With small-caps emerging as a favored idea for 2022 upside, many are likely to eschew stock picking and embrace the utility of broad-based exchange traded funds.

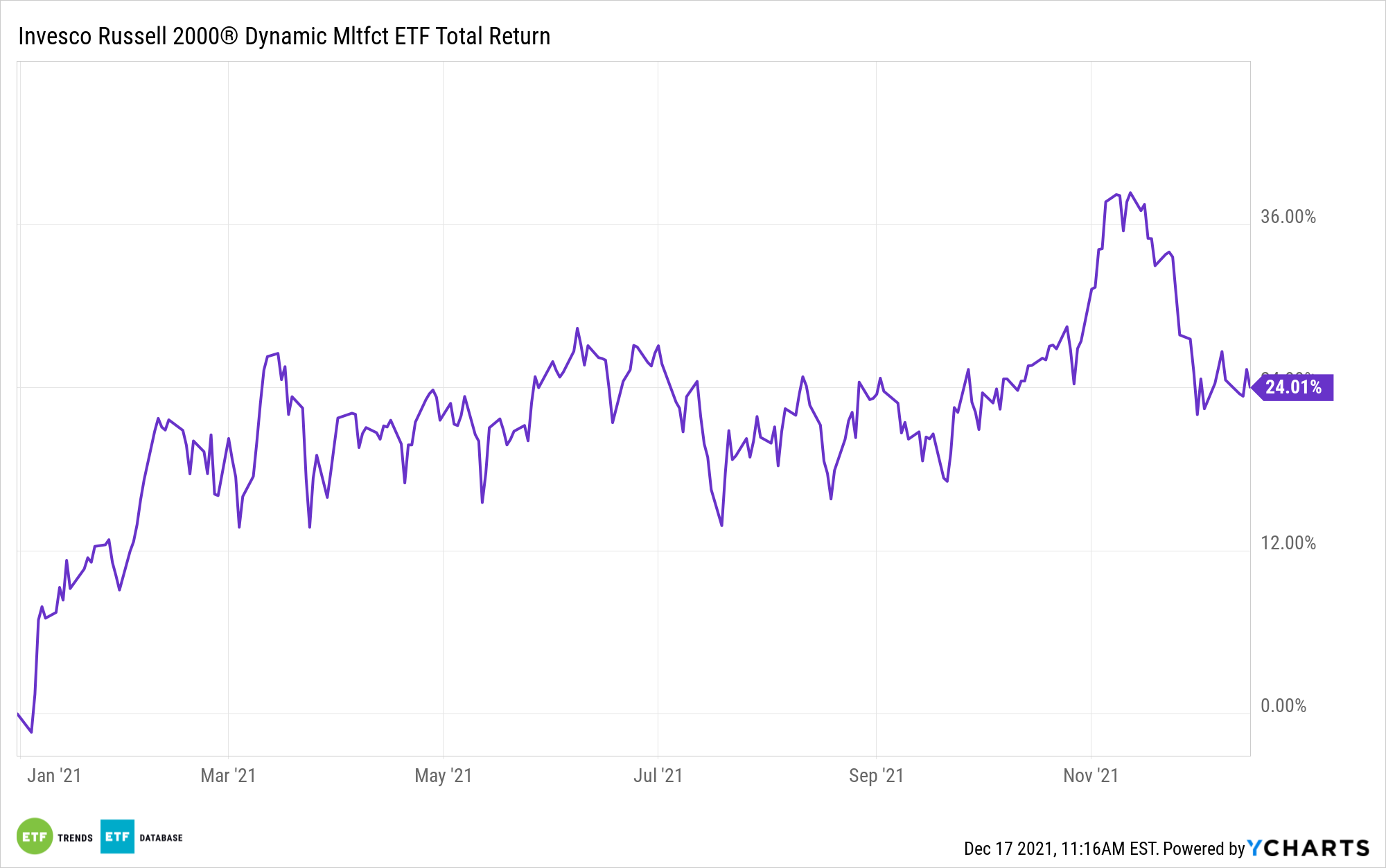

However, more selective market participants might demand more than the most basic approaches in this category. The Invesco Russell 2000 Dynamic Multifactor ETF (OMFS) is an example of an ETF that can meet the demands of choosy small-cap investors.

OMFS tracks the Russell 2000 Invesco Dynamic Multifactor Index, the multi-factor counterpart to the widely observed Russell 2000 Index.

“The Index is constructed using a rules-based approach that re-weights small-cap securities of the Russell 2000 Index according to economic cycles and market conditions, reflected by expansion, slowdown, contraction or recovery,” according to Invesco.

From there, OMFS holdings are assigned a factor, either value, momentum, quality, low volatility, or size. The fund holds 602 stocks, indicating that its methodology trims the pool found in standard Russell 2000 Index funds.

Heading into 2022, OMFS could make for a sound bet on ongoing strength in the U.S. economy because smaller companies are usually more domestically focused than large-cap counterparts. Not only that, but small-cap equities currently trade at steep discounts relative to large-caps.

“Small caps are more domestic, more exposed to the services spending recovery, bigger beneficiaries of capital spending and ‘reshoring’, and are inexpensive [compared with] large caps,” said Bank of America in its 2022 market outlook.

OMFS has some leverage to that valuation opportunity, as 26.22% of its holdings are considered value stocks. Not surprisingly, nearly 52% are considered blend stocks, reflecting the fund’s multi-factor persona. Additionally, small-caps could prove sturdy even if inflation lingers well into 2022.

“We found 14 periods when GDP came in above average, inflation is higher, and Fed raises rates,” Jefferies strategist Steven DeSanctis writes in a note. “In these periods, small performs well with a median rise of 11.7%. “If we are correct and we are in an outperformance cycle, never has it ended with small this cheap versus large.”

For its part, Bank of America recently revealed its preferred small-cap sectors with a top four of energy, financial services, consumer discretionary, and real estate. Financial services and real estate are OMFS’ largest and fourth-largest sector allocations, respectively, combining for over 36% of the ETF’s weight. Consumer discretionary and energy names combine for more than 5%.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.