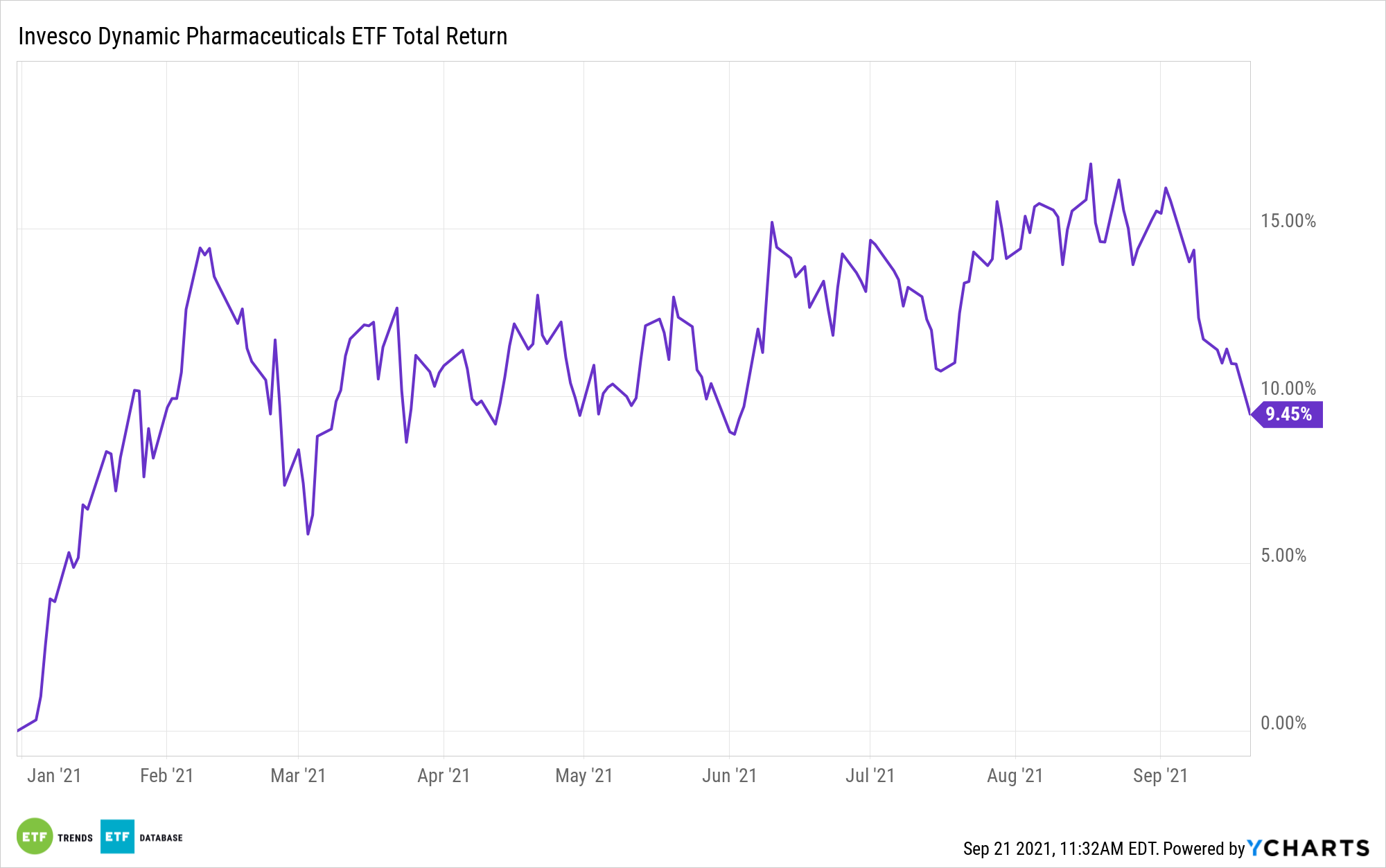

The Invesco Dynamic Pharmaceuticals ETF (NYSEArca: PJP) is off 3.66% month-to-date, and the source of that lethargy is easy to spot: The drug price reform debate is once again gaining momentum, prompting investors to take a cautious approach to pharmaceuticals stocks.

While the healthcare sector and pharmaceuticals stocks in particular have histories of being sensitive to political wranglings, PJP’s recent weakness could ultimately prove to be a buying opportunity. In fact, given the current political climate, PJP’s September slide may be much ado about nothing.

“We expect Congress will struggle to pass any system that includes significant Medicare price negotiation, such as pegging prices to international prices or deeply discounted (Medicaid, VA) U.S. prices, given pressure from more moderate Democrats in the Senate,” says Morningstar analyst Karen Andersen. “The razor-thin democrat majority will make significant healthcare system changes even more difficult.”

PJP, which recently turned 16 years old, follows the Dynamic Pharmaceutical Intellidex Index. That’s not any old cap-weighted pharmaceuticals benchmark. Rather, PJP’s underlying index evaluates companies based price momentum, earnings momentum, quality, management action, and value. That methodology could provide some buffer to investors if the drug price reform debate intensifies.

Recent headline risk may also be serving some benefit as some PJP holdings now look attractive on valuation, with biotech giant Gildead (NASDAQ:GILD) being a prime example.

“Gilead Sciences generates stellar profit margins with its HIV and HCV portfolio, which requires only a small salesforce and inexpensive manufacturing. We think its portfolio and pipeline support a wide moat, but Gilead needs HCV market stabilization, strong continued innovation in HIV, solid pipeline data, and smart future acquisitions to return to growth,” said Andersen.

Gilead Sciences is PJP’s second-largest holding at a weight of 6.13%. Another PJP holding earning praise from Morningstar is Merck (NYSE:MRK), a member of the Dow Jones Industrial Average. While Merck isn’t one of the pharmaceuticals names with exposure to coronavirus vaccines, its new drug pipeline is robust.

“Merck’s combination of a wide lineup of high-margin drugs and a pipeline of new drugs should ensure strong returns on invested capital over the long term,” according to Andersen. “Further, following the divestment of the Organon business in June 2021, the remaining portfolio at Merck holds a higher percentage of drugs with strong patent protection. On the pipeline front, after several years of only moderate research and development productivity, Merck’s drug development strategy is yielding important new drugs.”

Merck commands 5.75% of PJP’s roster.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.