Semiconductors are in the spotlight like never before this year. A global chip shortage is pinching an array of industries, from automobile manufacturers to smartphone producers.

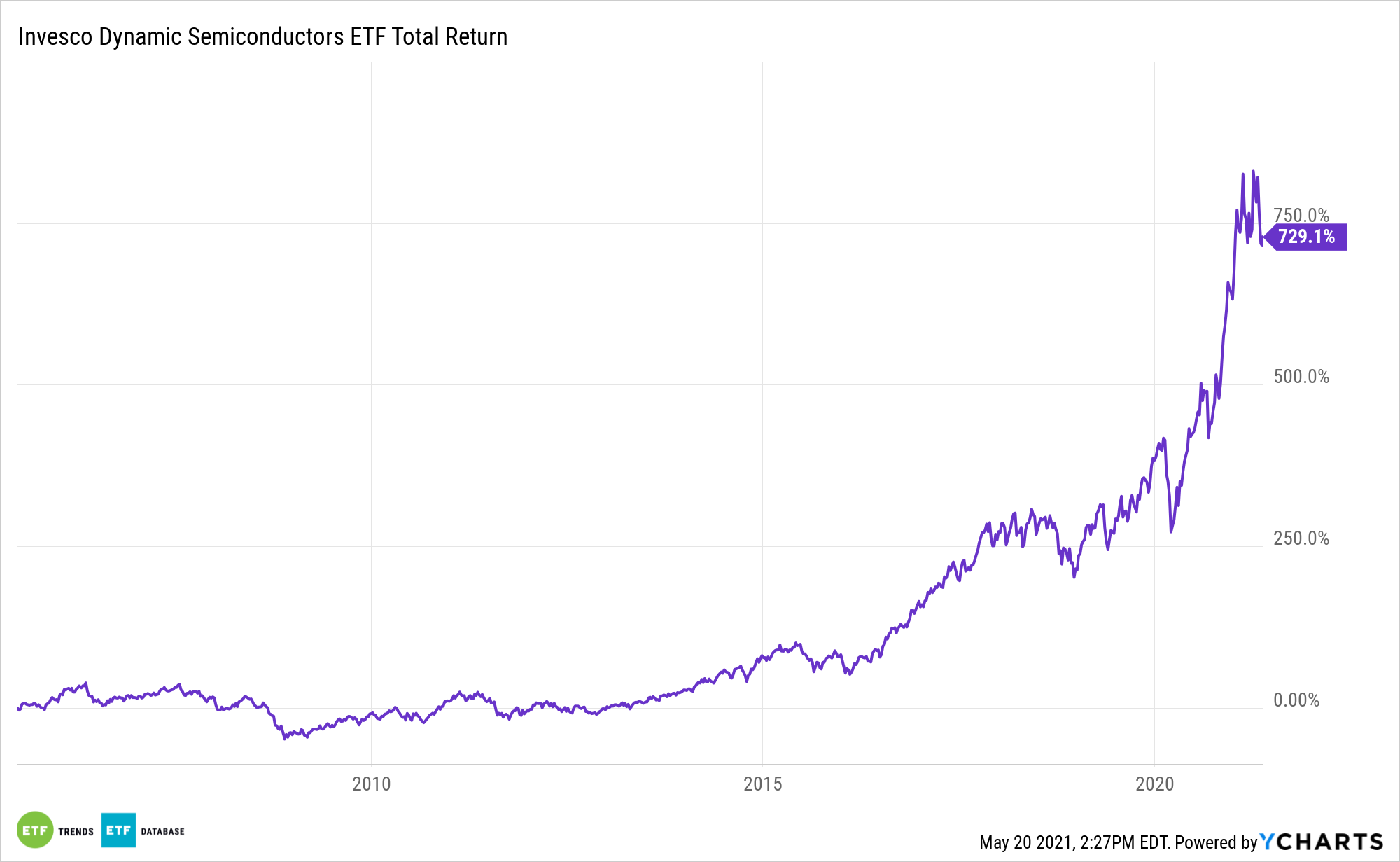

Even with the supply shortfall, the Invesco Dynamic Semiconductors ETF (PSI) is higher by 7% year-to-date. PSI follows the Dynamic Semiconductor Intellidex Index, which is based on the price momentum, earnings momentum, quality, management action, and value factors.

While the dearth of chips is weighing on semiconductor names, some market observers see industry revenue returning to pre-coronavirus pandemic levels later this year.

“Chip industry revenue should return to pre-pandemic levels this year, as a result of strong demand and pricing, and benefit from greater visibility into 2022, supporting semiconductor credit profiles,” said Fitch Ratings in a recent note.

Capacity Increases Could Support ‘PSI’ Gains

Chip foundries, including those that service PSI components, are looking to boost capacity and output to meet demands being created by disruptive technologies, including 5G, artificial intelligence, and data centers.

“We expect structurally higher inventory through the chip supply chain over time, and more strategic engagement between larger customers and chipmakers to reduce risks related to future supply constraints,” according to Fitch. “The significant uptick in industry capital spending is mainly dedicated to leading-edge capacity, which is used for cutting-edge technology such as 5G, internet of things and artificial intelligence.”

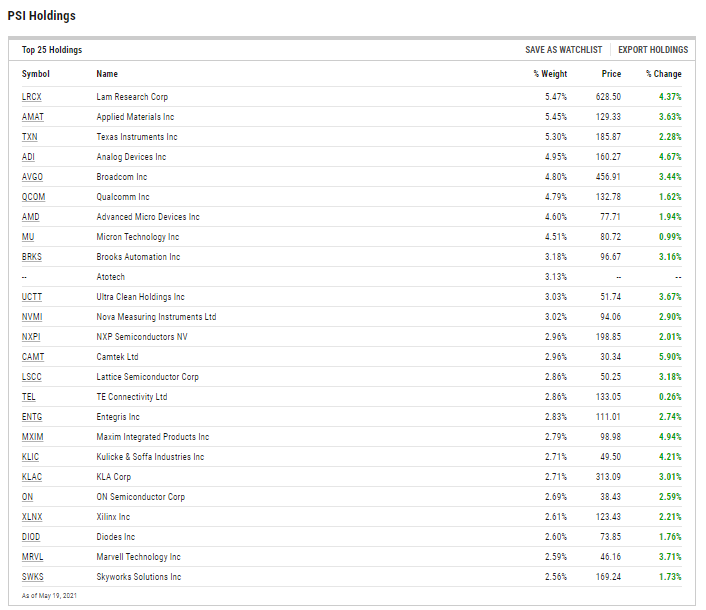

PSI’s 32 holdings have an average market capitalization of $58.28 billion. The fund also offers investors leverage to a rally in smaller stocks. Over 46% of the ETF;s holdings are classified as mid- and small-cap equities.

That strategy has served long-term PSI investors well. Since inception, the fund is beating the S&P 1500 Composite Semiconductor Index by 248 basis points, as of April 30.

As for the near-term impact for some PSI components, foundries are looking to add capacity for chips.

“Foundries are also adding trailing-edge capacity, the technologies on which semiconductor products for cyclical end markets, including automotive and industrial, more acutely affected by the chip shortage,” adds Fitch. “Auto manufacturers have significantly cut auto unit production, citing the shortage of chips, the content of which has increased sharply over time but also meaningfully heightens supply chain complexity. Shortages have also become more widespread for other end markets, ranging from consumer electronics, home appliances and construction equipment.”

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.