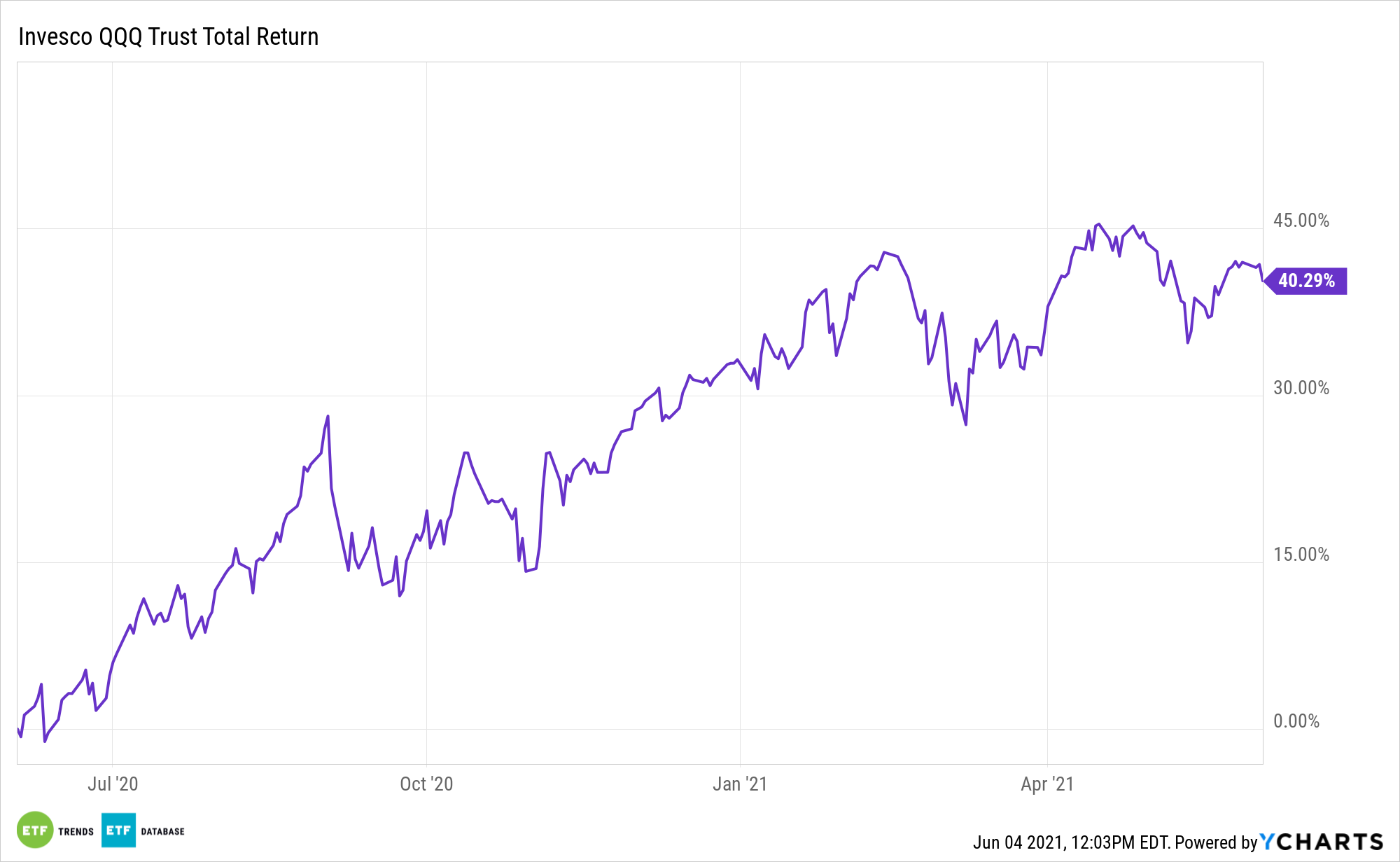

The Invesco QQQ Trust (QQQ), which tracks the widely followed Nasdaq-100 Index (NDX), is up 5.18% year-to-date. That’s a tepid showing relative to the legacy of the exchange traded fund and NDX, but that shouldn’t be motivation for investors abandon technology stocks.

With a 48% weight to tech and a deep growth stock profile, QQQ is lagging not because of poor fundamentals – broader tech sector fundamentals remain robust. Rather, the tech and growth stocks are trailing because of inflation fears, rising interest rates lifting bank stocks, and the economic cycle being in the recovery phase – a period that historically favors cyclical fare.

Still, investors should see the tech forest through the trees because the future is bright for the sector.

“Estimates for calendar year 2022 indicate that the tech sector is expected to have the fourth-highest revenue growth of any sector,” notes Invesco Chief Global Market Strategist Kristina Hooper.

Post-Pandemic Allure for ‘QQQ’

As has been widely noted, the coronavirus pandemic forced more rapid adoption of a plethora of innovative technologies and concepts, many of which QQQ has leverage to. Think fintech, healthcare innovation, online shopping, streaming entertainment, and more.

However, now that more folks are getting vaccinated and healthcare professionals are better able to treat the virus, there’s concern that some of the tech niches that benefited from the pandemic are vulnerable to retrenchment. The thesis is understandable. After all, people want to go out and live their lives again, potentially hurting the cases for online retailers and stay-at-home stocks.

Yet many of the disruptive technologies and market segments QQQ provides exposure were flourishing before COVID-19. All the pandemic did was move that adoption along. As Invesco’s Hooper notes, many of the changes in behavior brought on by the health crisis could be permanent.

“For example, e-commerce sales have dropped recently as COVID-19 infections have fallen and people have spent less time sequestered at home; however I expect they will remain a very substantial portion of overall retail sales — and that portion will soon resume its rise as a percentage of overall retail sales,” she said.

To that point, QQQ allocates 17.4% of its weight to consumer discretionary stocks, several of which are dedicated online retailers.

As for tech, spending by both companies and consumers is likely to accelerate. Corporations “reduced their tech spending in 2020, and therefore need to spend more in 2021 in order to keep up. Global information technology spending is expected to rise 8.4% in 2021, and it’s projected that the IT spending focus for 2021 will be on revenue growth,” according to Hooper.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.