Amid fears that the Delta variant of the coronavirus could stymie the reopening trade and put a cap on economic growth, U.S. stocks tumbled Monday, with the S&P 500 shedding 1.59%.

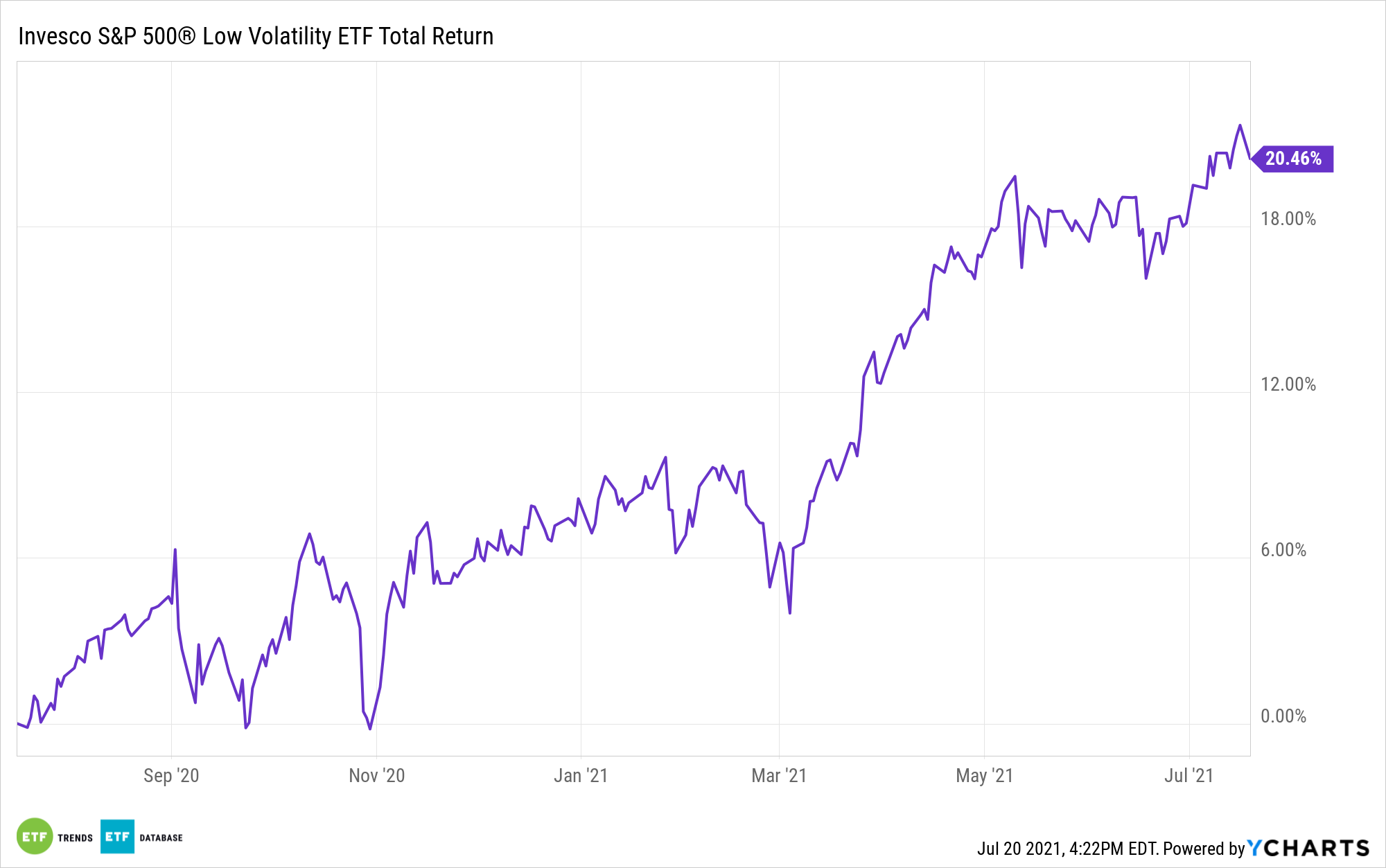

Granted, that’s just one day of market action and broader equity benchmarks have recently been strong, but if COVID-19 case counts and hospitalization rates continue rising, volatility could become an issue market participants need to address. That could be a recipe for examining exchange traded funds like the Invesco S&P 500 Low Volatility ETF (SPLV).

SPLV, which tracks the S&P 500 Low Volatility Index, offers investors a basket of the 100 least-turbulent members of the S&P 500 based on trailing 12-month volatility. Again, Monday is just one day, SPLV did its job though, performing 46 basis points less poorly than the S&P 500.

“More traditional defensive plays had also been gaining strength. JC O’Hara, chief market at technician at MKM Partners, pointed out in a note to clients that defensive plays had outperformed in recent days,” reports Jesse Pound for CNBC.

SPLV’s Defensive Credibility

In just over 10 years on the market, SPLV has amassed nearly $8 billion in assets under management, confirming its status as one of the beloved defensive ideas among large-\ cap equity ETFs. Speaking of playing defense, signs have been brewing that investors are moving into defensive stocks and sectors.

“For example, Duke Energy jumped more than 5% and NextEra rising 4.9% in that time period” over the past two weeks, reports CNBC. Duke Energy is a member of the SPLV roster.

While SPLV is a sector-agnostic strategy, some sectors typically and consistently sport lower volatility traits than others. Not surprisingly, those groups often include consumer staples and utilities, which currently combine for almost 38% of SPLV’s weight, according to issuer data.

Perhaps another perk of SPLV should volatility become elevated and trend higher is what’s excluded from the fund. The ETF has no exposure to the energy sector, arguably one of the group’s most vulnerable to negative COVID-19 news. In fact, oil’s recent slump has become so severe that on Monday, energy ceded its status as this year’s best-performing sector in the S&P 500 to real estate. Real estate stocks account for 5.11% of SPLV.

Bottom line: SPLV could be ready to have a moment over the near-term, but investors should remember the primary role of a low volatility ETF: deliver less downside when stocks falter, not capture all of the upside in a strong bull market.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.