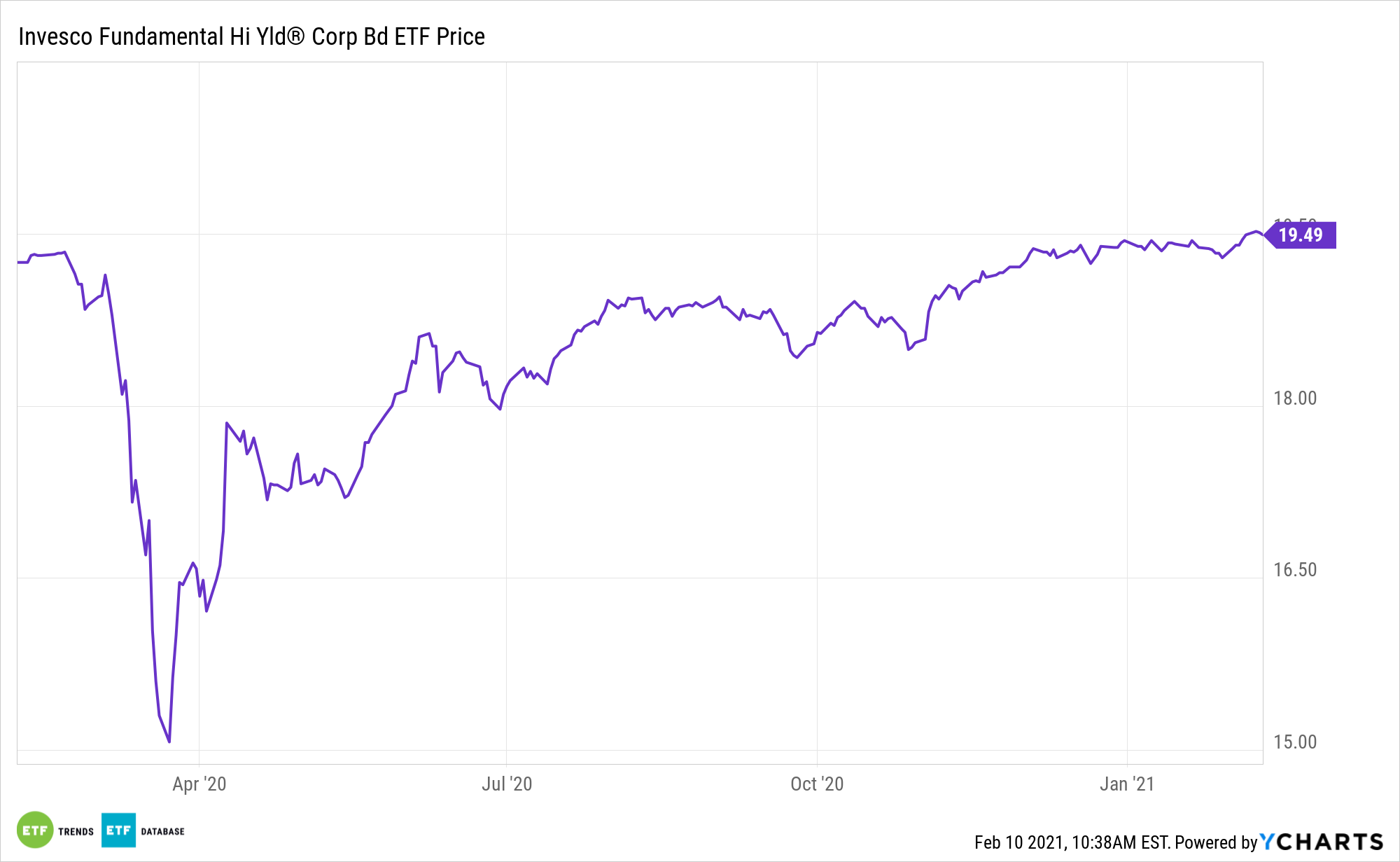

Yields on high-yield corporate debt are declining and underscoring the importance of emphasizing fundamentals. There’s an exchange traded fund for that: the Invesco Fundamental High Yield® Corporate Bond ETF (PHB).

The Invesco Fundamental High Yield® Corporate Bond ETF (Fund) is based on the RAFI® Bonds US High Yield 1-10 Index (Index). The Fund will generally invest at least 80% of its total assets in the securities that comprise the Index. The Index is comprised of US dollar-denominated high yield corporate bonds that are SEC-registered securities or Rule 144A securities with registration rights and whose issuers are public companies listed on a major US stock exchange.

Only investible non-convertible, non-exchangeable, non-zero, fixed coupon high-yield corporate bonds qualify for inclusion in the Index. Based on the Fundamental Index® methodology developed by Research Affiliates, LLC, the Index is compiled and calculated by ALM Research Solutions, LLC. The Fund and the Index are rebalanced monthly and reconstituted annually in March.

“The average yield on U.S. junk bonds dropped below 4% for the first time ever as investors seeking a haven from ultra-low interest rates keep piling into an asset class historically known for its high yields,” reports Carolina Gonzalez for Bloomberg. “The measure for the Bloomberg Barclays U.S. Corporate High-Yield index dipped to 3.96% on Monday evening, making it six straight sessions of declines.”

Why Go with PHB?

With its unique scoring methodology, PHB offers investors a potentially better mousetrap for junk bonds, especially for those investors seeking long-term, yield-bearing allocations.

“Yield-hungry investors have been gobbling up junk bonds as an alternative to the meager income offered in less-risky bond markets. Demand for the debt has outweighed supply by so much that some money managers are even calling companies to press them to borrow instead of waiting for deals to come their way. A majority of new issues, even those rated in the riskiest CCC tier of junk, have been hugely oversubscribed,” according to Bloomberg.

PHB’s emphasizes quality high-yield corporate bonds. PHB, which tracks the RAFI Bonds US High Yield 1-10 Index, tilts towards slightly higher quality corporate debt securities than its major competitors. The ETF features no exposure to CCC-rated bonds. Three-quarters of PHB’s holdings are rated BBB or BB.

“Some see continued outperformance from the junkiest part of the market. CCCs, which have accounted for a significant chunk of recent supply, may be one of the best parts of credit this year, according to David Norris, head of U.S. credit at TwentyFour Asset Management,” concludes Bloomberg.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.