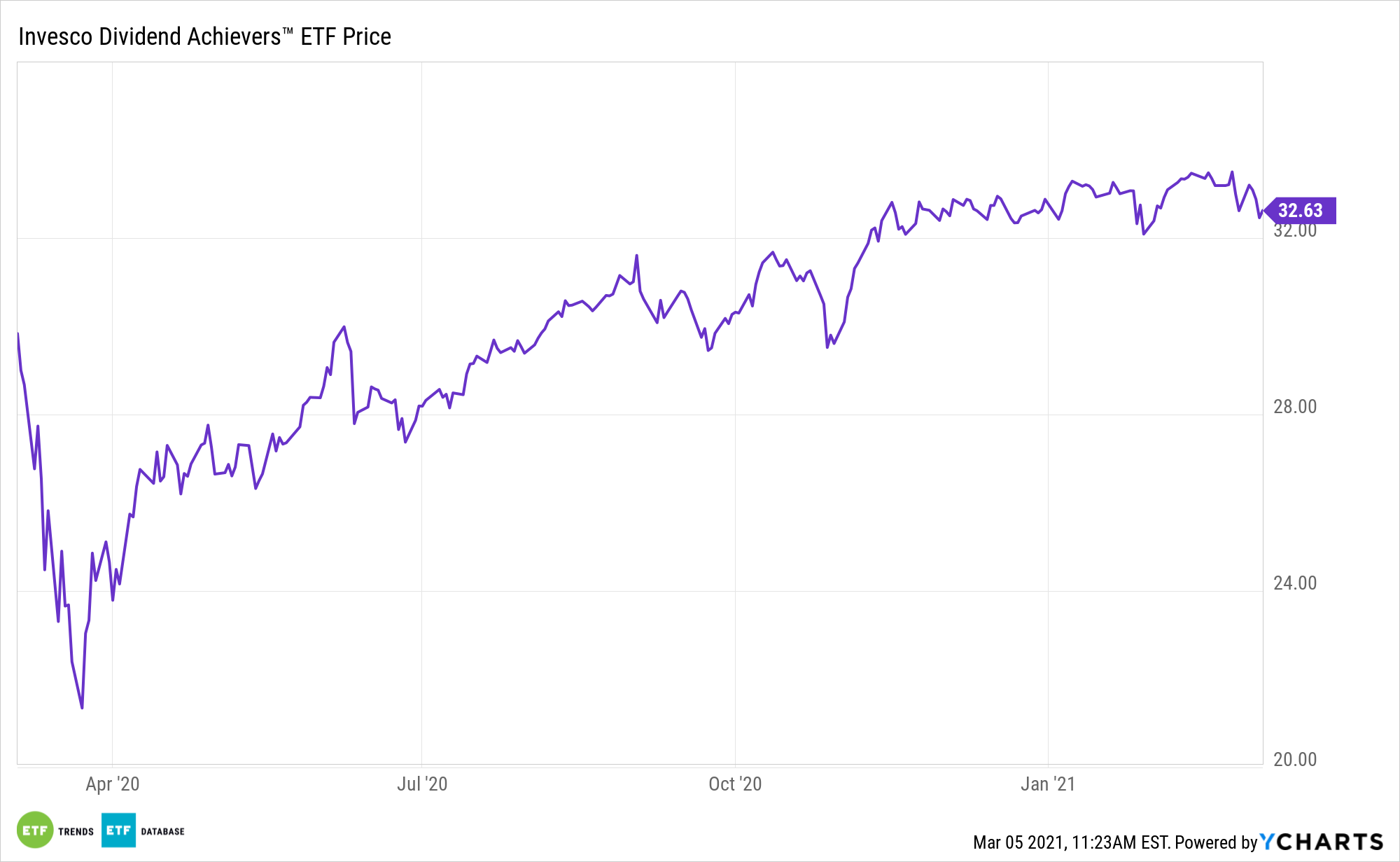

Treasury yields are rising, but with rates still near historic lows, the case for dividend grower ETFs like the Invesco Dividend Achievers ETF (NASDAQ: PFM) remains intact.

PFM tracks the NASDAQ US Broad Dividend Achievers. That benchmark requires member firms to have dividend increase streaks of at least 10 years.

Due to its emphasis on payout growth rather than high yields, PFM is a safe idea for investors looking to revisit dividend stocks over the near-term. Additionally, the fund is highly relevant for quality-seeking investors in the current environment.

“We see not only a valuation opportunity but an income one as well. With rates hitting new lows in 2020, many companies’ stocks now offer dividend yields that are higher than their respective corporate bonds yields. Moreover, dividends offer growth potential over time whereas bond coupons are fixed,” according to BlackRock research.

Capture Dividends with ‘PFM’

PFM’s emphasis on dividend growers is particularly relevant in today’s market environment. Dividend-growing companies are also high quality names. Steady dividend payouts have additionally helped produce improved risked-adjusted returns over time.

“We see not only a valuation opportunity but an income one as well. With rates hitting new lows in 2020, many companies’ stocks now offer dividend yields that are higher than their respective corporate bonds yields. Moreover, dividends offer growth potential over time whereas bond coupons are fixed,” adds BlackRock.

Companies are feeling better about returning more of their capital to shareholders. S&P 500 dividends are expected to grow 3% in 2021 from 2020, according to FactSet. The payout ratio—the percent of earnings companies use to pay dividends — is expected to fall to about 35% from 42%, but the pure growth in dividend dollars still provides an attractive yield opportunity at current prices.

Investors should consider quality dividend growth stocks that typically exhibit stable earnings, solid fundamentals, strong histories of profit and growth, commitment to shareholders, and management team conviction in their businesses.

“Combined with our more constructive outlook on economic growth ahead, we have been adding to dividend stocks in our portfolios over the past several months. While we enter 2021 moderately pro-risk, we are staying well-diversified and flexible as we may see bouts of volatility,” concludes BlackRock.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.