Equal weight is one of the oldest alternatives to traditional cap-weighted benchmarks, and the Invesco S&P 500 Equal Weight ETF (RSP) has long been one of the lynchpins among equal weight exchange traded funds.

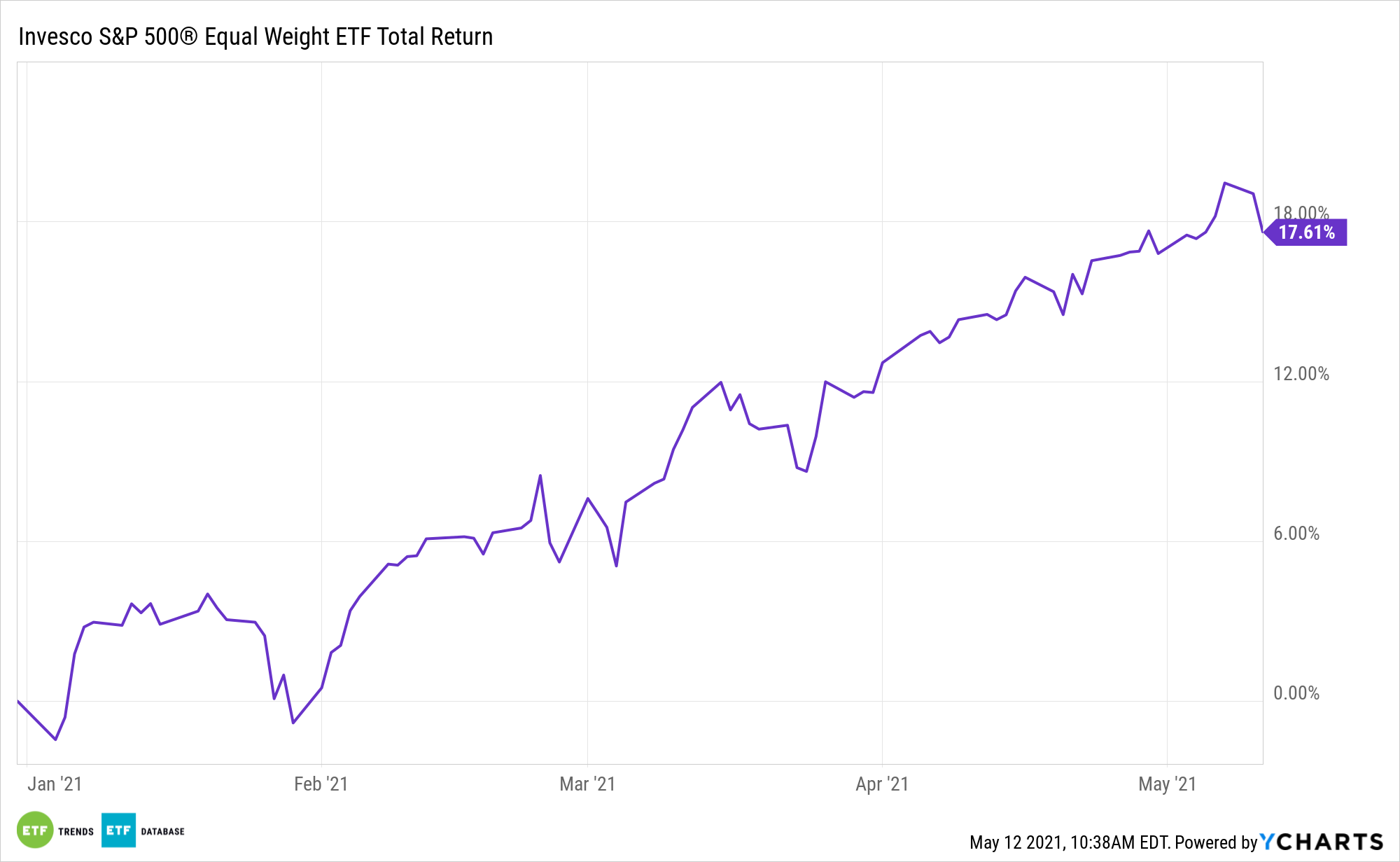

As an equal weight alternative to cap-weighted S&P 500 funds, RSP gives investors a different view of the benchmark domestic gauge. That view often boasts superior returns. Over the past year, RSP is higher 60.1%, while cap-weighted S&P 500 ETFs are up 45.2%.

That’s one indication RSP helps investors capitalize on trends such as the return of cyclical stocks and the reflation trade.

“We have already seen a steepening yield curve with longer-dated bond rates rising – this could temper the strong run up in growth-oriented stocks,” according to S&P Dow Jones Indices. “Near the end of last year, the move from growth stocks to more value-oriented cyclical stocks, and the move from large-cap stocks to small/mid-cap stocks started to occur. Many of these stocks, especially names in the S&P 500®, will tend to benefit more from the economy and society reopening.”

Damping Correlation Risk with ‘RSP’

Among more benefits of equal weight strategies is an ability to mute some of the correlation risk associated with cap-weighted funds – something that’s increasingly important as a smaller number of stocks take on larger weights in the cap-weighted index.

On that note, S&P 500 correlations are historically high, leading advisors to examine alternative options. Additionally, history confirms equal weighting is the way to go when the economy is emerging from a crisis or recession, as it is today.

“Historically, equal-weight indexing has provided outperformance during periods of recovery, relative to the broader market-cap weighted S&P 500® Index. In significant down periods, like the global financial crisis and tech bubble, the S&P 500® Equal Weight Index saw significant outperformance after the trough,” notes S&P Dow Jones.

Combine the economic recovery scenario with an environment that’s favoring cyclical stocks and smaller names, particularly mid caps, and investors will find an encouraging setup.

“After the significant decline from the tech bubble and global financial crisis, the S&P 500 ® Equal Weight Index showed significant excess return, as cyclical stocks, along with smaller names in the index, outperformed the mega-cap stocks in the index,” concludes S&P Dow Jones.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.