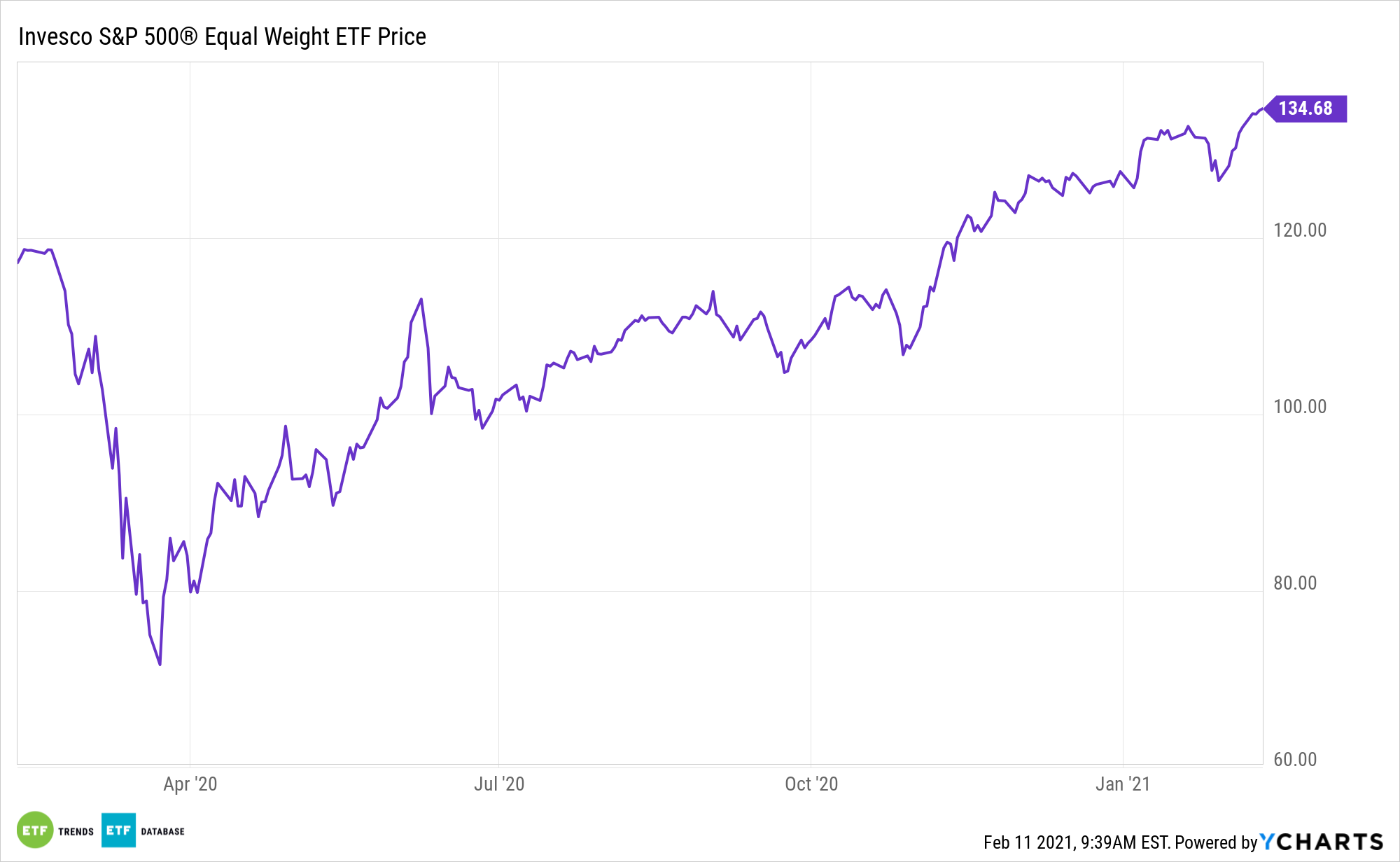

Equal weighting is one of the forefathers of smart beta methodologies. The Invesco S&P 500 Equal Weight ETF (RSP) is proving smart beta and equal weighting aren’t just a thing of the past.

RSP equally weights its holdings, so the ETF leans toward smaller companies with reduced concentration risk to the largest companies when compared to the cap-weighted benchmark S&P 500 Index. The size factor offers the potential higher-than-benchmark returns associated with relatively smaller stocks within the universe being considered. Smaller capitalization companies tend to have higher growth potential, and are less widely researched.

The fund is considered one of the industry’s first and oldest smart or strategic-beta ETFs. The fund eschews traditional market-capitalization weighting schemes in favor of a very simple alternative by equally weighting each of its components, ensuring that the smaller names within the S&P 500 are weighted as heavily as their larger peers.

On the back of $114 million of inflows last week, RSP has already hauled in $1.1 billion in new assets year-to-date, taking the exchange traded fund to $20.2 billion in assets under management.

Why RSP is Relevant Today

The equal-weight methodology offered by RSP has the potential to generate outperformance and reduce concentration weight to largest stocks in economy. It seeks enhanced return potential while targeting similar risk/reward trade-off to S&P 500 Index and imposing strict ‘buy low/sell high’ discipline through quarterly rebalancing.

RSP’s methodology results in exposure that is considerably more balanced than other alternatives such as SPY, and a methodology that some investors believe will add value over the long haul. In return for this unique exposure, investors can expect higher fees. The ETF is considerably more expensive and less liquid than both SPY and IVV, though it is still extremely cost-efficient when compared to most mutual funds.

RSP also brings a mid cap feel to the large cap S&P 500. That has benefits for longer-term investors.

Mid caps can outperform over a longer investment horizon. Middle-capitalization stocks combine the growth potential of younger companies with financial stability associated with larger companies to provide investors with the best of two worlds.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.