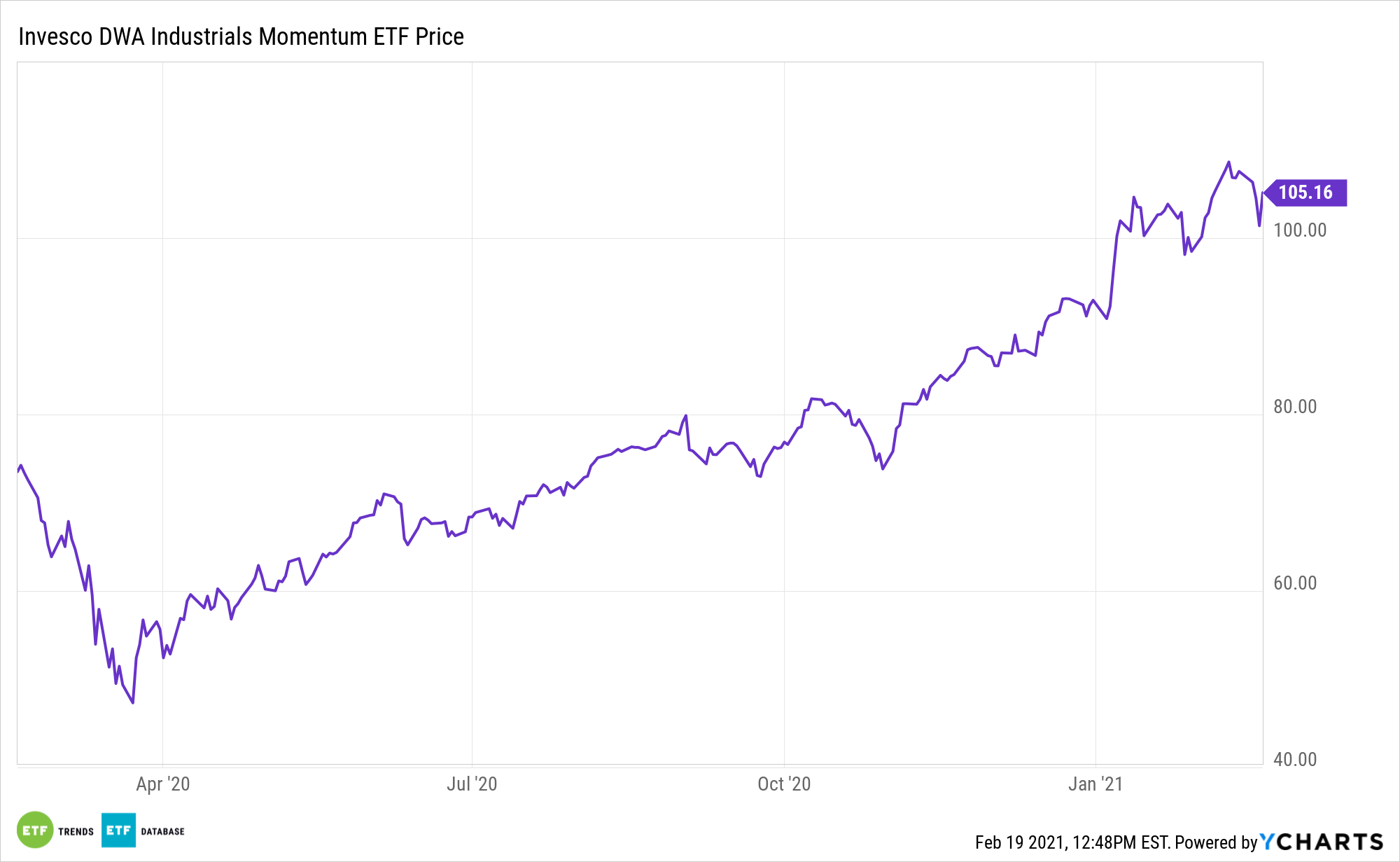

A shifting political environment and easy monetary policy are among the factors rewarding for cyclical stocks at the present. The industrial sector is one promising way for investors to home in on a cyclical recovery. Enter the Invesco DWA Industrials Momentum ETF (PRN).

PRN tracks the Dorsey Wright Industrials Technical Leaders Index, which is designed to identify companies that are showing relative strength (momentum), and is composed of at least 30 securities from the NASDAQ US Benchmark Index. Relative strength is the measurement of a security’s performance in a given universe over time as compared to the performance of all other securities in that universe.

As investors look to more fiscal stimulus and increased vaccine distributions to support a broad economic recovery, cyclical fare is pushing higher.

The Industrial Sector as a Gauge of Economic Health

Meanwhile, the decline in new coronavirus cases, rollout of vaccinations, and a better-than-expected fourth-quarter earnings season have all added to hopes of a quick recovery this year.

“Easy money and an improving economy suggest not only lower volatility but further equity gains. That said, those gains are not likely to be shared equally,” according to BlackRock. “Assuming volatility continues to grind lower, history suggests favoring cyclical over defensive stocks. Based on 20 years of data, when the VIX is falling the MSCI Cyclical – Defensive Return Spread Index posts an average monthly gain of around 1%. When the drop in volatility is large, 10% or more, average cyclical outperformance expands to nearly 2%.”

The industrial sector includes companies that create machinery, equipment, and supplies that take part in construction and manufacturing, as well as those that offer related services. Interestingly, these companies are closely connected with the economy, and their business volume often declines steeply in a recession.

As the global economy shakes off the effects of the coronavirus pandemic, PRN and industrial equities could be among the leaders.

“Given this dynamic I would continue to favor cyclical expressions including machinery, specialty chemicals, and cyclical parts of technology,” adds BlackRock. “At the same time, I would remain underweight the more overpriced parts of consumer staples, particularly household and food products. For investors, the conclusion is not just to maintain equity exposure, but to favor those parts of the market most likely to benefit from a normalization of both the economy and (hopefully) financial markets.”

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.