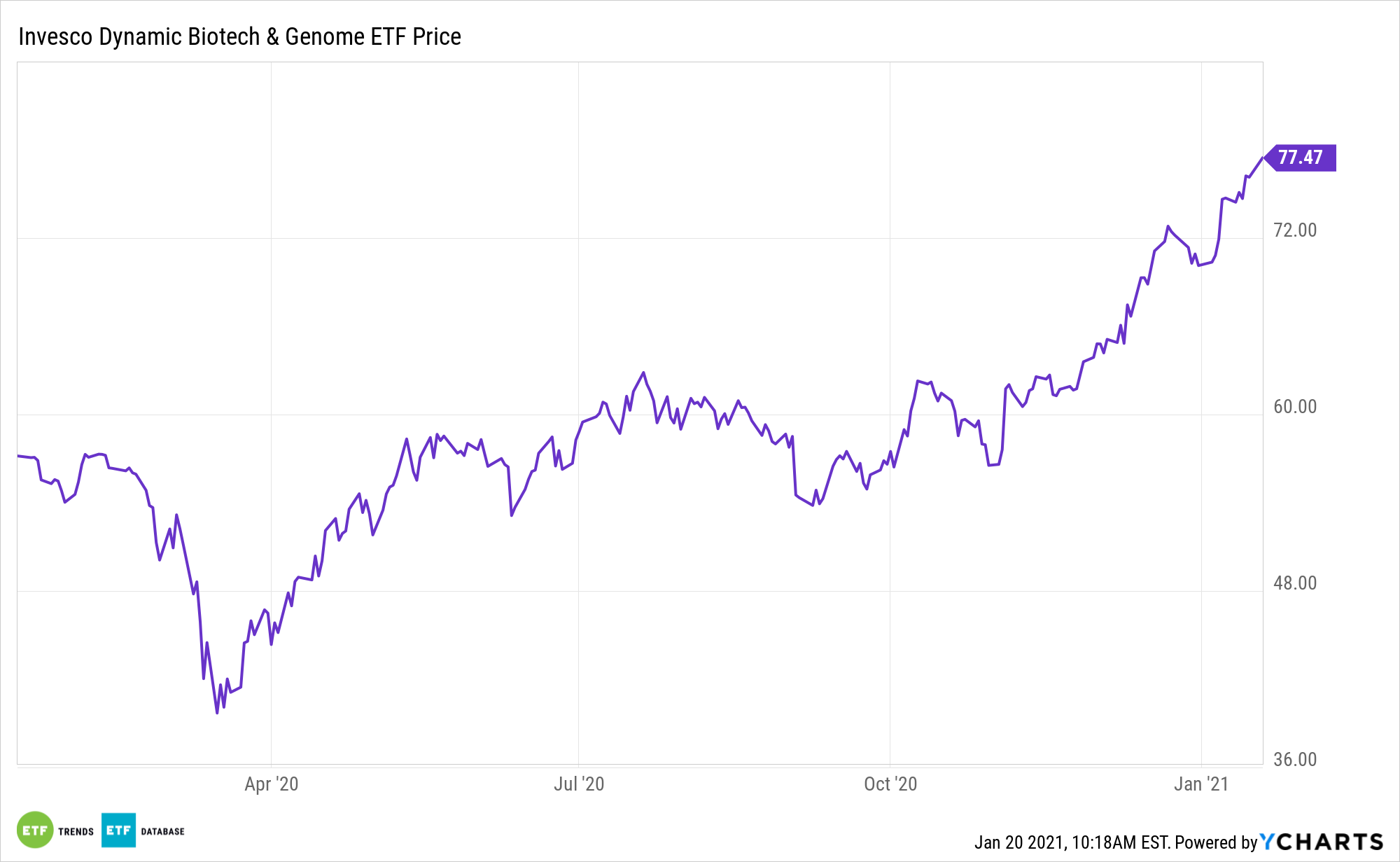

The coronavirus pandemic could be a long-term positive for biopharma companies and the Invesco Dynamic Biotechnology & Genome ETF (PBE).

PBE tracks the Dynamic Biotech & Genome Intellidex Index, which “is designed to provide capital appreciation by thoroughly evaluating companies based on a variety of investment merit criteria, including price momentum, earnings momentum, quality, management action, and value,” according to Invesco.

Due to the high priority of rolling out COVID-19 treatments, some PBE components could enjoy top line growth this year and in 2022.

“As with most viruses, developing COVID-19 treatments has been difficult, but several drugs have shown strong enough efficacy to gain regulatory support,” writes Morningstar analyst Damien Conover. “Historically, one of the best ways to control viruses is through vaccines, and we believe the vaccines emerging will significantly lower the need for COVID-19 treatments by 2023 and beyond. Nevertheless, treatments are in high demand currently and are likely to remain so through 2021 and into 2022. Currently, several drugs are used to treat COVID-19, but most have limitations in efficacy and timing of use relative to the disease progression.”

The Future of Healthcare

PBE holdings with antibody focuses could be poised to benefit as coronavirus vaccines are more broadly distributed.

“Overall, we see the highest sales potential for antibody treatments for mild to moderate COVID-19 patients at more than $6 billion in total 2021 antibody treatment sales, with Eli Lilly and Regeneron (partnered with Roche) leading the class,” notes Conover. “Additionally, while further strains of COVID-19 could emerge, we believe both vaccines and treatments will still be effective.”

The healthcare sector appears cheap relative to the broader market as this segment has underperformed the recent run-up in the S&P 500. Healthcare stocks were among the second weakest performers among the 11 major sectors on the benchmark index. Looking ahead, healthcare companies are projected to generate annual earnings of 9% and revenue growth of 14%, the highest of all sectors in the S&P 500, according to FactSet data.

Healthcare spending makes up 18% of U.S. GDP, and it is rising. It is projected that global healthcare spending could shoot up to $8.7 trillion as the industry faces increased challenges from an aging population, rising costs, a shortage of skilled workers, legacy I.T. systems, invasive procedures, and medical errors.

PBE is up a promising 8.57% to start 2021.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.