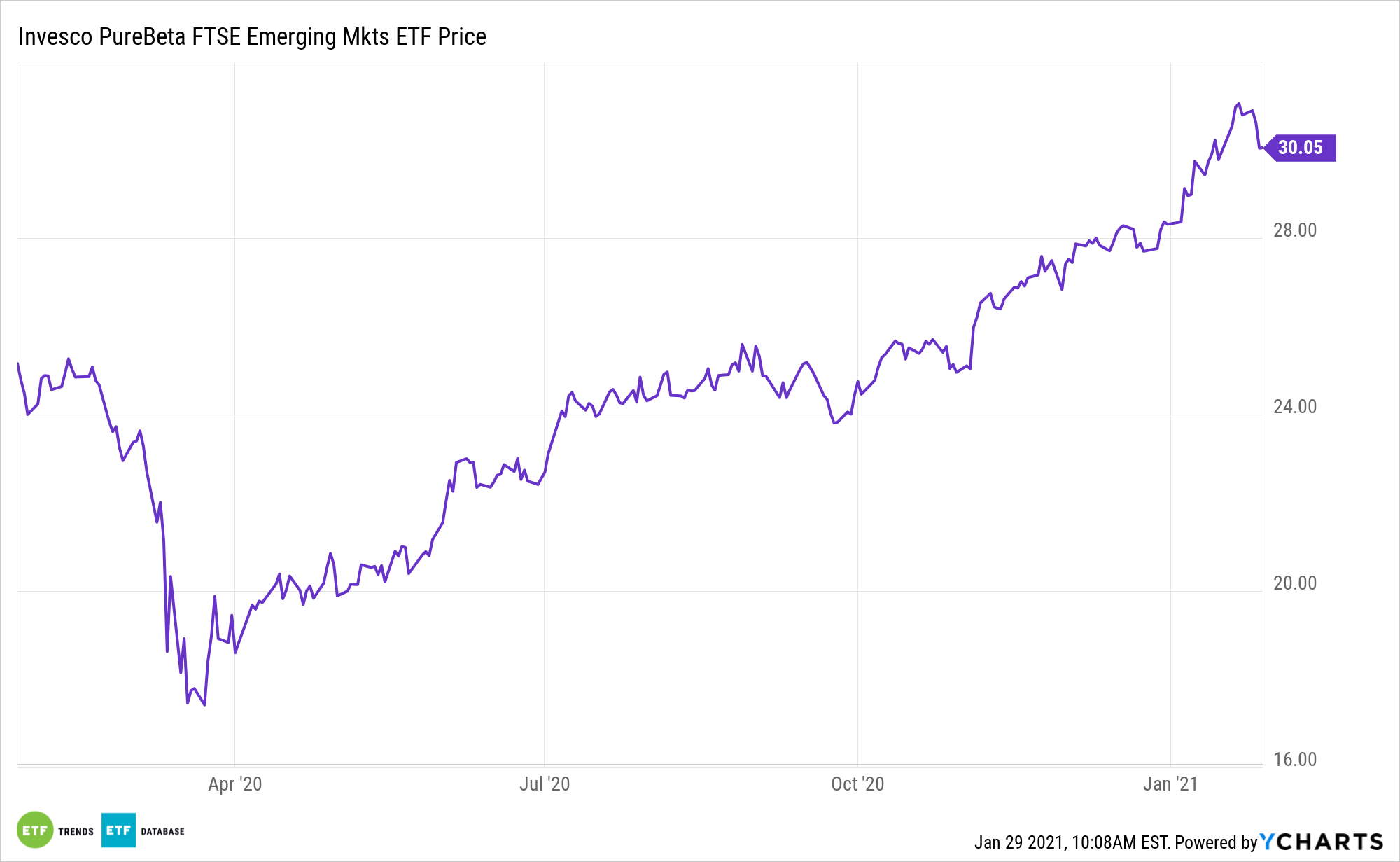

Emerging markets equities aren’t a static asset class, and even basic exchange traded funds like the Invesco PureBeta FTSE Emerging Markets ETF (PBEE) capture dynamic opportunities.

PBEE seeks to track the investment results (before fees and expenses) of the FTSE Emerging Index. The fund generally will invest at least 90% of its total assets common stocks that comprise the underlying index, as well as American depositary receipts (“ADRs”) and global depositary receipts (“GDRs”) that represent securities in the underlying index.

The index is designed to measure the performance of the large- and mid-capitalization segments of equity markets of countries around the world that are classified as emerging markets within the country classification definition of the index provider.

Not only is PBEE a broad-based, cost-effective avenue to emerging markets stocks, but it captures evolution in the underlying asset class.

“Per MSCI, emerging-markets stocks made up about 13% of the global stock market (using the MSCI All Country World Investable Market Index as a proxy) as of the end of 2020. When the MSCI Emerging Markets Index was launched in 1988, these stocks represented less than 1% of the world’s investable equity market capitalization,” writes Morningstar’s Ben Johnson. Emerging markets are dynamic by definition. They have changed dramatically in the past three-plus decades, and the pace of change has only accelerated in recent years.”

Is PBEE Pertinent in 2021?

It appears that investors are once again diving back into the risk pool with emerging markets. While China might be deemed the safest bet, other funds are also churning out strong performances in the new year.

PBEE is keeping up with the shifting look of emerging markets.

“In terms of sector composition, there’s been an even more significant shift in the index. In June 2008, energy and materials stocks represented a combined 40.2% of the MSCI Emerging Markets Index. As of the end of 2020, this figure had declined to 12.5%. Back in 2008, technology names accounted for 10.1% of the index portfolio; by the end of 2020, that figure had increased to 20.5%,” notes Johnson.

For its part, PBEE has a distinct growth feel as consumer cyclical, technology, and communication services stocks combine for over 46% of the ETF’s roster. That’s reflective of emerging markets today, not the stodgy view of bygone market eras.

“While the makeup of the universe of emerging-markets stocks will inevitably continue to evolve, it is impossible to say what it will look like 10 years from now. That’s precisely why many investors choose to invest in this market segment using a broad, market-cap-weighted index fund,” concludes Johnson.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.