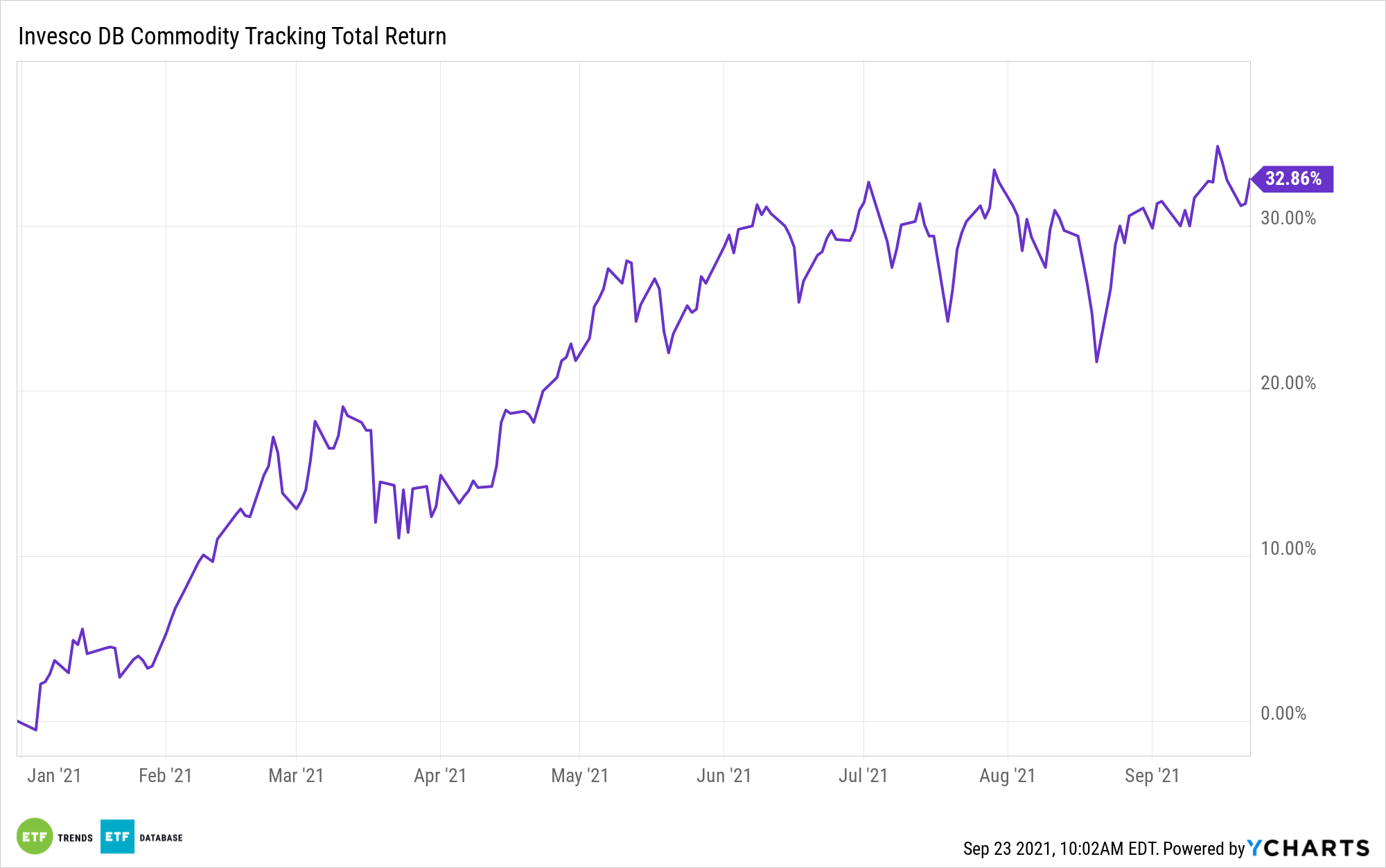

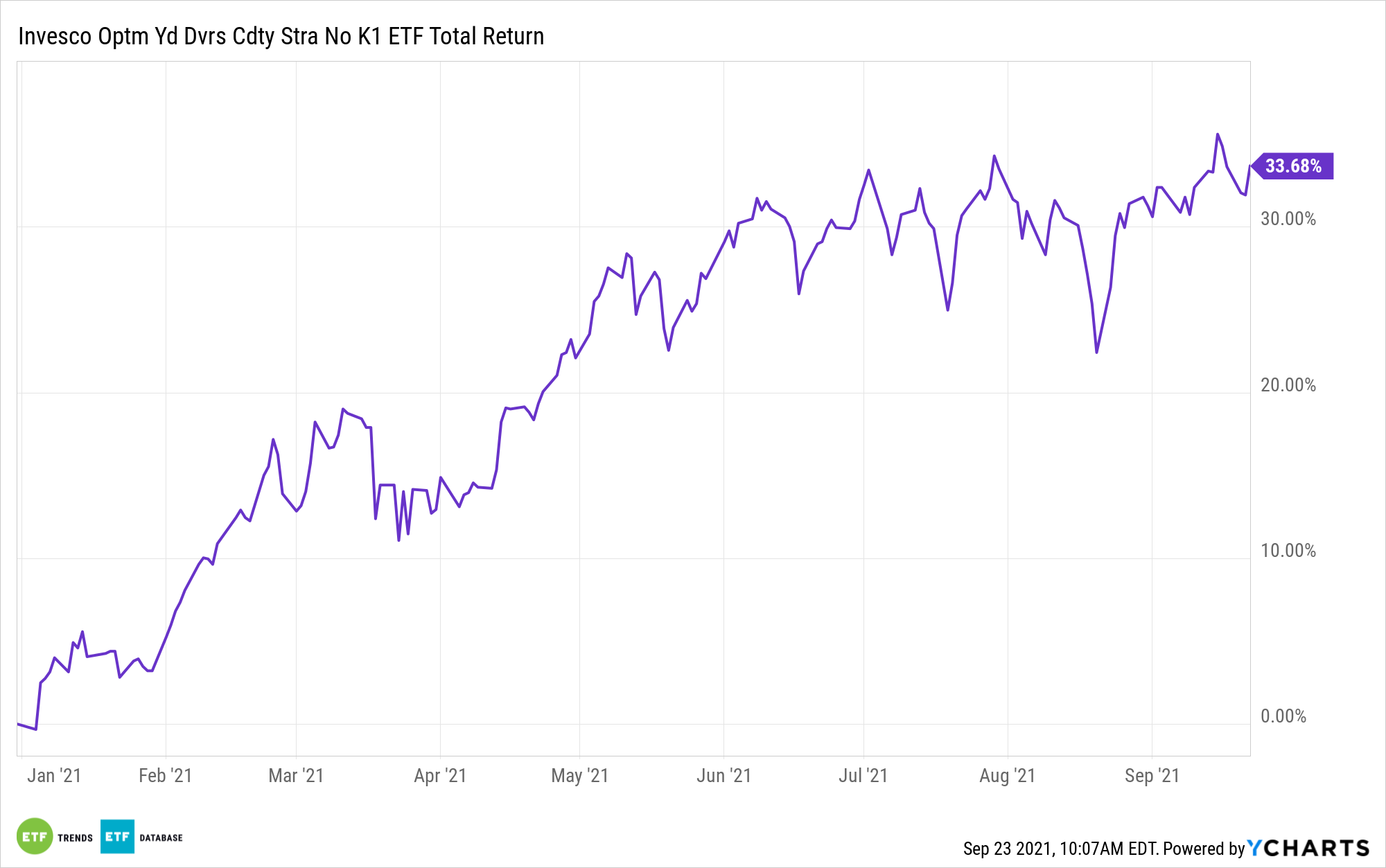

Historically, investors turn to commodities to protect portfolios from inflation, putting a spotlight on 2021 opportunities with the Invesco DB Commodity Index Tracking Fund (DBC) and the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC).

DBC follows the DBIQ Optimum Yield Diversified Commodity Index and is usually comprised of 14 actively traded commodities futures contracts, while PDBC is an active fund that attempts to top DBC’s underlying index. Both are relevant considerations today for inflation-wary investors.

“Because rising prices can have a damaging effect on an investor’s money. They reduce the purchasing power of every dollar, meaning that it requires more money to purchase the same good today then it did yesterday when prices were lower,” according to Invesco research. “As a result, holding onto cash or being in an investment that doesn’t keep up with inflation is a losing proposition. One way to help combat this threat is by having an allocation to commodities.”

The $2.37 billion DBC is currently heavily allocated to energy commodities with West Texas Intermediate (WTI), gasoline, unleaded gasoline, and Brent crude combining for over 58% of the ETF’s weight. That’s a plus at a time during which some global banks are saying that oil prices will rally into year-end.

“Both of these products can potentially benefit from the economic growth because of their 55%-60% exposure to energy. Demand for oil, which is considered ‘energy’ in this instance, may grow from the reopening as more cars hit the road and airline traffic increases. As a result, investors may want to consider having exposure to oil via DBC or PDBC,” adds Invesco.

From a broader perspective, historical data confirm the efficacy of commodities during inflationary environments. During inflationary climates spanning 1991 to this year, the average annualized return of commodities was 19.5% — more than double that of the S&P 500 and quadruple that of U.S. Treasuries, according to Invesco data. With the economic reopening still in swing, DBC and PDBC are all the more relevant.

“DBC and PDBC offer exposure to commodities that may benefit from both the potentially growing economy as well as potentially provide protection against rising inflation,” concludes Invesco.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.